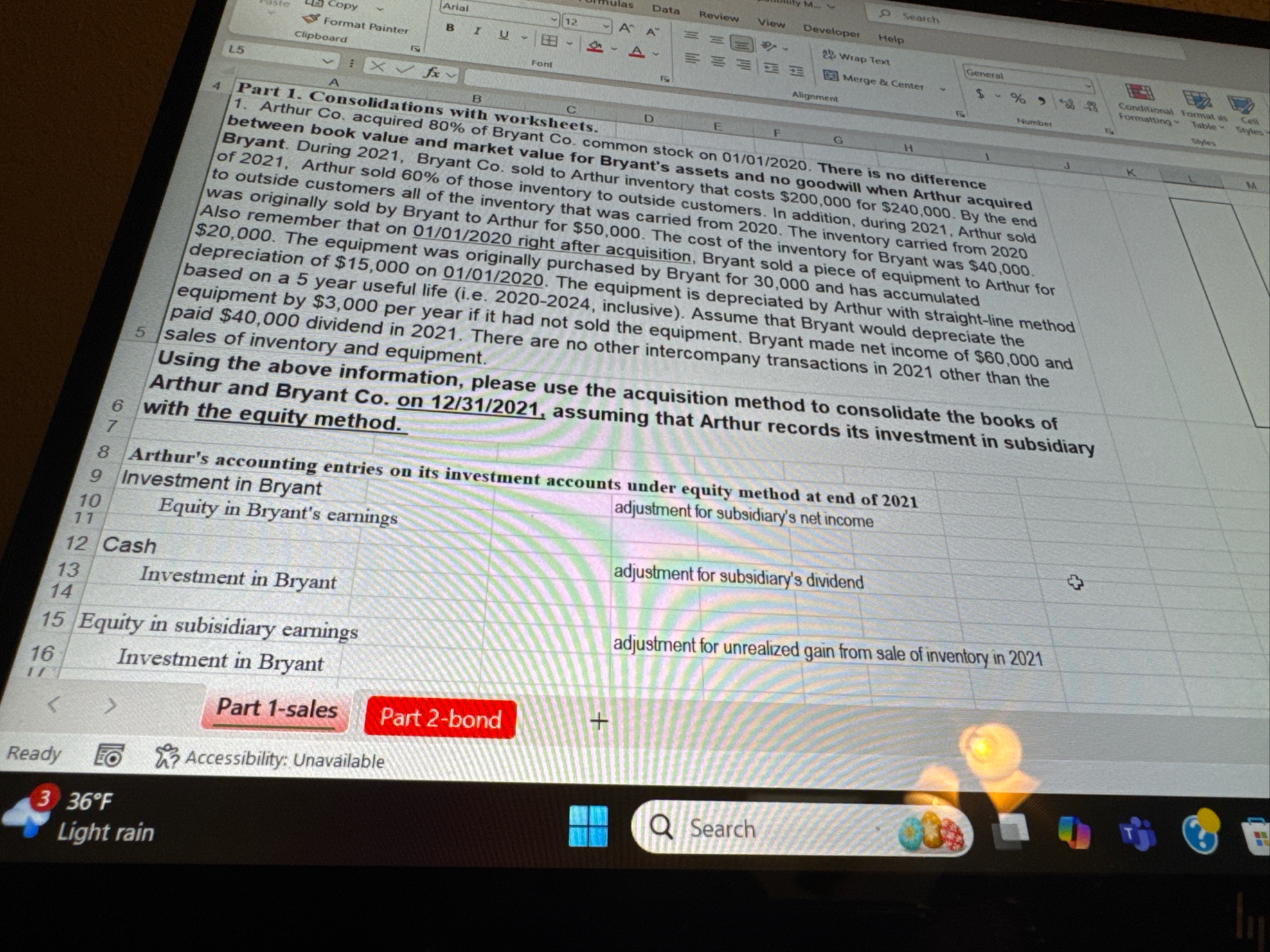

Question: Part 1 . Consolidations with worksheets. between book value and market value for Bryan stock on 0 1 0 1 ? 2 0 2 0

Part Consolidations with worksheets. between book value and market value for Bryan stock on There is no difference of Arthur sold of those inventory to outsentory that costs $ for $ By the end to outside customers all of the inventory that was cale customers. In addition, during Arthur sold was originally sold by Bryant to Arthur for $ Thed from The inventory carried from Also remember that on right after acq. The cost of the inventory for Bryant was $ $ The equipment was originally purchased byition, Bryant sold a piece of equipment to Arthur for based on a year useful life ie inclusive is depreciated by Arthur with straightline method equipment by $ per year if it had not sold the Assume that Bryant would depreciate the paid $ dividend in There are no oquipment. Bryant made net income of $ and sales of inventory and equipment. with the equity method.

Arthur's accounting entries on its investment accounts under equity method at end of

Investment in Bryant

Equity in Bryant's earnings

Cash

Investment in Bryant

Equity in subisidiary earnings

Investment in Bryant

Ready

Accessibility: Unavailable

Light rain

Q SearchSGA expenses

Retained earnings. begining

balance, Bryant

net income dividends paid retained earnings ending balance

Cash

Inventory

Land

Buildings net

Equipment

Accum. DepreEquipment

Part sales

Part bond

Accessibility: Unavailable

Light rain

Search

Clipboard Painter

balanco

Cash

Inventory

and

Buildings net

Equipment

Inverm. DepreEquipment

Total debits

Accounts payable

Longterm liabilities

Common stock

tableRetained earnings, Ending

tablePlease help me answer everythingevery part

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock