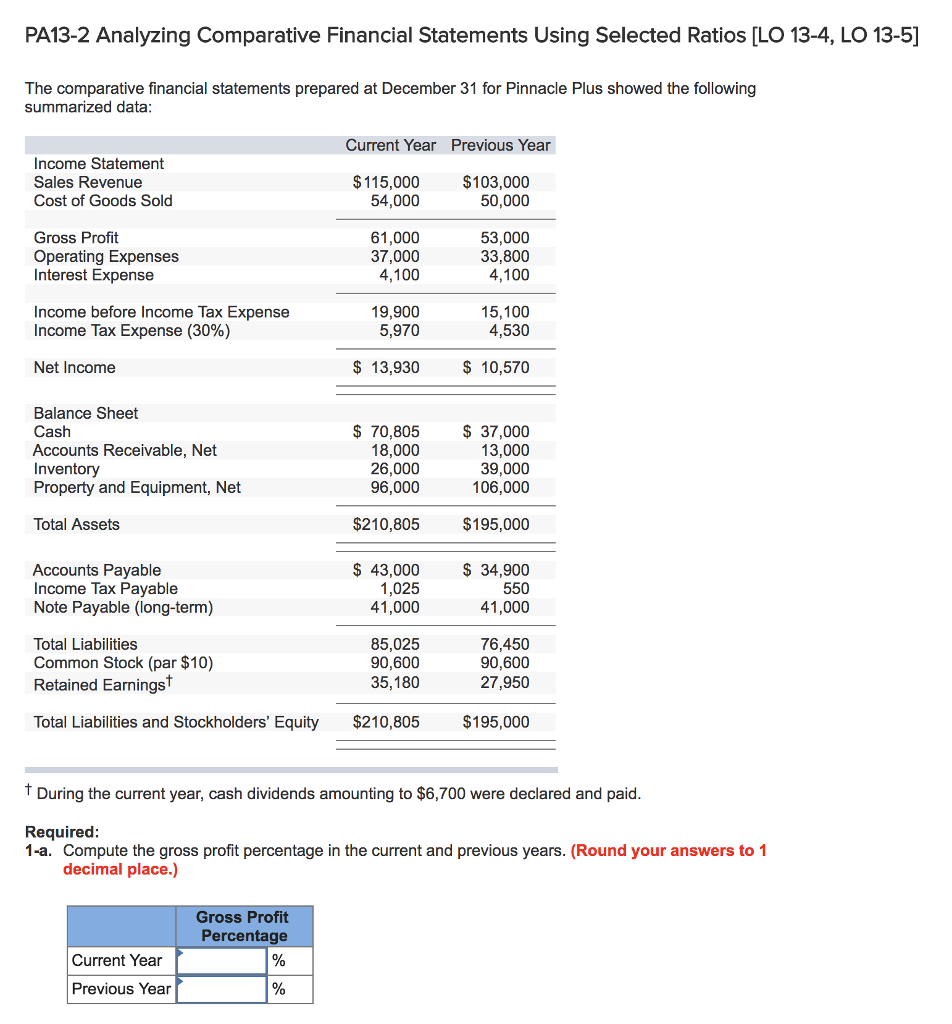

Question: PA13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus showed the

![13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e86651bc6cb_57766e8665139ce6.jpg)

PA13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus showed the following summarized data Current Year Previous Year Income Statement Sales Revenue Cost of Goods Sold $115,000 $103,000 50,000 54,000 Gross Profit Operating Expenses Interest Expense 61,000 37,000 4,100 53,000 33,800 4,100 Income before Income Tax Expense Income Tax Expense (30%) 19,900 5,970 15,100 4,530 Net Income $ 13,930 10,570 Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net $ 70,805 18,000 26,000 96,000 37,000 13,000 39,000 106,000 Total Assets $210,805 $195,000 $ 43,000 1,025 41,000 $ 34,900 550 41,000 Accounts Payable Income Tax Pavable Note Payable (long-term) Total Liabilities Common Stock (par $10) Retained EarningsT 85,025 90,600 35,180 76,450 90,600 27,950 Total Liabilities and Stockholders' Equity $210,805 $195,000 T During the current year, cash dividends amounting to $6,700 were declared and paid Required: 1-a. Compute the gross profit percentage in the current and previous years. (Round your answers to 1 decimal place.) Gross Profit Percentage Current Year Previous Year PA13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Pinnacle Plus showed the following summarized data Current Year Previous Year Income Statement Sales Revenue Cost of Goods Sold $115,000 $103,000 50,000 54,000 Gross Profit Operating Expenses Interest Expense 61,000 37,000 4,100 53,000 33,800 4,100 Income before Income Tax Expense Income Tax Expense (30%) 19,900 5,970 15,100 4,530 Net Income $ 13,930 10,570 Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net $ 70,805 18,000 26,000 96,000 37,000 13,000 39,000 106,000 Total Assets $210,805 $195,000 $ 43,000 1,025 41,000 $ 34,900 550 41,000 Accounts Payable Income Tax Pavable Note Payable (long-term) Total Liabilities Common Stock (par $10) Retained EarningsT 85,025 90,600 35,180 76,450 90,600 27,950 Total Liabilities and Stockholders' Equity $210,805 $195,000 T During the current year, cash dividends amounting to $6,700 were declared and paid Required: 1-a. Compute the gross profit percentage in the current and previous years. (Round your answers to 1 decimal place.) Gross Profit Percentage Current Year Previous Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts