Question: Page 1: 1 2 3 - > At the end of 2021, ACME Corporation faced increasing competition leading to a build up of inventory

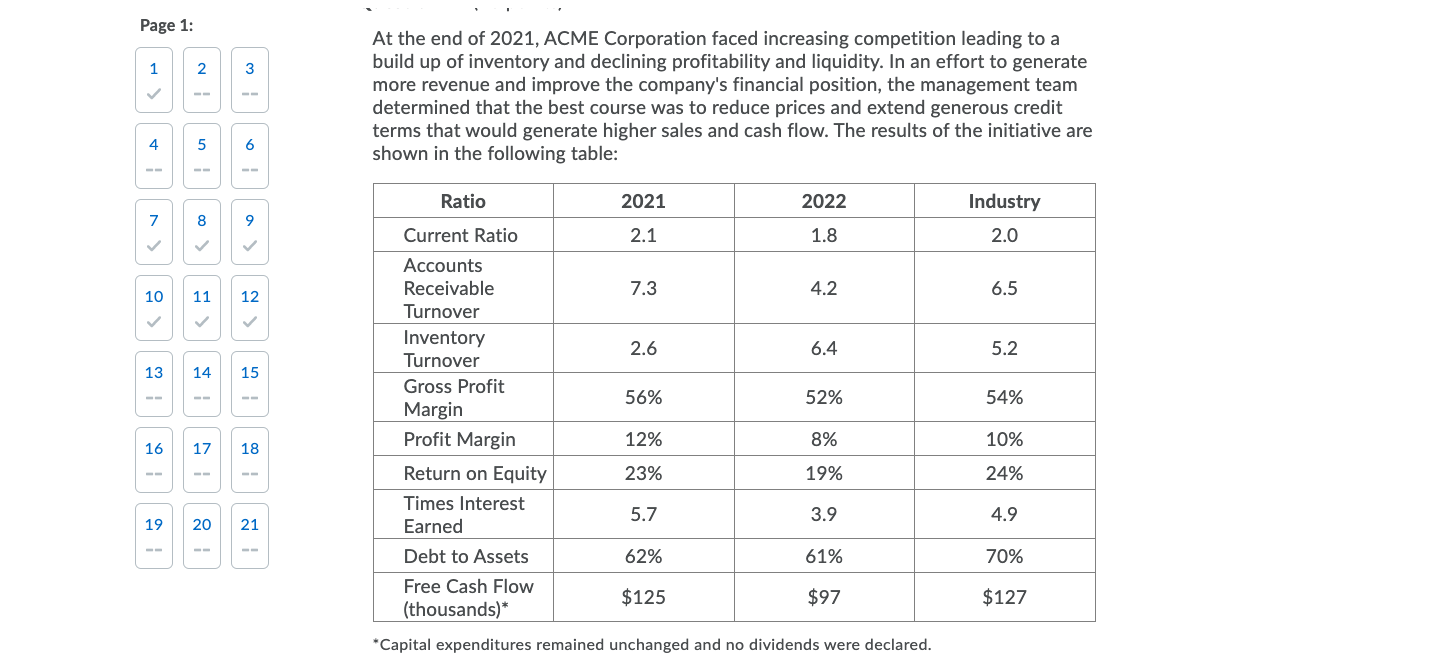

Page 1: 1 2 3 - > At the end of 2021, ACME Corporation faced increasing competition leading to a build up of inventory and declining profitability and liquidity. In an effort to generate more revenue and improve the company's financial position, the management team determined that the best course was to reduce prices and extend generous credit terms that would generate higher sales and cash flow. The results of the initiative are shown in the following table: Ratio 2021 2022 a > 7 > > 8 9 Current Ratio 2.1 1.8 Industry 2.0 Accounts Receivable 7.3 4.2 6.5 10 11 12 4 5 6 > Turnover Inventory 2.6 6.4 5.2 Turnover 13 #1 1 14 15 Gross Profit 56% 52% 54% Margin 11 16 Profit Margin 12% 8% 10% 17 18 Return on Equity 23% 19% 24% Times Interest 19 15 21 5.7 3.9 4.9 20 21 21 Earned Debt to Assets 62% 61% 70% Free Cash Flow $125 $97 $127 (thousands)* < *Capital expenditures remained unchanged and no dividends were declared.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts