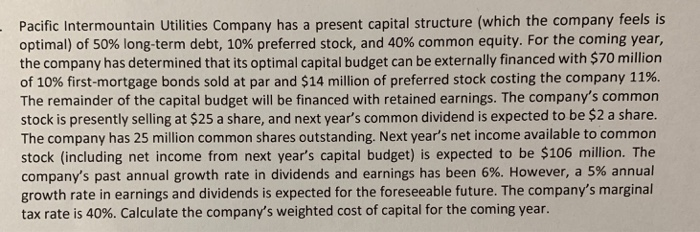

Question: Pacific Intermountain Utilities Company has a present capital structure (which the company feels is optimal) of 50% long-term debt, 10% preferred stock, and 40% common

Pacific Intermountain Utilities Company has a present capital structure (which the company feels is optimal) of 50% long-term debt, 10% preferred stock, and 40% common equity. For the coming year, the company has determined that its optimal capital budget can be externally financed with $70 million of 10% first-mortgage bonds sold at par and $14 million of preferred stock costing the company 11%. The remainder of the capital budget will be financed with retained earnings. The company's common stock is presently selling at $25 a share, and next year's common dividend is expected to be $2 a share. The company has 25 million common shares outstanding. Next year's net income available to common stock (including net income from next year's capital budget) is expected to be $106 million. The company's past annual growth rate in dividends and earnings has been 6%. However, a 5% annual growth rate in earnings and dividends is expected for the foreseeable future. The company's marginal tax rate is 40%. Calculate the company's weighted cost of capital for the coming year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts