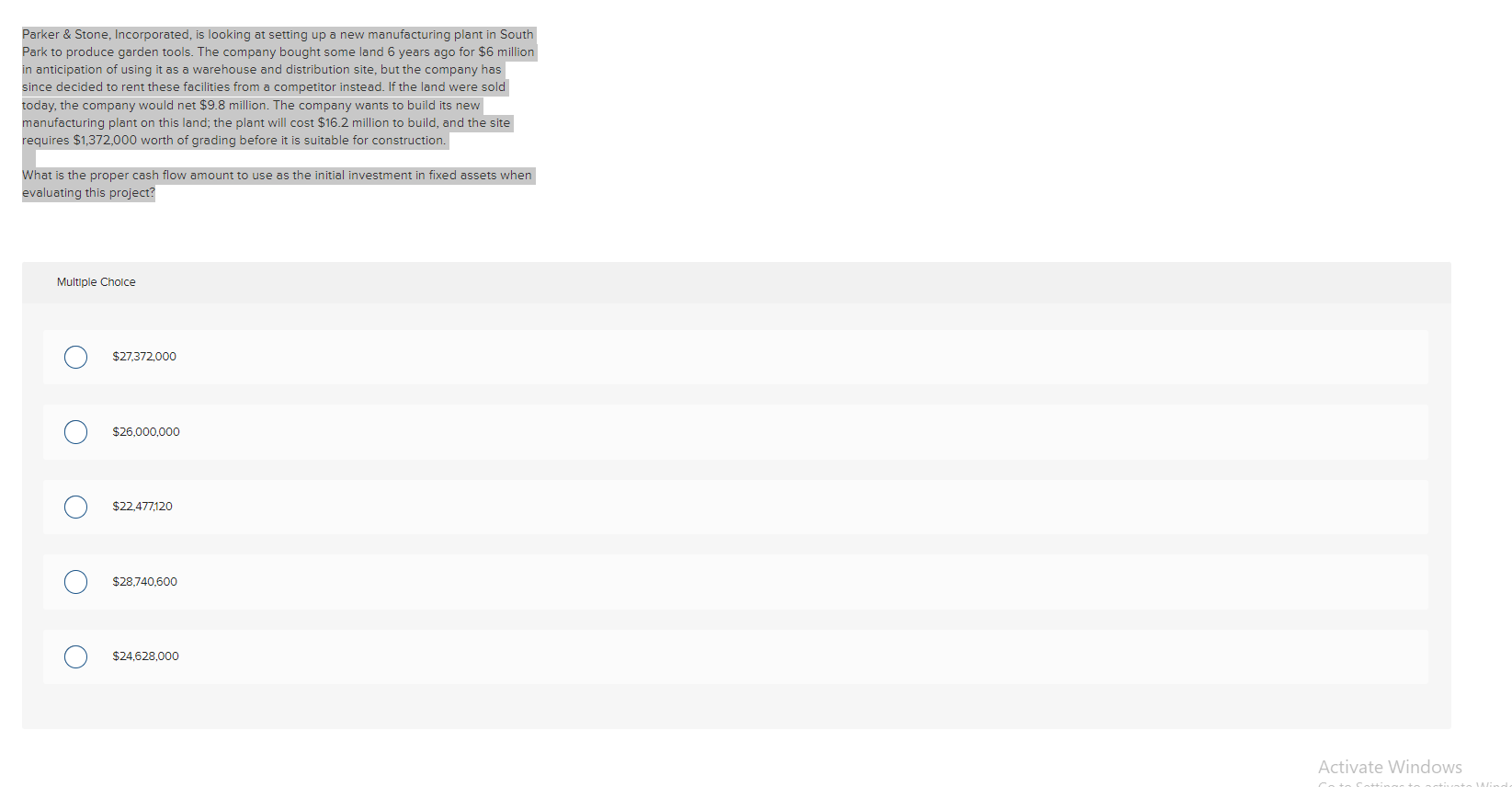

Question: Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land

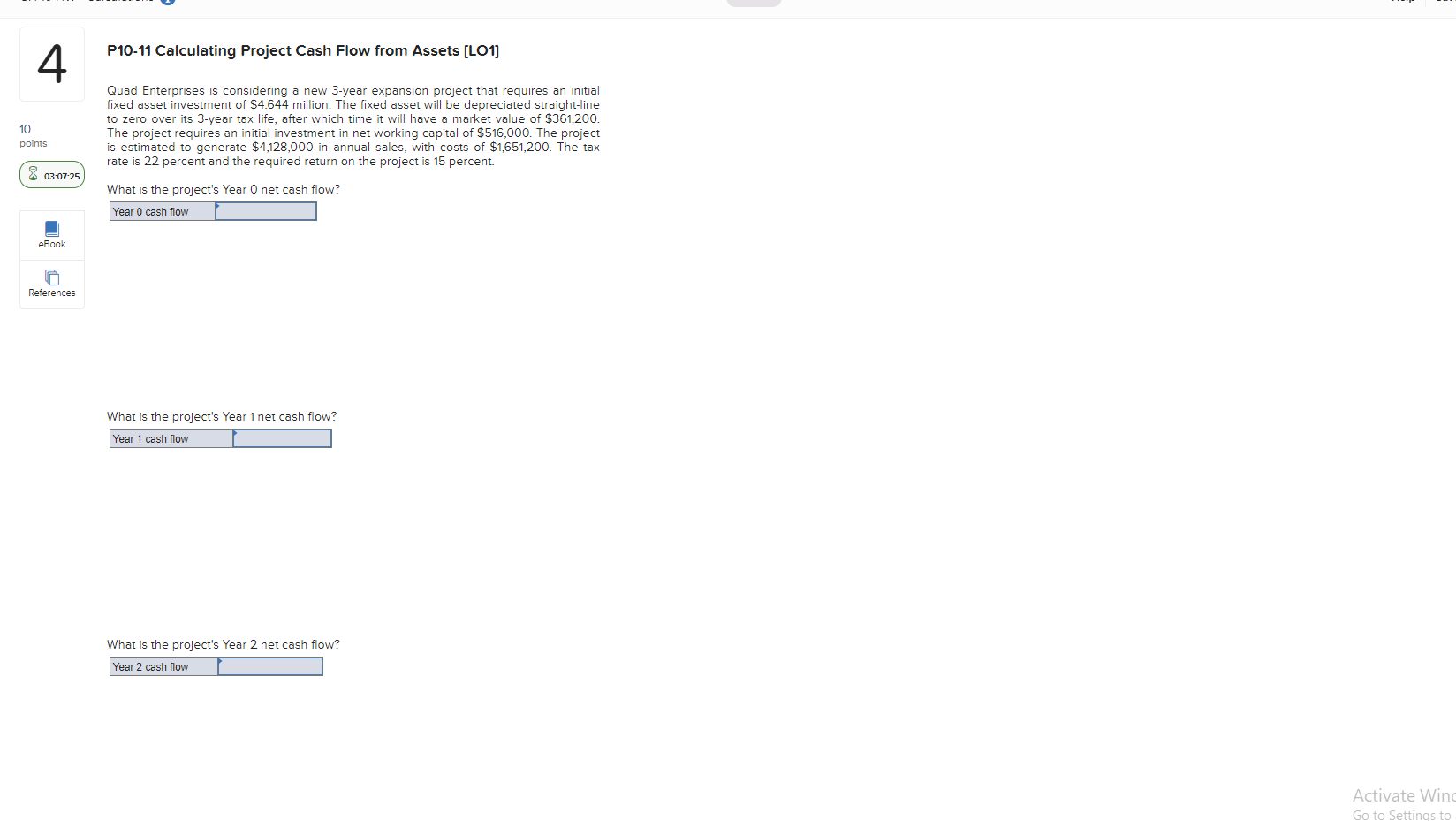

Parker \& Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land 6 years ago for $6 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $9.8 million. The company wants to build its new manufacturing plant on this land; the plant will cost $16.2 million to build, and the site requires $1,372,000 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project? Multiple Choice $27,372,000 $26,000,000 $22,477,120 $28,740,600 $24,628,000 Winnebagel Corporation currently sells 25,200 motor homes per year at $37,800 each, and 10,080 luxury motor coaches per year at $71,400 each. The company wants to introduce a new portable camper to fill out its product line; it hopes to sell 15,960 of these campers per year at $10,080 each. An independent consultant has determined that if the company introduces the new campers, it should boost the sales of its existing motor homes by 3,780 units per year, and reduce the sales of its motor coaches by 756 units per year. What is the amount to use as the annual sales figure when evaluating this project? Multiple Choice $249,782,400 $160,876,800 $262,271,520 $237,293,280 $357,739,200 P10-11 Calculating Project Cash Flow from Assets [LO1] Quad Enterprises is considering a new 3-year expansion project that requires an initial fixed asset investment of $4.644 million. The fixed asset will be depreciated straight-line to zero over its 3 -year tax life, after which time it will have a market value of $361,200. The project requires an initial investment in net working capital of $516,000. The project is estimated to generate $4,128,000 in annual sales, with costs of $1,651,200. The tax rate is 22 percent and the required return on the project is 15 percent. What is the project's Year 0 net cash flow? Year0cashflow What is the project's Year 1 net cash flow? Year1cashflow What is the project's Year 2 net cash flow? What is the project's Year 3 net cash flow? Year 3 cash flow What is the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts