Question: Pacific Intermountain Utilities Company has a present capital structure (which the company feels is optimal) of 60 percent long-term debt, 15 percent preferred stock, and

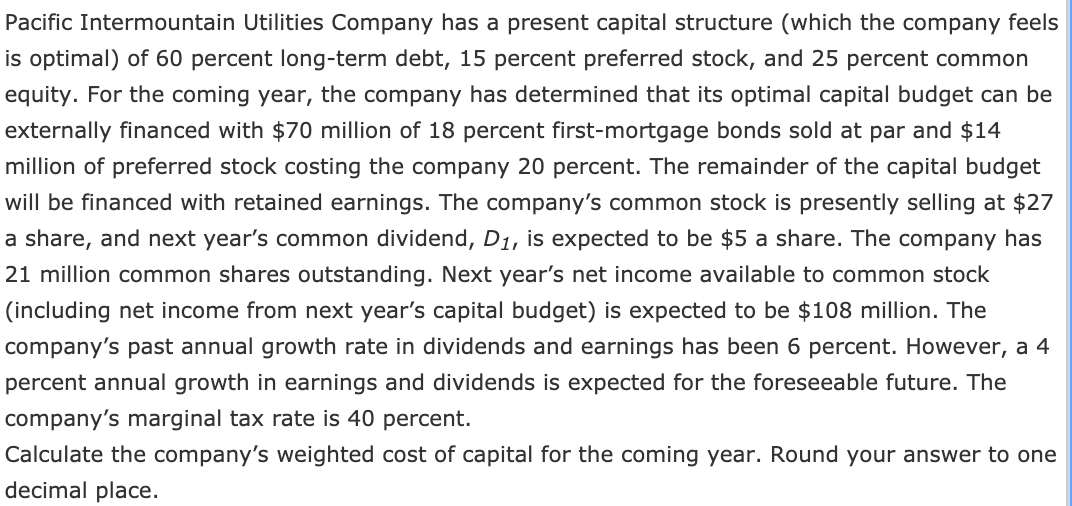

Pacific Intermountain Utilities Company has a present capital structure (which the company feels is optimal) of 60 percent long-term debt, 15 percent preferred stock, and 25 percent common equity. For the coming year, the company has determined that its optimal capital budget can be externally financed with $70 million of 18 percent first-mortgage bonds sold at par and $14 million of preferred stock costing the company 20 percent. The remainder of the capital budget will be financed with retained earnings. The company's common stock is presently selling at $27 a share, and next year's common dividend, D1, is expected to be $5 a share. The company has 21 million common shares outstanding. Next year's net income available to common stock (including net income from next year's capital budget) is expected to be $108 million. The company's past annual growth rate in dividends and earnings has been 6 percent. However, a 4 percent annual growth in earnings and dividends is expected for the foreseeable future. The company's marginal tax rate is 40 percent. Calculate the company's weighted cost of capital for the coming year. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts