Question: PA CASE 12 Innovative Toys Inc. Consumer Shopping Behavior and Channel Design for in a prie 1993 of the companion for By 200 Inowwe in

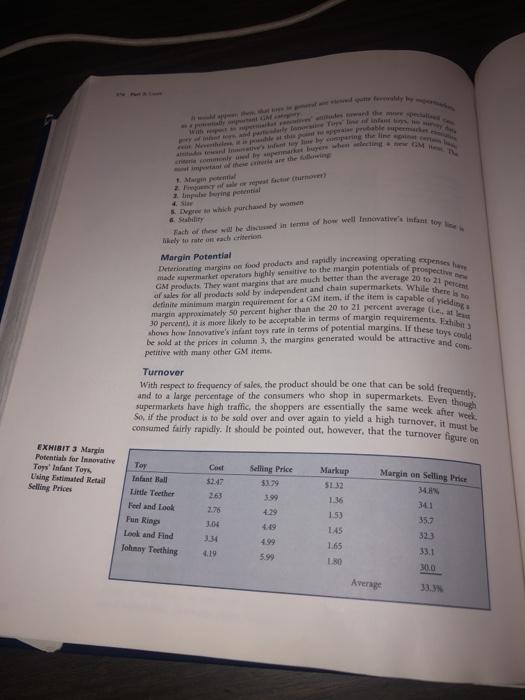

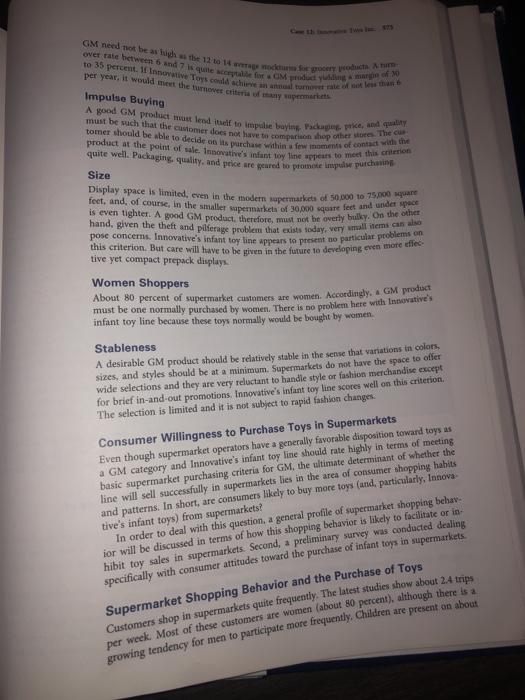

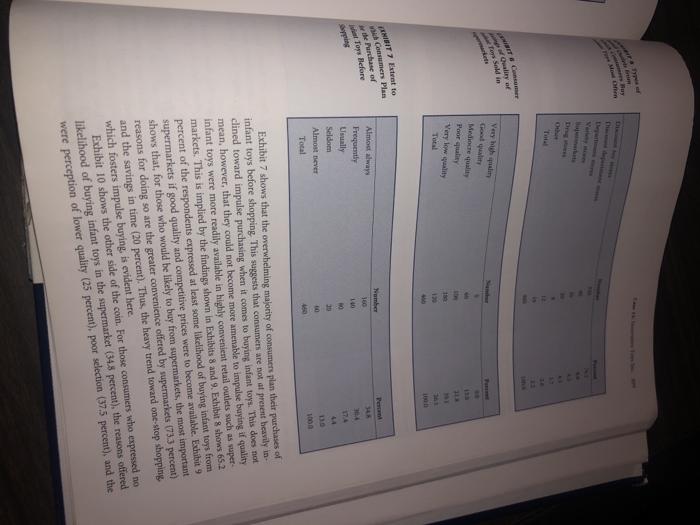

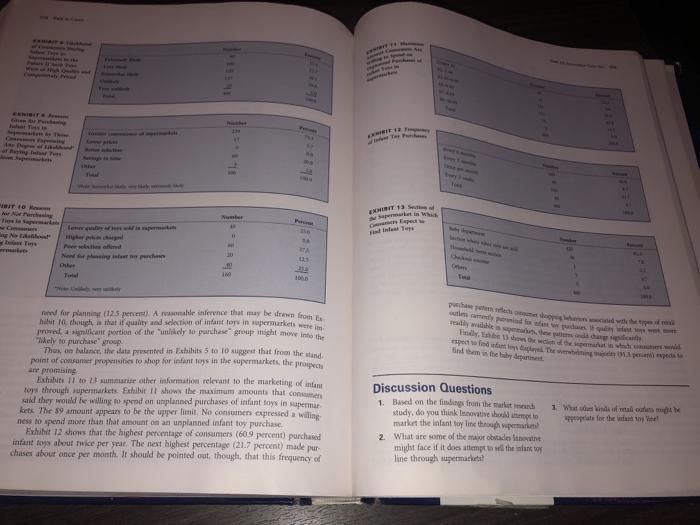

PA CASE 12 Innovative Toys Inc. Consumer Shopping Behavior and Channel Design for in a prie 1993 of the companion for By 200 Inowwe in developed my be consigo hicho and discount det stores Inmove Wa considering the possibility of pe the major channel for many merchandise new tey line through supermarket To appraise the few of wing supermarkets to distribute the insan soy Donald Mornion, Vice president of marketing hired an outside marketing cards fum to study the question. The research report follows Marketing Research Firm's Report Supermarkets have not played a large role in the distribution of Infant toys or other classes of toys. In fact, it is estimated that only about percent of total industry toy may be in store for the distribution of toys through supermarkets. The underlying factor responsible for this change is the heavy push by the supermarket industry to put more emphasis on the sale of nonfoods, particularly general merchandise, because of the higher margins available. Toys, particularly infant toys might play prominent role in this overall trend toward more emphasis on general merchandise (GM) by supermarkets Two basic factors must be present , however, in order to market toys successfully through supermarket channels (1) supermarket buyers must be favorably disposed to ward toys as an important and profitable GM category, and (2) consumers must be willi- ing to purchase toys from supermarkets. An analysis of each of these factors follows Disposition of Supermarket Executives toward Toys as a General Merchandise Category Several studies show a generally favorable attitude by supermarket executives toward toys as an important GM category. For example, a study of a nationwide panel of supermar ket executives reported in Progressive Grocer yielded the results shown in Exhibit 1. No ratings were less than good, while 54 percent of the supermarket executives rated toys as either very good or excellent as a GM category. Another study conducted by the research division of Progressive Grocer developed a comparative rating scale to show how toys are rated by supermarket executives among 30 GM categories. This is shown in Exhibit 2. As indicated, toys do reasonably well. scoring 79 (peg) and 67 (boxed) out of a possible 100. While toys are not rated as highly as light bulbs, disposable lighters, motor oil, and other GM categories, peg toys rated ahead of such items as basic soft goods, batteries, and sunglasses, and boxed toys are rated higher than glassware, photo finishing, hardware, and other items. 22 cu curmowe 4. Which purchased by women Each of the will be in me of how well innovativenant toy key to rate on white Margin Potential made supermarket oprit ahily sensitive to the marin potential of project GM products. They want moins that are much better than the average 20 10 21 percent Deteriorating Ilargins on lood products and rapidly increasing operating pendesh of sales for all products sold by independent and chain supermarkets. While there is definite minimum margin requirement for a GM item, if the item is capable of yed marginapproximately 50 percent higher than the 20 TO 21 percent average lead shows how Innovative's instant toys rate in terms of potential marins. If these toys could 30 percent it is more likely to be acceptable in terms of margin requirements Fathions be sold at the prices in column 3 the margins generated would be attractive and con petitive with many other GM items. Turnover With respect to frequency of sale, the product should be one that can be sold frequently, supermarkets have high traffic, the shoppers are essentially the same week after work consumed fairly rapidly. It should be pointed out, however, that the turnover figure on EXHIBIT 3 Margir Potential for Innovative Toys'Infant Toys Using Estimated Retail Selling Prices Cost $2.47 Toy Infant Ball Little Teether Feel and Look Fun Ring Look and Find Johnny Teething Selling Price 51.79 399 4.29 4.49 Markup 5132 1.36 153 263 2.76 304 334 4.19 Margin on Selling Price 34. 341 357 323 33.1 145 165 1.80 5.99 300 Average GM need to be as the 12 to 14 procent och over rate between 6 7 is quite creat Matteo to 35 percent. I live Toys Cachumbles that per year, it would meet the recite or any promarket Impulse Buying A good GM product must lead to imple buying Padang price and quality must be such that the customer does not have to comparison top other store the tomer should be able to decide to purchase within a few moments of contact with the product at the point of sale. Innovative's infant toy line appears to meet this criterion quite well Packaging, quality and price are geared to promote impul purchasing Size Display space is limited, even in the modern supermarkets of 50,000 to 75,000 square feet, and, of course, in the smaller supermarket of 30,000 square feet andet spec is even tighter. A good GM product, therefore, must not be overly bulky. On the other hand, given the theft and pilferage problem that exists today, very small items can also pose concerns. Innovative's infant toy line appears to present no particular problems on tive yet compact prepack displays Women Shoppers About 80 percent of supermarket customers are women. Accordingly. GM product must be one normally purchased by women. There is no problem here with Inutive's infant toy line because these toys normally would be bought by women. Stableness A desirable GM product should be relatively stable in the sense that variations in colors, sizes, and styles should be at a minimum. Supermarkets do not have the space to offer wide selections and they are very reluctant to handle style or fashion merchandise except for brief in-and-out promotions. Innovative's infant toy line scores well on this criterion. The selection is limited and it is not subject to rapid fashion changes Consumer Willingness to Purchase Toys in Supermarkets Even though supermarket operators have a generally favorable disposition toward toys as a GM category and Innovative's infant toy line should rate highly in terms of meeting basic supermarket purchasing criteria for GM, the ultimate determinant of whether the line will sell successfully in supermarkets lies in the area of consumer shopping habits and patterns. In short, are consumers likely to buy more toys (and, particularly, Innova tive's infant toys) from supermarkets? In order to deal with this question, a general profile of supermarket shopping behav- ior will be discussed in terms of how this shopping behavior is likely to facilitate or in hibit toy sales in supermarkets. Second, a preliminary survey was conducted dealing specifically with consumer attitudes toward the purchase of infant toys in supermarkets Supermarket Shopping Behavior and the Purchase of Toys Customers shop in supermarkets quite frequentiy. The latest studies show about 24 trips per week. Most of these customers are women about so percent), although there is a growing tendency for men to participate more frequently, Children are present on about Harta EXHIBIT 4 Preparation fine hyping Trips by Supermarket shoppen Od tamil Men 11 Alm 100 100 EX Sup 17 percent of the trip. In general during their trips to the supermarket, customers are in a buying mood. Most buy more than they had planned to purchase before visiting the supermarket. With the continuing stigma of the recession, however, careful planning by study conducted by the Home Testing Institute yielded the findings shown in Exhibit 4 the shopper is becoming more common as a way of staying within the budget Arect Because much of the success of supermarket GM marketing stems from frequent shop ping and impulse buying any indication of a decline in shopping frequency and impube buying could have negative implications for GM sales, whether for toya or other GM pro ducts. Fortunately, this does not appear to be the case. Shopping frequency has remained relatively stable ewer the past five years, and although consumers are becoming more atre ful and sharper shoppers, they are not turning away from impulse buying. They will, how ever. exercise more care and judgment about which impulse items they buy at the supermarket. More attention will be given to the quality and value of the GM products they buy. Impulse buying in the more extreme sense (haphazardly grabbing a GM item off the shelf and tossing it into the shopping cart) will be replaced by what might be called "point-of purchase judgment shopping New GM products (and new food products, for that matter) will be more carefully scrutinized at the point of purchase. If the product passes this more careful scrutiny, then the basic advantages of having a desirable GM item available in the supermarket will prevail. Customers will be happy to take advantage of the one-stop shopping offered by the supermarket because they will be able to take care of more requirements without making additional stops at the drugstore, hardware store discount department store, toy store, or other retail outlets. In summary, while becoming more planned and careful, consumers will still be quite amenable to impulse purchases of GM products of all types, including toys, if these pro- ducts appear to offer good value as well as the convenience of buying them in supermarkets w for In SE Survey of Consumer Attitudes toward the Purchase of Infant Toys in Supermarkets In order to appraise the attitudes and behavior of consumers dealing specifically with the purchases of infant toys from supermarkets, a survey of 500 mothers with infant children was conducted. About 460 usable questionnaires were obtained. The findings are shown Exhibit 5 shows that for the sample group of consumers, the overwhelming choice of (17 percent) mentioned supermarkets. This is not surprising, however, especially in light of consumer perceptions of low quality of infant toys presently sold in supermarkets, shown in Exhibit 6. Hence, at present, it is very rare to find consumers who look to supermarkets as their most likely choice for buying infant toys. T&C with wow Soldi Mediocre qui Poor Very low quality The Total Pew FENISIT 7 Extent to Consumers Plan de Purchase or Tor Refun Spring Member 360 Almost always Frequently Usually Seldon Almost ever Total 30 Exhibit 7 shows that the overwhelming majority of consumers plan their purchases of infant toys before shopping This suggests that consumers are not at present beavily in clined toward impulse purchasing when it comes to buying infant toys. This does not mean, however, that they could not become more ametable to impulse buying if quality infant toys were more readily available in highly convenient retail outlets such as vaper- markets. This is implied by the findings shown in Exhibits 8 and 9. Exhibit shows 652 percent of the respondents expressed at least some likelihood of buying infunt toys from supermarkets if good quality and competitive prices were to become available. Exhibit 9 shows that, for those who would be likely to buy from supermarkets, the most important reasons for doing so are the greater convenience offered by supermarkets (73.3 percent) and the savings in time (20 percent). Thus, the heavy trend toward one-stop shopping which fosters impulse buying, is evident here Exhibit 10 shows the other side of the coin. For those consumers who expressed no likelihood of buying infant toys in the supermarket (34.8 percent), the reasons offered were perception of lower quality (25 percent), poor selection (37.5 percent), and the 1 har EMBIT 13 S fenerima the purch Titel 1000 en een bepaal com todas as speciale el color the permanent 11 them in the baby department form for planning (125 pct. Aromalle inference that may be drawn from te hibutochough that if quality and lection or infant for in rupermarkets were in Jowed a piticant portion of the unlikely to purchase group might move into the Mikely to purchase group Thus cellance, the data presented in Whibits 5 to 10 suggest that from the stand point of conantur propensities to shop for infants in the supermarkets, the project ane promising Exchabte 17 to 13 summare other information relevant to the marketing of inten tors through supermarket Exhibit it slows the maximum amounts that consumer said they would be willing to spend on unplanned purchases of infant foys in supermar kets. The 89 amount appears to be the upper limit. No consumen expressed willing ness to spend more than that amount on an unplanned Infant toy purchase Exhibit 12 shows that the highest percentage of consumers (60.9 percent) purchased intant toys about twice per year. The next highest percentage (21.7 percent) made pur chases about once per month. It should be pointed out, though, that this frequency of Discussion Questions 1. Based on the fings from the market study, do you think lovative solutie market the infant to line through em 2. What are some of the major obtain might face if it does attempt to sell the inity line through supermarket I reasonal calens up propriate for the way! Introduction: During this module, you will complete your third 1-page memo styled analysis. The Case Spotlight for Module 5 is....Innovative Toys. Innovative Toys Inc. is Case 12 in the Marketing Channels text. Upon reviewing, be sure to conduct additional research on the state of Innovative Toys current distribution using YouTube, Google, CNBC. You can also find an assortment of recent Innovative Toys ads, testimonials, and other information at https://www.creativechild.com/manufacturers/view/innovative-toys-inc Directions: Using the guidelines handout and examples, you will create a 1-page memo styled analysis addressing the following. 1. Summarize the Situation: First, start the analysis by sharing information that gets the reader interested and that makes them alert to what you have to say. For example, consider a S/W/O/T framework (Strengths/Weaknesses/ Opportunities/Threats). You can also share key facts, information or industry trends that set up the discussion such as market size, revenue, profitability, etc. 2. State the Idea - Compose a Compelling Tagline: Now that you have their attention, don't beat around the bush, get right to the point and tell them a brief statement of the idea. Provide a headline of your analysis stated in a way that makes it compelling. To quote Blue Ocean about Southwest Airlines: The speed of a plane at the price of a car-whenever you need it" 3. Explain how it Works: Once you've clearly stated the proposition, now is the time to provide details of the product/service/business/situation. Typically, this includes more information about the product, pricing. promotion, placement and execution such as timing and logistics. Profit and economic health are important factors to review. 4. Reinforce Key Benefits for the Customer - Differentiation: Now that you understand the detail, it is the time to hit home the key reasons to move forward, 3 Reasons. A prospect will only focus on the top couple issues, so it is an excellent practice to narrow down the list to the top 3 key reasons. 5. Suggest Easy Next Steps: Naturally, no sales process would be a best practice without "The Close". Be sure to move very naturally right into the close by "suggesting easy next steps". The emphasis is to make it easy for the decision maker (DMU) to say "yes" by planning in advance to remove barriers and showing them a path to agreement that fit easily into their situation. Submission: To submit this assignment, upload the Case Spotlight - Innovative Toys Inc. PDF or WORD document to the Case Spotlight Innovative Toys Inc. Assignment Folder. Introduction: During this module, you will complete your third 1-page memo styled analysis. The Case Spotlight for Module 5 is....Innovative Toys, Innovative Toys Inc. is Case 12 in the Marketing Channels text. Upon reviewing, be sure to conduct additional research on the state of Innovative Toys current distribution using YouTube, Google. CNBC. You can also find an assortment of recent Innovative Toys ads, testimonials, and other information at https://www.creativechild.com/manufacturers/view/innovative-toys-inc Directions: Using the guidelines handout and examples, you will create a 1-page memo styled analysis addressing the following. 1. Summarize the Situation: First, start the analysis by sharing information that gets the reader interested and that makes them alert to what you have to say. For example, consider a S/W/O/T framework (Strengths/Weaknesses/ Opportunities/ Threats). You can also share key facts, information or industry trends that set up the discussion such as market size, revenue, profitability, etc. 2. State the Idea - Compose a Compelling Tagline: Now that you have their attention, don't beat around the bush, get right to the point and tell them a brief statement of the idea. Provide a headline of your analysis stated in a way that makes it compelling. To quote Blue Ocean about Southwest Airlines: The speed of a plane at the price of a car - whenever you need it" 3. Explain how it Works: Once you've clearly stated the proposition, now is the time to provide details of the product/service/business/situation. Typically, this includes more information about the product, pricing, promotion, placement and execution such as timing and logistics. Profit and economic health are important factors to review. 4. Reinforce Key Benefits for the Customer - Differentiation: Now that you understand the detail, it is the time to hit home the key reasons to move forward, 3 Reasons. A prospect will only focus on the top couple issues, so it is an excellent practice to narrow down the list to the top 3 key reasons. 5. Suggest Easy Next Steps: Naturally, no sales process would be a best practice without "The Close". Be sure to move very naturally right into the close by "suggesting easy next steps". The emphasis is to make it easy for the decision maker (OMU) to say "yes" by planning in advance to remove barriers and showing them a path to agreement that fit easily into their situation Submission: To submit this assignment, upload the Case Spotlight - Innovative Toys Inc. PDF or WORD document to the Case Spotlight Innovative Toys Inc. Assignment Folder PA CASE 12 Innovative Toys Inc. Consumer Shopping Behavior and Channel Design for in a prie 1993 of the companion for By 200 Inowwe in developed my be consigo hicho and discount det stores Inmove Wa considering the possibility of pe the major channel for many merchandise new tey line through supermarket To appraise the few of wing supermarkets to distribute the insan soy Donald Mornion, Vice president of marketing hired an outside marketing cards fum to study the question. The research report follows Marketing Research Firm's Report Supermarkets have not played a large role in the distribution of Infant toys or other classes of toys. In fact, it is estimated that only about percent of total industry toy may be in store for the distribution of toys through supermarkets. The underlying factor responsible for this change is the heavy push by the supermarket industry to put more emphasis on the sale of nonfoods, particularly general merchandise, because of the higher margins available. Toys, particularly infant toys might play prominent role in this overall trend toward more emphasis on general merchandise (GM) by supermarkets Two basic factors must be present , however, in order to market toys successfully through supermarket channels (1) supermarket buyers must be favorably disposed to ward toys as an important and profitable GM category, and (2) consumers must be willi- ing to purchase toys from supermarkets. An analysis of each of these factors follows Disposition of Supermarket Executives toward Toys as a General Merchandise Category Several studies show a generally favorable attitude by supermarket executives toward toys as an important GM category. For example, a study of a nationwide panel of supermar ket executives reported in Progressive Grocer yielded the results shown in Exhibit 1. No ratings were less than good, while 54 percent of the supermarket executives rated toys as either very good or excellent as a GM category. Another study conducted by the research division of Progressive Grocer developed a comparative rating scale to show how toys are rated by supermarket executives among 30 GM categories. This is shown in Exhibit 2. As indicated, toys do reasonably well. scoring 79 (peg) and 67 (boxed) out of a possible 100. While toys are not rated as highly as light bulbs, disposable lighters, motor oil, and other GM categories, peg toys rated ahead of such items as basic soft goods, batteries, and sunglasses, and boxed toys are rated higher than glassware, photo finishing, hardware, and other items. 22 cu curmowe 4. Which purchased by women Each of the will be in me of how well innovativenant toy key to rate on white Margin Potential made supermarket oprit ahily sensitive to the marin potential of project GM products. They want moins that are much better than the average 20 10 21 percent Deteriorating Ilargins on lood products and rapidly increasing operating pendesh of sales for all products sold by independent and chain supermarkets. While there is definite minimum margin requirement for a GM item, if the item is capable of yed marginapproximately 50 percent higher than the 20 TO 21 percent average lead shows how Innovative's instant toys rate in terms of potential marins. If these toys could 30 percent it is more likely to be acceptable in terms of margin requirements Fathions be sold at the prices in column 3 the margins generated would be attractive and con petitive with many other GM items. Turnover With respect to frequency of sale, the product should be one that can be sold frequently, supermarkets have high traffic, the shoppers are essentially the same week after work consumed fairly rapidly. It should be pointed out, however, that the turnover figure on EXHIBIT 3 Margir Potential for Innovative Toys'Infant Toys Using Estimated Retail Selling Prices Cost $2.47 Toy Infant Ball Little Teether Feel and Look Fun Ring Look and Find Johnny Teething Selling Price 51.79 399 4.29 4.49 Markup 5132 1.36 153 263 2.76 304 334 4.19 Margin on Selling Price 34. 341 357 323 33.1 145 165 1.80 5.99 300 Average GM need to be as the 12 to 14 procent och over rate between 6 7 is quite creat Matteo to 35 percent. I live Toys Cachumbles that per year, it would meet the recite or any promarket Impulse Buying A good GM product must lead to imple buying Padang price and quality must be such that the customer does not have to comparison top other store the tomer should be able to decide to purchase within a few moments of contact with the product at the point of sale. Innovative's infant toy line appears to meet this criterion quite well Packaging, quality and price are geared to promote impul purchasing Size Display space is limited, even in the modern supermarkets of 50,000 to 75,000 square feet, and, of course, in the smaller supermarket of 30,000 square feet andet spec is even tighter. A good GM product, therefore, must not be overly bulky. On the other hand, given the theft and pilferage problem that exists today, very small items can also pose concerns. Innovative's infant toy line appears to present no particular problems on tive yet compact prepack displays Women Shoppers About 80 percent of supermarket customers are women. Accordingly. GM product must be one normally purchased by women. There is no problem here with Inutive's infant toy line because these toys normally would be bought by women. Stableness A desirable GM product should be relatively stable in the sense that variations in colors, sizes, and styles should be at a minimum. Supermarkets do not have the space to offer wide selections and they are very reluctant to handle style or fashion merchandise except for brief in-and-out promotions. Innovative's infant toy line scores well on this criterion. The selection is limited and it is not subject to rapid fashion changes Consumer Willingness to Purchase Toys in Supermarkets Even though supermarket operators have a generally favorable disposition toward toys as a GM category and Innovative's infant toy line should rate highly in terms of meeting basic supermarket purchasing criteria for GM, the ultimate determinant of whether the line will sell successfully in supermarkets lies in the area of consumer shopping habits and patterns. In short, are consumers likely to buy more toys (and, particularly, Innova tive's infant toys) from supermarkets? In order to deal with this question, a general profile of supermarket shopping behav- ior will be discussed in terms of how this shopping behavior is likely to facilitate or in hibit toy sales in supermarkets. Second, a preliminary survey was conducted dealing specifically with consumer attitudes toward the purchase of infant toys in supermarkets Supermarket Shopping Behavior and the Purchase of Toys Customers shop in supermarkets quite frequentiy. The latest studies show about 24 trips per week. Most of these customers are women about so percent), although there is a growing tendency for men to participate more frequently, Children are present on about Harta EXHIBIT 4 Preparation fine hyping Trips by Supermarket shoppen Od tamil Men 11 Alm 100 100 EX Sup 17 percent of the trip. In general during their trips to the supermarket, customers are in a buying mood. Most buy more than they had planned to purchase before visiting the supermarket. With the continuing stigma of the recession, however, careful planning by study conducted by the Home Testing Institute yielded the findings shown in Exhibit 4 the shopper is becoming more common as a way of staying within the budget Arect Because much of the success of supermarket GM marketing stems from frequent shop ping and impulse buying any indication of a decline in shopping frequency and impube buying could have negative implications for GM sales, whether for toya or other GM pro ducts. Fortunately, this does not appear to be the case. Shopping frequency has remained relatively stable ewer the past five years, and although consumers are becoming more atre ful and sharper shoppers, they are not turning away from impulse buying. They will, how ever. exercise more care and judgment about which impulse items they buy at the supermarket. More attention will be given to the quality and value of the GM products they buy. Impulse buying in the more extreme sense (haphazardly grabbing a GM item off the shelf and tossing it into the shopping cart) will be replaced by what might be called "point-of purchase judgment shopping New GM products (and new food products, for that matter) will be more carefully scrutinized at the point of purchase. If the product passes this more careful scrutiny, then the basic advantages of having a desirable GM item available in the supermarket will prevail. Customers will be happy to take advantage of the one-stop shopping offered by the supermarket because they will be able to take care of more requirements without making additional stops at the drugstore, hardware store discount department store, toy store, or other retail outlets. In summary, while becoming more planned and careful, consumers will still be quite amenable to impulse purchases of GM products of all types, including toys, if these pro- ducts appear to offer good value as well as the convenience of buying them in supermarkets w for In SE Survey of Consumer Attitudes toward the Purchase of Infant Toys in Supermarkets In order to appraise the attitudes and behavior of consumers dealing specifically with the purchases of infant toys from supermarkets, a survey of 500 mothers with infant children was conducted. About 460 usable questionnaires were obtained. The findings are shown Exhibit 5 shows that for the sample group of consumers, the overwhelming choice of (17 percent) mentioned supermarkets. This is not surprising, however, especially in light of consumer perceptions of low quality of infant toys presently sold in supermarkets, shown in Exhibit 6. Hence, at present, it is very rare to find consumers who look to supermarkets as their most likely choice for buying infant toys. T&C with wow Soldi Mediocre qui Poor Very low quality The Total Pew FENISIT 7 Extent to Consumers Plan de Purchase or Tor Refun Spring Member 360 Almost always Frequently Usually Seldon Almost ever Total 30 Exhibit 7 shows that the overwhelming majority of consumers plan their purchases of infant toys before shopping This suggests that consumers are not at present beavily in clined toward impulse purchasing when it comes to buying infant toys. This does not mean, however, that they could not become more ametable to impulse buying if quality infant toys were more readily available in highly convenient retail outlets such as vaper- markets. This is implied by the findings shown in Exhibits 8 and 9. Exhibit shows 652 percent of the respondents expressed at least some likelihood of buying infunt toys from supermarkets if good quality and competitive prices were to become available. Exhibit 9 shows that, for those who would be likely to buy from supermarkets, the most important reasons for doing so are the greater convenience offered by supermarkets (73.3 percent) and the savings in time (20 percent). Thus, the heavy trend toward one-stop shopping which fosters impulse buying, is evident here Exhibit 10 shows the other side of the coin. For those consumers who expressed no likelihood of buying infant toys in the supermarket (34.8 percent), the reasons offered were perception of lower quality (25 percent), poor selection (37.5 percent), and the 1 har EMBIT 13 S fenerima the purch Titel 1000 en een bepaal com todas as speciale el color the permanent 11 them in the baby department form for planning (125 pct. Aromalle inference that may be drawn from te hibutochough that if quality and lection or infant for in rupermarkets were in Jowed a piticant portion of the unlikely to purchase group might move into the Mikely to purchase group Thus cellance, the data presented in Whibits 5 to 10 suggest that from the stand point of conantur propensities to shop for infants in the supermarkets, the project ane promising Exchabte 17 to 13 summare other information relevant to the marketing of inten tors through supermarket Exhibit it slows the maximum amounts that consumer said they would be willing to spend on unplanned purchases of infant foys in supermar kets. The 89 amount appears to be the upper limit. No consumen expressed willing ness to spend more than that amount on an unplanned Infant toy purchase Exhibit 12 shows that the highest percentage of consumers (60.9 percent) purchased intant toys about twice per year. The next highest percentage (21.7 percent) made pur chases about once per month. It should be pointed out, though, that this frequency of Discussion Questions 1. Based on the fings from the market study, do you think lovative solutie market the infant to line through em 2. What are some of the major obtain might face if it does attempt to sell the inity line through supermarket I reasonal calens up propriate for the way! Introduction: During this module, you will complete your third 1-page memo styled analysis. The Case Spotlight for Module 5 is....Innovative Toys. Innovative Toys Inc. is Case 12 in the Marketing Channels text. Upon reviewing, be sure to conduct additional research on the state of Innovative Toys current distribution using YouTube, Google, CNBC. You can also find an assortment of recent Innovative Toys ads, testimonials, and other information at https://www.creativechild.com/manufacturers/view/innovative-toys-inc Directions: Using the guidelines handout and examples, you will create a 1-page memo styled analysis addressing the following. 1. Summarize the Situation: First, start the analysis by sharing information that gets the reader interested and that makes them alert to what you have to say. For example, consider a S/W/O/T framework (Strengths/Weaknesses/ Opportunities/Threats). You can also share key facts, information or industry trends that set up the discussion such as market size, revenue, profitability, etc. 2. State the Idea - Compose a Compelling Tagline: Now that you have their attention, don't beat around the bush, get right to the point and tell them a brief statement of the idea. Provide a headline of your analysis stated in a way that makes it compelling. To quote Blue Ocean about Southwest Airlines: The speed of a plane at the price of a car-whenever you need it" 3. Explain how it Works: Once you've clearly stated the proposition, now is the time to provide details of the product/service/business/situation. Typically, this includes more information about the product, pricing. promotion, placement and execution such as timing and logistics. Profit and economic health are important factors to review. 4. Reinforce Key Benefits for the Customer - Differentiation: Now that you understand the detail, it is the time to hit home the key reasons to move forward, 3 Reasons. A prospect will only focus on the top couple issues, so it is an excellent practice to narrow down the list to the top 3 key reasons. 5. Suggest Easy Next Steps: Naturally, no sales process would be a best practice without "The Close". Be sure to move very naturally right into the close by "suggesting easy next steps". The emphasis is to make it easy for the decision maker (DMU) to say "yes" by planning in advance to remove barriers and showing them a path to agreement that fit easily into their situation. Submission: To submit this assignment, upload the Case Spotlight - Innovative Toys Inc. PDF or WORD document to the Case Spotlight Innovative Toys Inc. Assignment Folder. Introduction: During this module, you will complete your third 1-page memo styled analysis. The Case Spotlight for Module 5 is....Innovative Toys, Innovative Toys Inc. is Case 12 in the Marketing Channels text. Upon reviewing, be sure to conduct additional research on the state of Innovative Toys current distribution using YouTube, Google. CNBC. You can also find an assortment of recent Innovative Toys ads, testimonials, and other information at https://www.creativechild.com/manufacturers/view/innovative-toys-inc Directions: Using the guidelines handout and examples, you will create a 1-page memo styled analysis addressing the following. 1. Summarize the Situation: First, start the analysis by sharing information that gets the reader interested and that makes them alert to what you have to say. For example, consider a S/W/O/T framework (Strengths/Weaknesses/ Opportunities/ Threats). You can also share key facts, information or industry trends that set up the discussion such as market size, revenue, profitability, etc. 2. State the Idea - Compose a Compelling Tagline: Now that you have their attention, don't beat around the bush, get right to the point and tell them a brief statement of the idea. Provide a headline of your analysis stated in a way that makes it compelling. To quote Blue Ocean about Southwest Airlines: The speed of a plane at the price of a car - whenever you need it" 3. Explain how it Works: Once you've clearly stated the proposition, now is the time to provide details of the product/service/business/situation. Typically, this includes more information about the product, pricing, promotion, placement and execution such as timing and logistics. Profit and economic health are important factors to review. 4. Reinforce Key Benefits for the Customer - Differentiation: Now that you understand the detail, it is the time to hit home the key reasons to move forward, 3 Reasons. A prospect will only focus on the top couple issues, so it is an excellent practice to narrow down the list to the top 3 key reasons. 5. Suggest Easy Next Steps: Naturally, no sales process would be a best practice without "The Close". Be sure to move very naturally right into the close by "suggesting easy next steps". The emphasis is to make it easy for the decision maker (OMU) to say "yes" by planning in advance to remove barriers and showing them a path to agreement that fit easily into their situation Submission: To submit this assignment, upload the Case Spotlight - Innovative Toys Inc. PDF or WORD document to the Case Spotlight Innovative Toys Inc. Assignment Folder