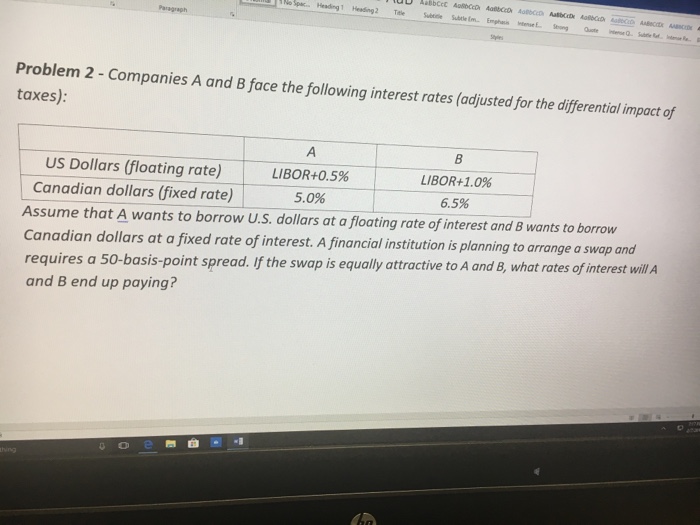

Question: Paragraph Problem 2 - Companies A and B face the following interest rates (adjusted for the differential impact of taxes): US Dollars (floating rate) LIBOR+0.5%

Paragraph Problem 2 - Companies A and B face the following interest rates (adjusted for the differential impact of taxes): US Dollars (floating rate) LIBOR+0.5% Canadian dollars (fixed rate) Assume that A wants to borrow U.S. dollars at a floating rate of interest and B wants to borrow Canadian dollars at a fixed rate of interest. A financial institution is planning to arrange a swap an requires a 50-basis-point spread. If the swap is equally attractive to A and B, what rates of interest will A LIBOR+1.0% 5.0% 6.5% and B end up paying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts