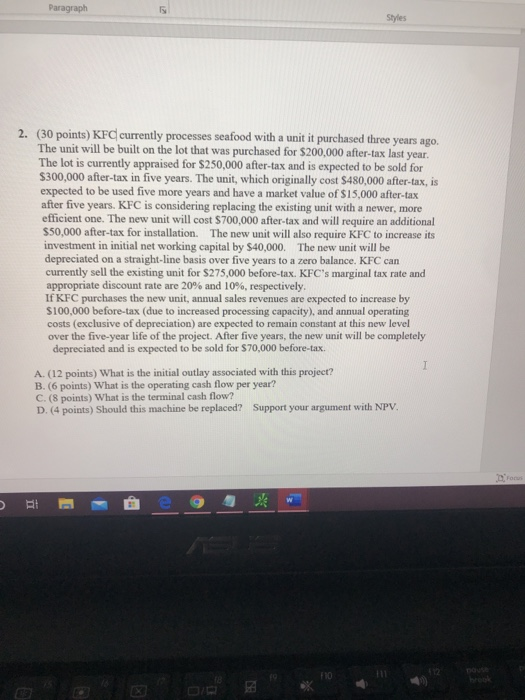

Question: Paragraph Styles 2. (30 points) KFC currently processes seafood with a unit it purchased three years ago. The unit will be built on the lot

Paragraph Styles 2. (30 points) KFC currently processes seafood with a unit it purchased three years ago. The unit will be built on the lot that was purchased for $200,000 after-tax last year. The lot is currently appraised for $250,000 after-tax and is expected to be sold for $300,000 after-tax in five years. The unit, which originally cost $480,000 after-tax, is expected to be used five more years and have a market value of $15,000 after-tax after five years. KFC is considering replacing the existing unit with a newer, more efficient one. The new unit will cost $ 700,000 after-tax and will require an additional $50,000 after-tax for installation. The new unit will also require KFC to increase its investment in initial networking capital by $40,000. The new unit will be depreciated on a straight-line basis over five years to a zero balance. KFC can currently sell the existing unit for $275,000 before-tax. KFC's marginal tax rate and appropriate discount rate are 20% and 10%, respectively. If KFC purchases the new unit, annual sales revenues are expected to increase by $100,000 before-tax (due to increased processing capacity), and annual operating costs (exclusive of depreciation) are expected to remain constant at this new level over the five-year life of the project. After five years, the new unit will be completely depreciated and is expected to be sold for $70,000 before-tax. A. (12 points) What is the initial outlay associated with this project? B. (6 points) What is the operating cash flow per year? C. (8 points) What is the terminal cash flow? D. (4 points) Should this machine be replaced? Support your argument with NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts