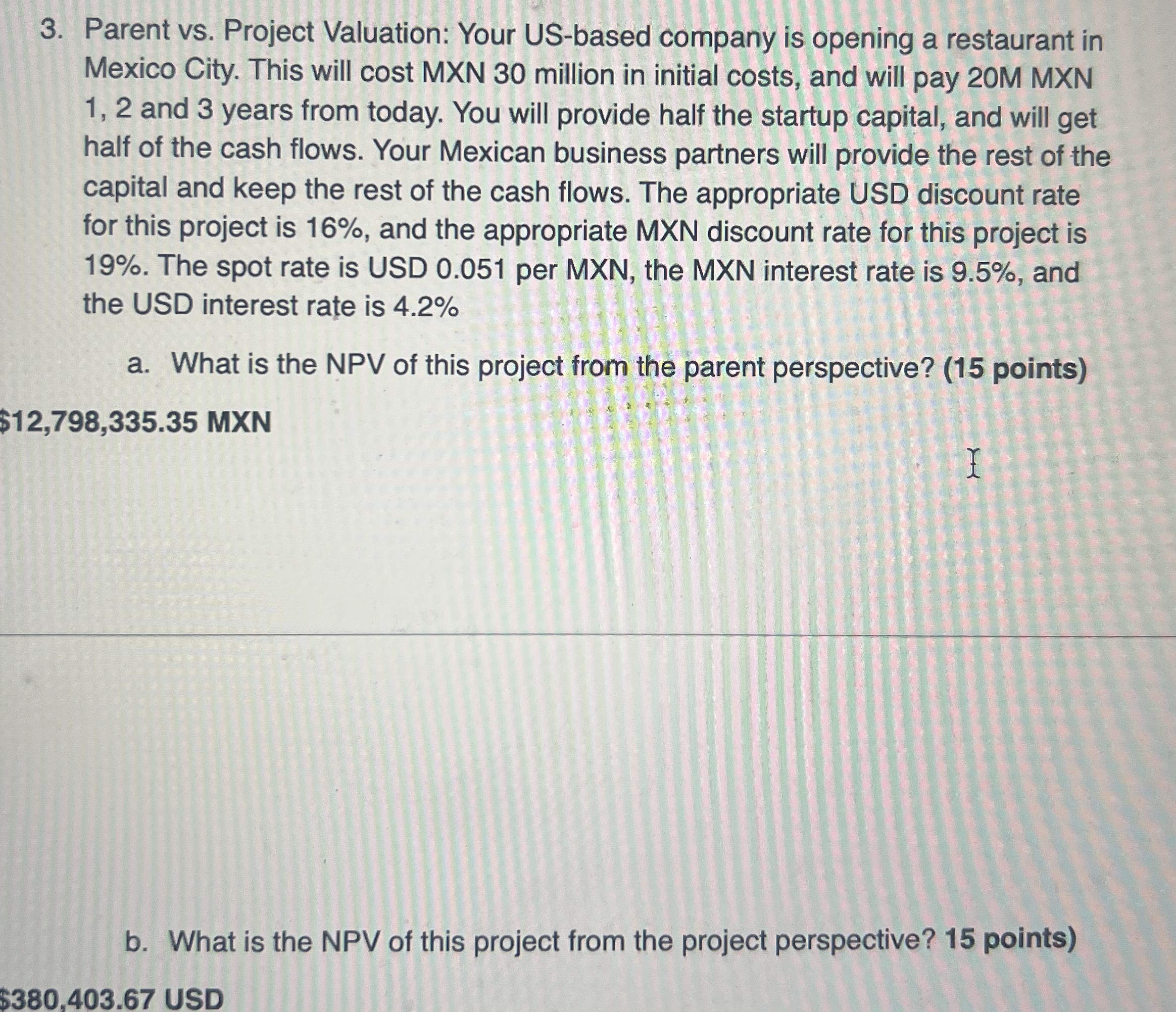

Question: Parent vs . Project Valuation: Your US - based company is opening a restaurant in Mexico City. This will cost MXN 3 0 million in

Parent vs Project Valuation: Your USbased company is opening a restaurant in Mexico City. This will cost MXN million in initial costs, and will pay M MXN and years from today. You will provide half the startup capital, and will get half of the cash flows. Your Mexican business partners will provide the rest of the capital and keep the rest of the cash flows. The appropriate USD discount rate for this project is and the appropriate MXN discount rate for this project is The spot rate is USD per MXN the MXN interest rate is and the USD interest rate is

a What is the NPV of this project from the parent perspective? points

$ MXN

b What is the NPV of this project from the project perspective? points

$ USD

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock