Question: Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land

Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South

Park to produce garden tools. The company bought some land six years ago for $ million

in anticipation of using it as a warehouse and distribution site, but the company has since

decided to rent facilities elsewhere. If the land were sold today, the company would net $

million. The company now wants to build its new manufacturing plant on this land; the plant

will cost $ million to build, and the site requires $ worth of grading before it is

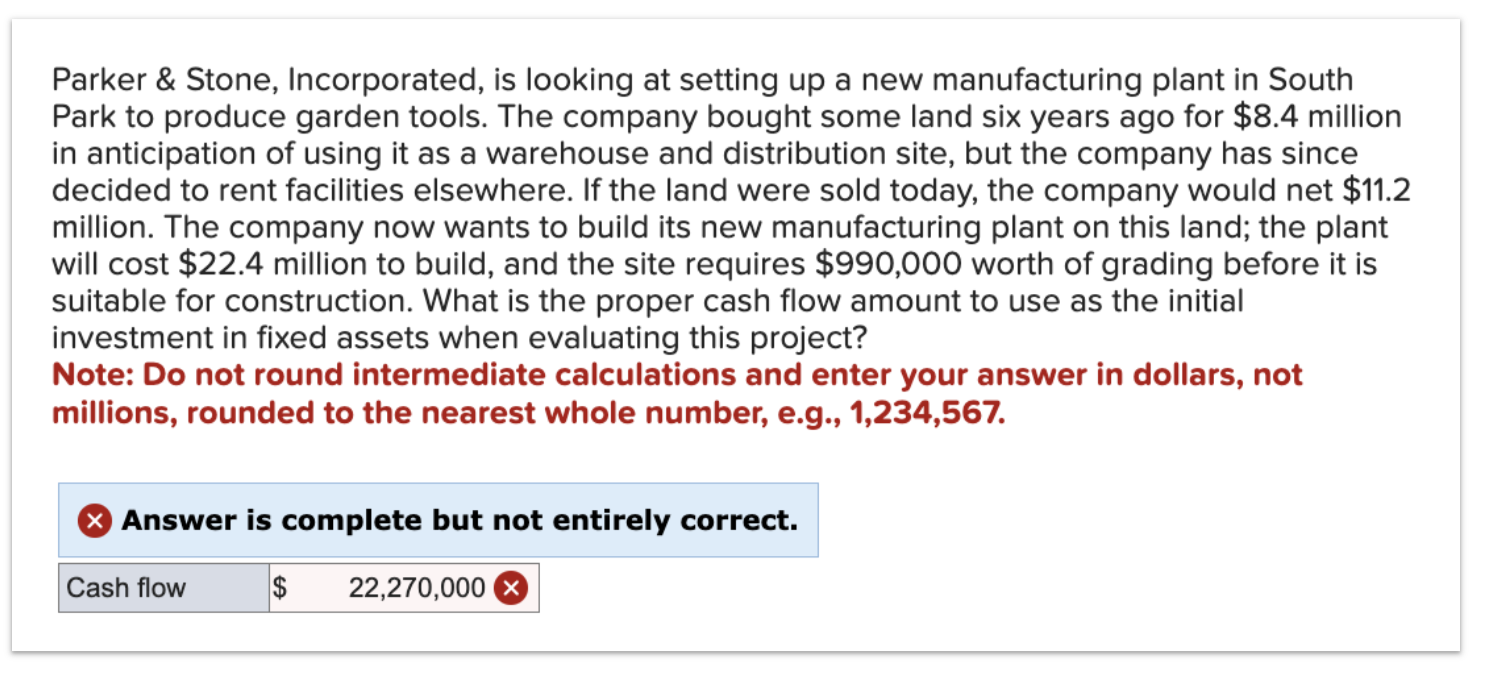

suitable for construction. What is the proper cash flow amount to use as the initial

investment in fixed assets when evaluating this project?

Note: Do not round intermediate calculations and enter your answer in dollars, not

millions, rounded to the nearest whole number, eg

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock