Question: Paragraph Dactate Select- 2. What is going on at CPK Rwhat decisions does Susan Collezs face? Styles Editing Vaate Sensie What a Discuss the operating

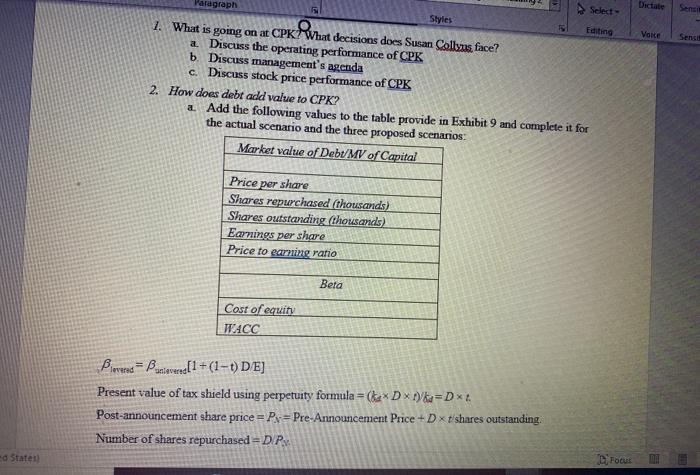

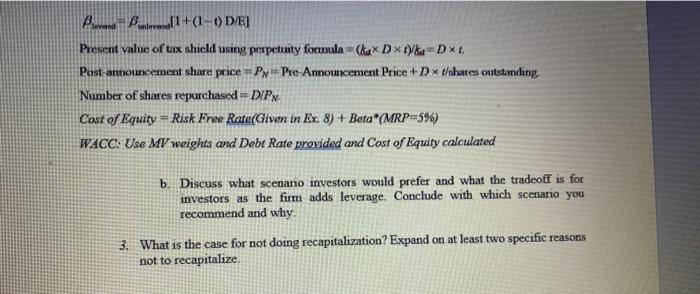

Paragraph Dactate Select- 2. What is going on at CPK Rwhat decisions does Susan Collezs face? Styles Editing Vaate Sensie What a Discuss the operating performance of CPK b. Discuss management's agenda c. Discuss stock price performance of CPK 2. How does debt add value to CPK? Add the following values to the table provide in Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: Market value of Debt/MV of Capital a Price per share Shares repurchased thousands) Shares outstanding thousands) Earnings per share Price to earning ratio Beta Cost of equin W.ACC Blivered = Bunieved [1 + (1-1) DE] Present value of tax shield using perpetuity formula = (*D*\ka=D*% Post-announcement share price = Px= Pre-Announcement Price +Dxt shares outstanding. Number of shares repurchased =D P. d State Focus Bola 1 (1-0) D/E] Present value of uix shield using perpetunity formula( kxDxVxDxL Post announcement share pricePx Pre-Amouxement Price+Dxt/shares outstanding Number of shares repurchased =DIP. Cost of Equity = Risk Free Rate(Given in Ex. 8) + Beta"(MRP=5%) WACC: Use MV weights and Debt Rate provided and Cost of Equity calculated b. Discuss what scenario investors would prefer and what the tradeoff is for investors as the firm adds leverage. Conclude with which scenario you recommend and why. 3. What is the case for not doing recapitalization? Expand on at least two specific reasons not to recapitalize Paragraph Dactate Select- 2. What is going on at CPK Rwhat decisions does Susan Collezs face? Styles Editing Vaate Sensie What a Discuss the operating performance of CPK b. Discuss management's agenda c. Discuss stock price performance of CPK 2. How does debt add value to CPK? Add the following values to the table provide in Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: Market value of Debt/MV of Capital a Price per share Shares repurchased thousands) Shares outstanding thousands) Earnings per share Price to earning ratio Beta Cost of equin W.ACC Blivered = Bunieved [1 + (1-1) DE] Present value of tax shield using perpetuity formula = (*D*\ka=D*% Post-announcement share price = Px= Pre-Announcement Price +Dxt shares outstanding. Number of shares repurchased =D P. d State Focus Bola 1 (1-0) D/E] Present value of uix shield using perpetunity formula( kxDxVxDxL Post announcement share pricePx Pre-Amouxement Price+Dxt/shares outstanding Number of shares repurchased =DIP. Cost of Equity = Risk Free Rate(Given in Ex. 8) + Beta"(MRP=5%) WACC: Use MV weights and Debt Rate provided and Cost of Equity calculated b. Discuss what scenario investors would prefer and what the tradeoff is for investors as the firm adds leverage. Conclude with which scenario you recommend and why. 3. What is the case for not doing recapitalization? Expand on at least two specific reasons not to recapitalize

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts