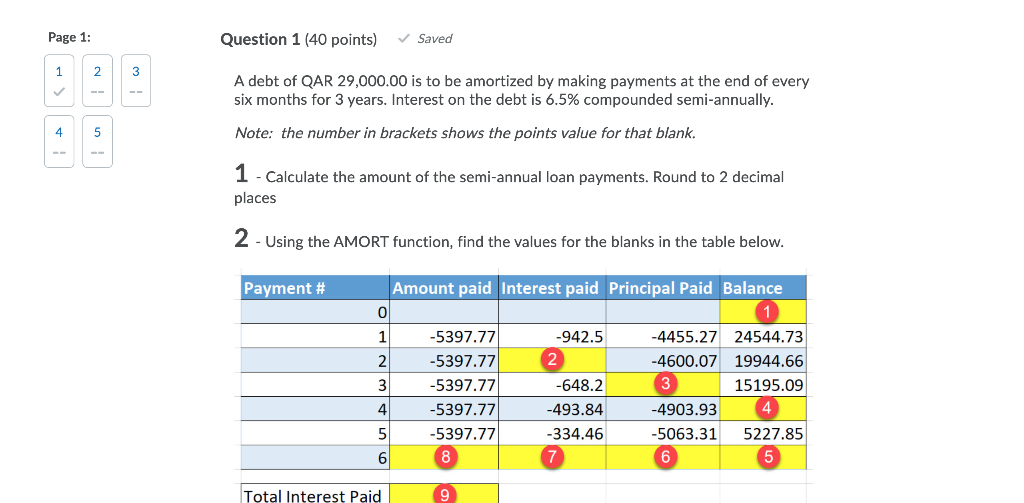

Question: Page 1: Question 1 (40 points) Saved 1 2 3 A debt of QAR 29,000.00 is to be amortized by making payments at the end

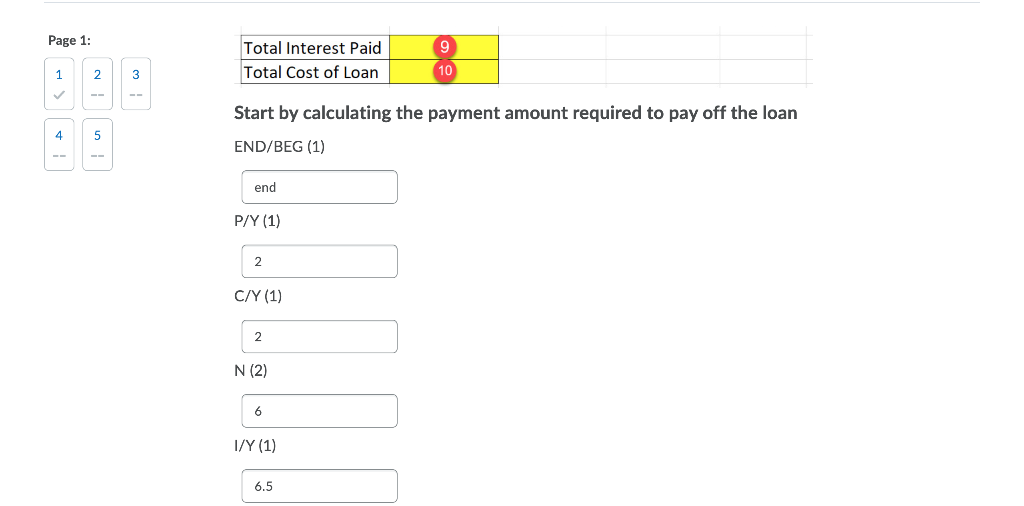

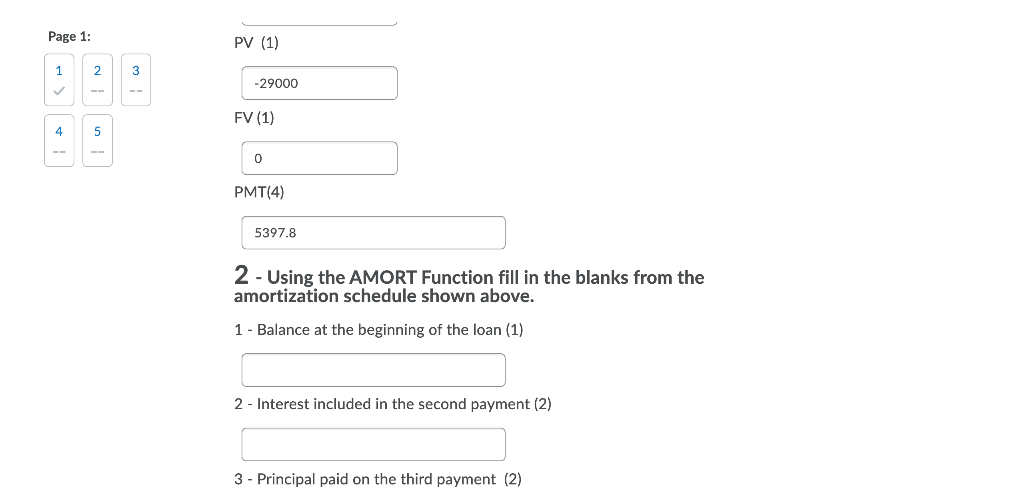

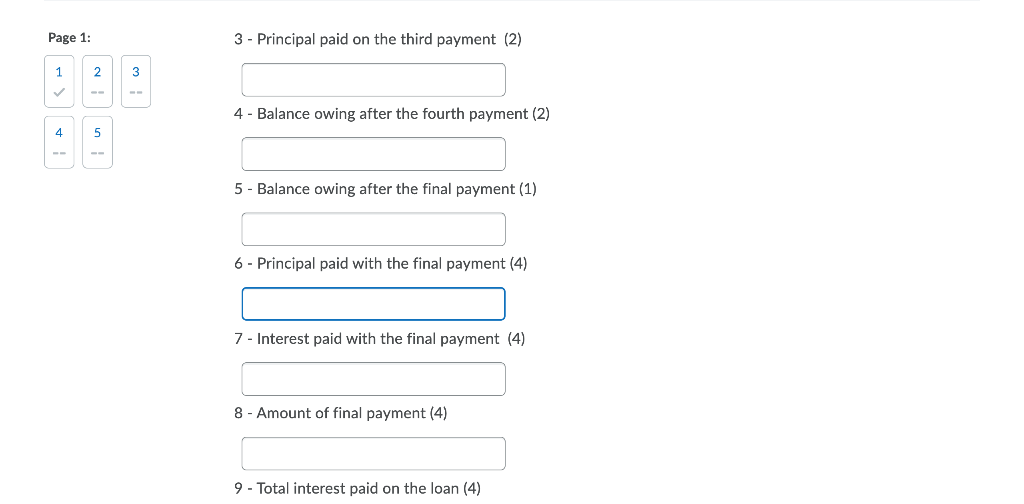

Page 1: Question 1 (40 points) Saved 1 2 3 A debt of QAR 29,000.00 is to be amortized by making payments at the end of every six months for 3 years. Interest on the debt is 6.5% compounded semi-annually. 4 5 Note: the number in brackets shows the points value for that blank. 1 - Calculate the amount of the semi-annual loan payments. Round to 2 decimal places 2 - Using the AMORT function, find the values for the blanks in the table below. Payment # Amount paid Interest paid Principal Paid Balance 0 -942.5 2 1 2 3 4 -5397.77 -5397.77 -5397.77 -5397.77 -5397.77 8 -648.2 -493.84 -334.46 -4455.27 24544.73 -4600.07 19944.66 3 15195.09 -4903.93 -5063.31 5227.85 6 5 5 6 Total Interest Paid 9 Page 1: 9 Total Interest Paid Total Cost of Loan 1 2 3 10 Start by calculating the payment amount required to pay off the loan 4 5 END/BEG (1) end P/Y (1) 2 C/Y (1) 2 N (2) 6 I/Y (1) 6.5 Page 1: PV (1) 1 2 3 -29000 FV (1) 4 5 0 PMT(4) 5397.8 2 - Using the AMORT Function fill in the blanks from the amortization schedule shown above. 1 - Balance at the beginning of the loan (1) 2 - Interest included in the second payment (2) 3 - Principal paid on the third payment (2) Page 1: 3 - Principal paid on the third payment (2) 1 2 3 4 - Balance owing after the fourth payment (2) 4 5 5 - Balance owing after the final payment (1) 6 - Principal paid with the final payment (4) 7 - Interest paid with the final payment (4) 8 - Amount of final payment (4) 9 - Total interest paid on the loan (4) Page 1: 5- Balance owing after the final payment (1) 1 2 3 6 - Principal paid with the final payment (4) 4 5 7 - Interest paid with the final payment (4) 8 - Amount of final payment (4) 9 - Total interest paid on the loan (4) 10 - Total cost of the loan (4) Page 1: Question 1 (40 points) Saved 1 2 3 A debt of QAR 29,000.00 is to be amortized by making payments at the end of every six months for 3 years. Interest on the debt is 6.5% compounded semi-annually. 4 5 Note: the number in brackets shows the points value for that blank. 1 - Calculate the amount of the semi-annual loan payments. Round to 2 decimal places 2 - Using the AMORT function, find the values for the blanks in the table below. Payment # Amount paid Interest paid Principal Paid Balance 0 -942.5 2 1 2 3 4 -5397.77 -5397.77 -5397.77 -5397.77 -5397.77 8 -648.2 -493.84 -334.46 -4455.27 24544.73 -4600.07 19944.66 3 15195.09 -4903.93 -5063.31 5227.85 6 5 5 6 Total Interest Paid 9 Page 1: 9 Total Interest Paid Total Cost of Loan 1 2 3 10 Start by calculating the payment amount required to pay off the loan 4 5 END/BEG (1) end P/Y (1) 2 C/Y (1) 2 N (2) 6 I/Y (1) 6.5 Page 1: PV (1) 1 2 3 -29000 FV (1) 4 5 0 PMT(4) 5397.8 2 - Using the AMORT Function fill in the blanks from the amortization schedule shown above. 1 - Balance at the beginning of the loan (1) 2 - Interest included in the second payment (2) 3 - Principal paid on the third payment (2) Page 1: 3 - Principal paid on the third payment (2) 1 2 3 4 - Balance owing after the fourth payment (2) 4 5 5 - Balance owing after the final payment (1) 6 - Principal paid with the final payment (4) 7 - Interest paid with the final payment (4) 8 - Amount of final payment (4) 9 - Total interest paid on the loan (4) Page 1: 5- Balance owing after the final payment (1) 1 2 3 6 - Principal paid with the final payment (4) 4 5 7 - Interest paid with the final payment (4) 8 - Amount of final payment (4) 9 - Total interest paid on the loan (4) 10 - Total cost of the loan (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts