Question: ****Please make sure you walk through exactly how you answer the question with steps and formulas so i learn how to do it, thank you*****

****Please make sure you walk through exactly how you answer the question with steps and formulas so i learn how to do it, thank you*****

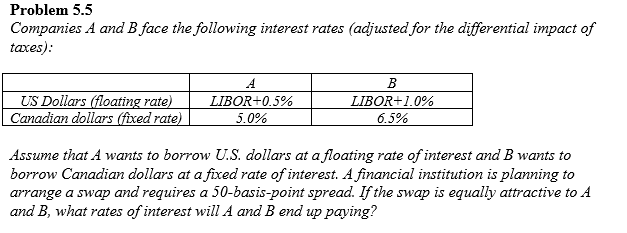

Problem 5.5 Companies A and B face the following interest rates (adjusted for the differential impact of taxes) US Dollars (floating rate) Canadian dollars (fixed rate) LIBOR-0.5% 5.0% LIBOR-10% 6.5% Assume that A wants to borrow U.S. dollars at a floating rate of interest and B wants to borrow Canadian dollars at a fixed rate of interest. A financial institution is planning to arrange a swap and requires a 50-basis-point spread. Ifthe swap is equally attractive to A and B, what rates of interest will A and B end up paying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts