Question: Paragraph Styles JESTION THREE [25] heetah Wheel & Alignment is considering the purchase or lease of a new state of the art heel alignment machine

![Paragraph Styles JESTION THREE [25] heetah Wheel & Alignment is considering](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e2f72b0ee2a_44266e2f72a2f930.jpg)

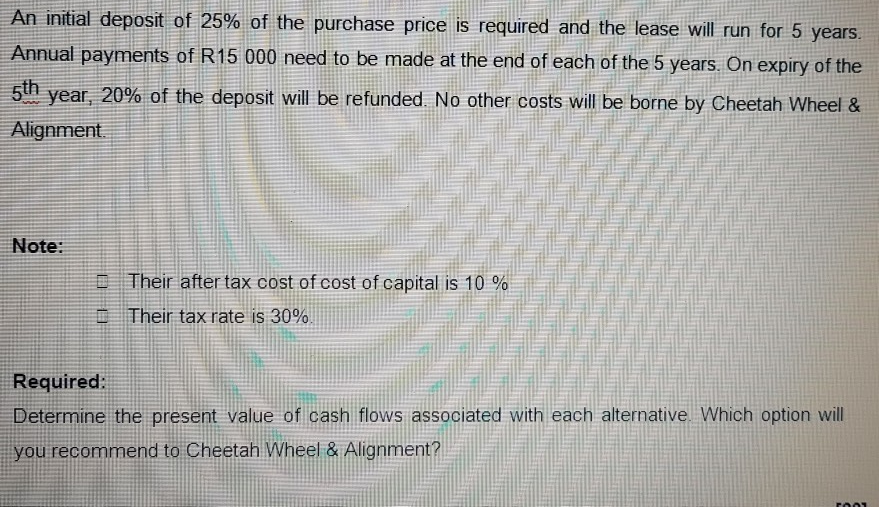

Paragraph Styles JESTION THREE [25] heetah Wheel & Alignment is considering the purchase or lease of a new state of the art heel alignment machine for their premises in Brickfield Road, Overport, KwaZulu-Natal. The siness has 2 options to facilitate the purchase ie buy it straight out or lease it. Below are the etails for the 2 options: he Purchase Option ne cost is R 60 000. This amount will be paid in cash. It is estimated that this machine ill only have a lifespan of 5 years and will then be sold back to the seller at a residual alue of R10 000. Depreciation is calculated on a straight-line basis. There is an annual oftware update and it will cost, R10 000 p a. Maintenance Costs are as follows: Years 1 and 2 R6 000 per year Year 3 R5 500 Years 4 and 5 R5 000 per year The Leasing Option An initial deposit of 25% of the purchase price is required and the lease will run for 5 years. Annual payments of R15 000 need to be made at the end of each of the 5 years. On expiry of the 5th year, 20% of the deposit will be refunded. No other costs will be borne by Cheetah Wheel & Alignment Note: Their after tax cost of cost of capital is 10 % Their tax rate is 30%. Required: Determine the present value of cash flows associated with each alternative. Which option will you recommend to Cheetah Wheel & Alignment? TOO Paragraph Styles JESTION THREE [25] heetah Wheel & Alignment is considering the purchase or lease of a new state of the art heel alignment machine for their premises in Brickfield Road, Overport, KwaZulu-Natal. The siness has 2 options to facilitate the purchase ie buy it straight out or lease it. Below are the etails for the 2 options: he Purchase Option ne cost is R 60 000. This amount will be paid in cash. It is estimated that this machine ill only have a lifespan of 5 years and will then be sold back to the seller at a residual alue of R10 000. Depreciation is calculated on a straight-line basis. There is an annual oftware update and it will cost, R10 000 p a. Maintenance Costs are as follows: Years 1 and 2 R6 000 per year Year 3 R5 500 Years 4 and 5 R5 000 per year The Leasing Option An initial deposit of 25% of the purchase price is required and the lease will run for 5 years. Annual payments of R15 000 need to be made at the end of each of the 5 years. On expiry of the 5th year, 20% of the deposit will be refunded. No other costs will be borne by Cheetah Wheel & Alignment Note: Their after tax cost of cost of capital is 10 % Their tax rate is 30%. Required: Determine the present value of cash flows associated with each alternative. Which option will you recommend to Cheetah Wheel & Alignment? TOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts