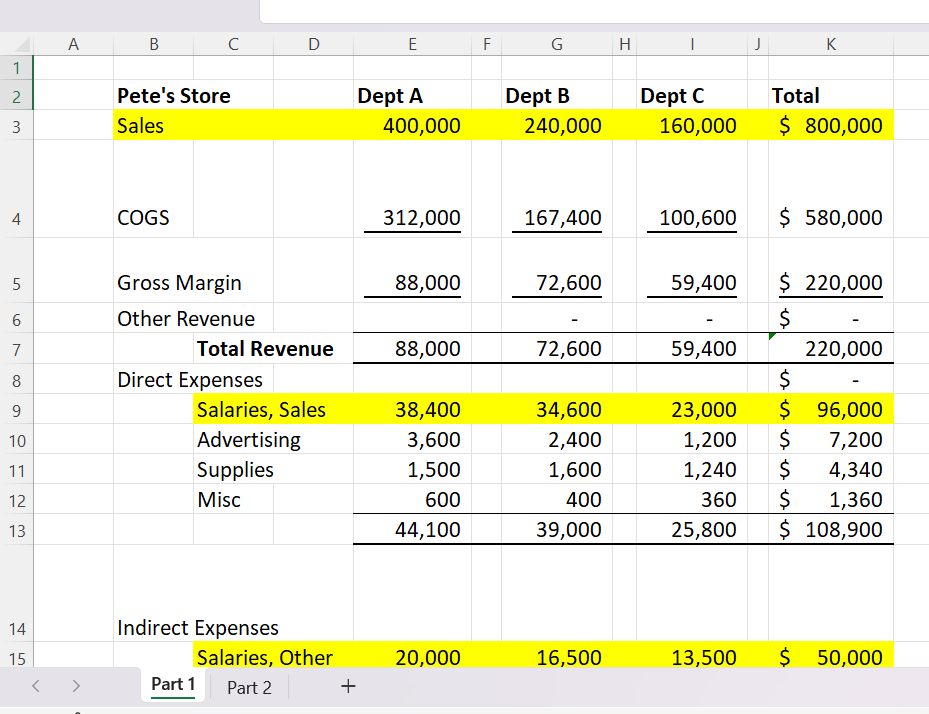

Question: PART 1: A B C D E F G H K 2 Pete's Store Dept A Dept B Dept C Total 3 Sales 400,000 240,000

PART 1:

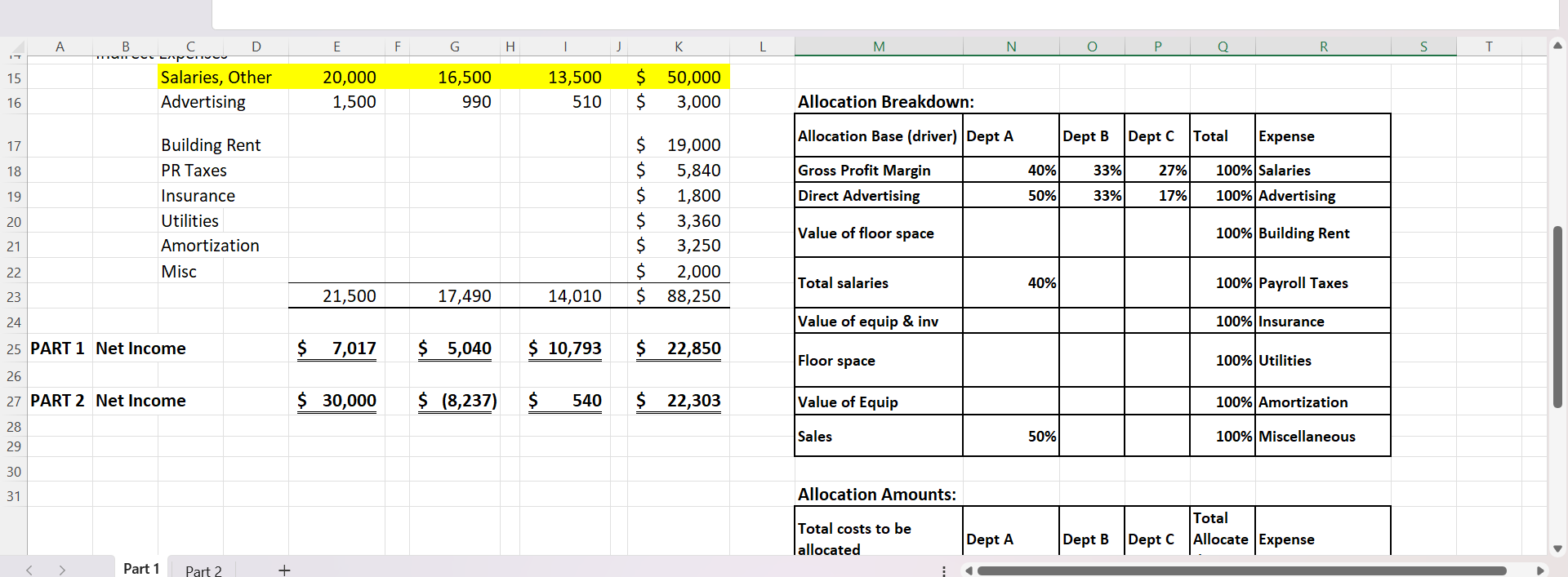

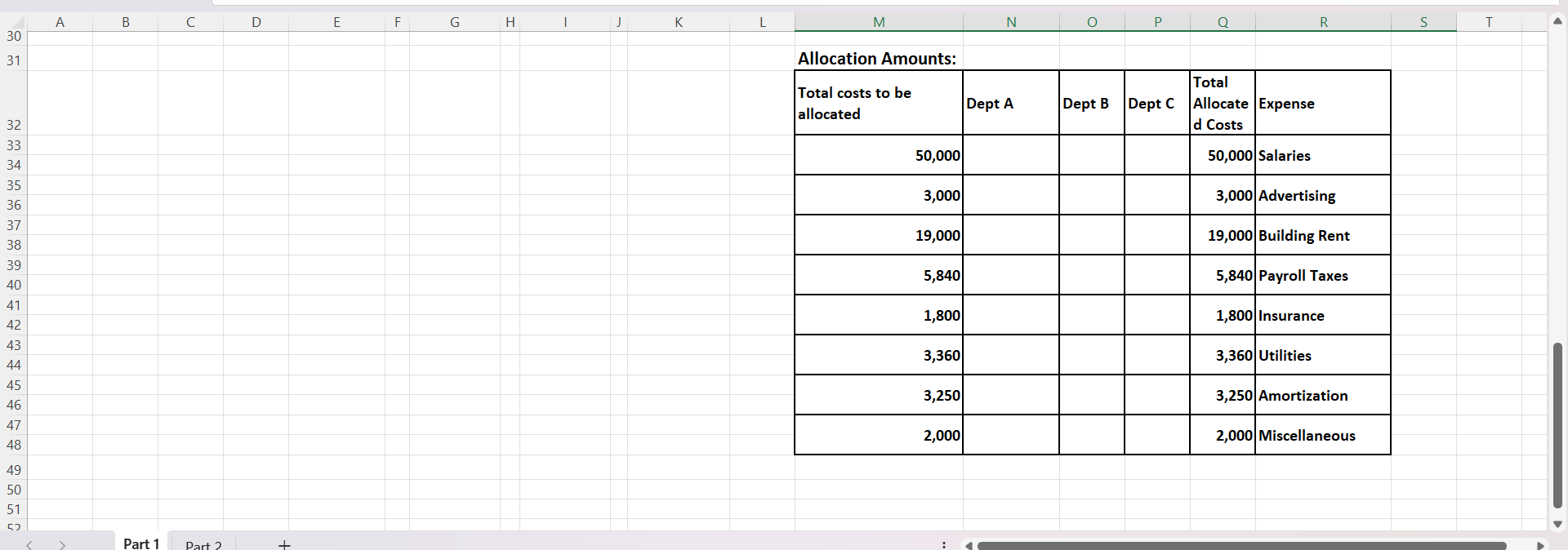

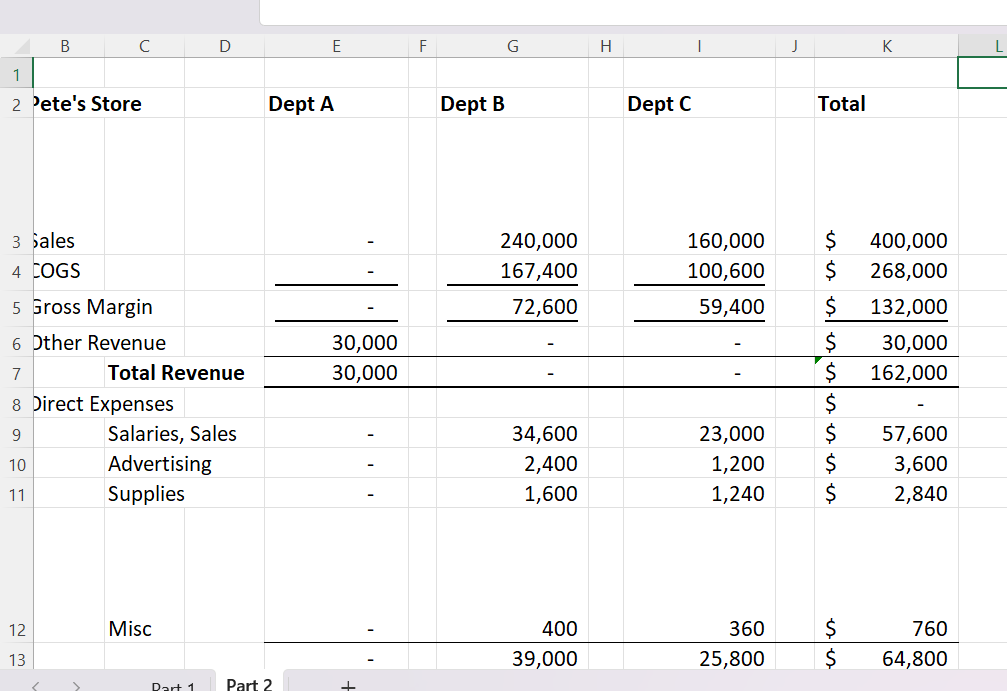

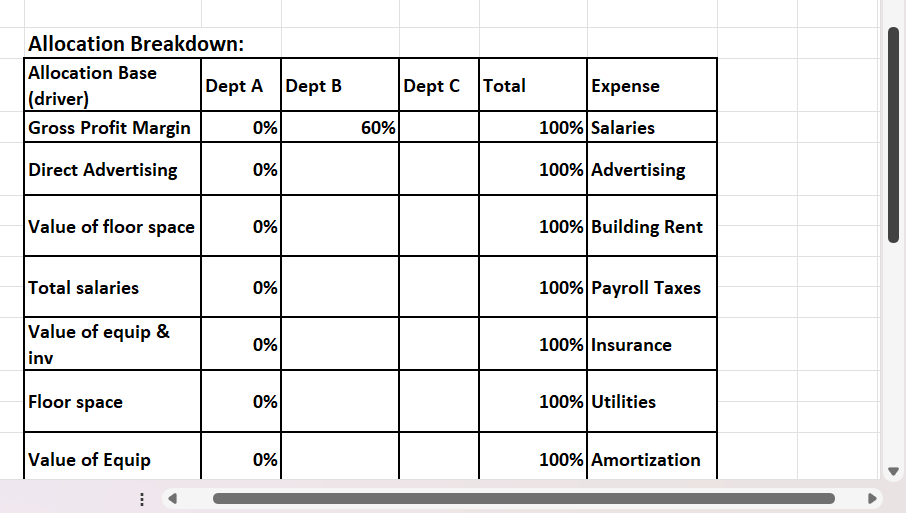

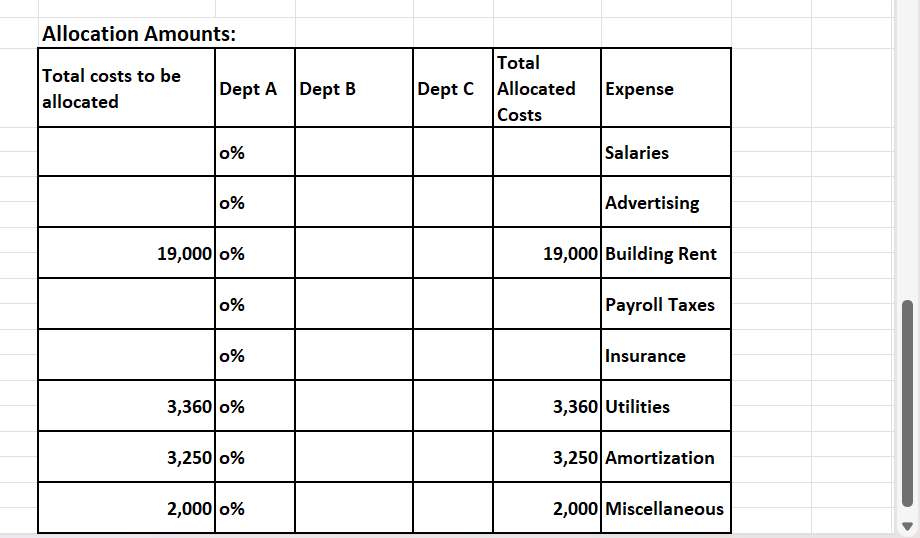

A B C D E F G H K 2 Pete's Store Dept A Dept B Dept C Total 3 Sales 400,000 240,000 160,000 $ 800,000 4 COGS 312,000 167,400 100,600 $ 580,000 Gross Margin 88,000 72,600 59,400 $ 220,000 Other Revenue Total Revenue 88,000 72,600 59,400 220,000 Direct Expenses 9 Salaries, Sales 38,400 34,600 23,000 S 96,000 10 Advertising 3,600 2,400 1,200 7,200 11 Supplies 1,500 1,600 1,240 4,340 12 Misc 600 400 360 1,360 13 44,100 39,000 25,800 $ 108,900 14 Indirect Expenses 15 Salaries, Other 20,000 16,500 13,500 $ 50,000 > Part 1 Part 2 +R S A C D E F G H J K M N O P Q T IT 15 Salaries, Other 20,000 16,500 13,500 $ 50,000 16 Advertising 1,500 990 510 S 3,000 Allocation Breakdown: Dept B Dept C Total Expense 17 Building Rent 19,000 Allocation Base (driver) | Dept A $ 18 PR Taxes S 5,840 Gross Profit Margin 40 33% 27% 100% Salaries 19 Insurance S 1,800 Direct Advertising 50% 33% 17% 100% Advertising 20 Utilities $ 3,360 Value of floor space 100% Building Rent 21 Amortization 3,250 22 Misc 2,000 Total salaries 40% 100% Payroll Taxes 23 21,500 17,490 14,010 88,250 24 Value of equip & inv 100% Insurance 25 PART 1 Net Income $ 7,017 $ 5,040 $ 10,793 $ 22,850 Floor space 100% Utilities 26 27 PART 2 Net Income $ 30,000 $ (8,237) $ 540 $ 22,303 Value of Equip 100% Amortization 28 Sales 50% 100% Miscellaneous 29 30 31 Allocation Amounts: Total Total costs to be allocated Dept A Dept B Dept C Allocate Expense Part 1 Part 2L N O A B C D E F G H J K M P Q R S T 30 31 Allocation Amounts: Total Total costs to be Dept A Dept B |Dept C Allocate |Expense allocated d Costs 32 33 50,000 50,000 Salaries 34 35 3,000 3,000 Advertising 36 37 19,000 19,000 Building Rent 38 39 5,840 5,840 Payroll Taxes 40 41 1,800 1,800 Insurance 42 43 3,360 O Utilities 44 45 3,250 3,250 Amortization 46 2,000 2,000 Miscellaneous 48 49 50 Part 1B C D E F G H I J K 2 Pete's Store Dept A Dept B Dept C Total 3 Sales 240,000 160,000 400,000 4 LOGS 167,400 100,600 268,000 5 Gross Margin 72,600 59,400 132,000 6 Other Revenue 30,000 30,000 7 Total Revenue 30,000 162,000 8 Direct Expenses 9 Salaries, Sales 34,600 23,000 57,600 10 Advertising 2,400 1,200 3,600 11 Supplies 1,600 1,240 2,840 12 Misc 400 360 760 13 39,000 25,800 64,800 Part 2Allocation Breakdown: Allocation Base D t A D t B D t c T t I {driver} 8P 3P BF 0 a Gross Profit Margin % 100% Direct Advertising 0% 100% Advertising Value of floor space % 100% Building Rent Total salaries % 100% Payroll Taxes Value of equip 8: 100% Inv Floor space 100% Utilities Value of Equip 0% 100% Amortization Allocation Amounts: Total costs to be Dept A Dept B Dept C Allocated allocated o 35! O o 32 Advertising 19,000 0% 19,000 Building Rent Payroll Taxes 0 32 Utilities 0 BE Amortization Miscellaneous 0 32 o%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts