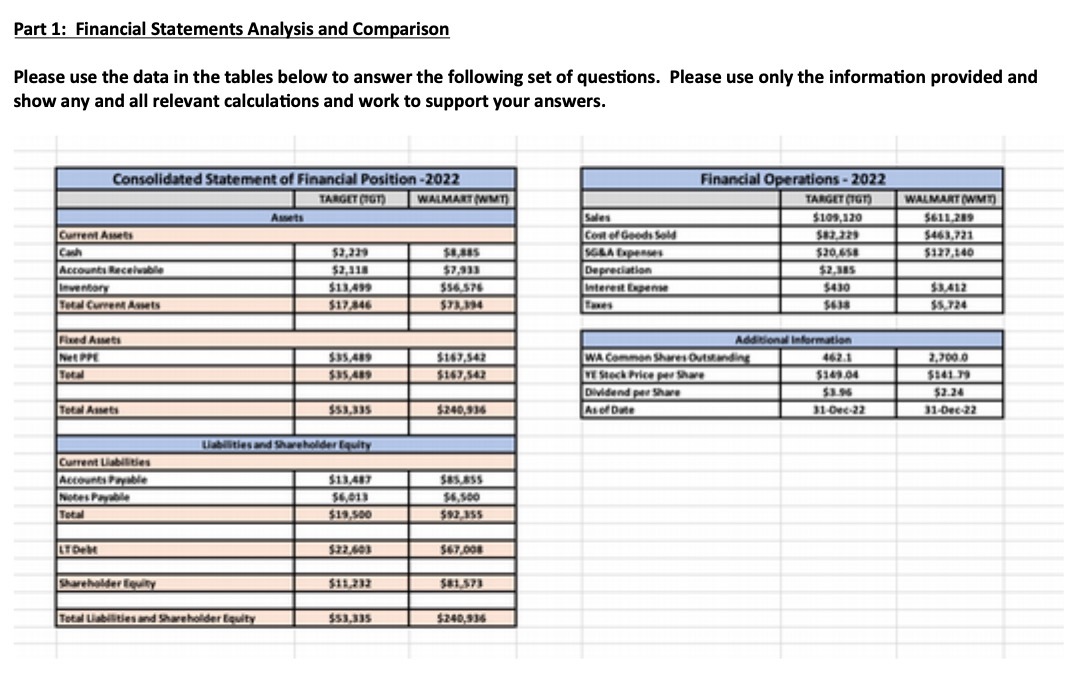

Question: Part 1: Financial Statements Analysis and Comparison Please use the data in the tables below to answer the following set of questions. Please use only

Part 1: Financial Statements Analysis and Comparison Please use the data in the tables below to answer the following set of questions. Please use only the information provided and show any and all relevant calculations and work to support your answers. Consolidated Statement of Financial Position -2022 Financial Operations - 2022 TARGET DOT) WALMART WWMT) TARGET CIGT WALMART (WMD) Assets $109.120 $611.289 Current Awet Col of Goodi Sold $82.321 $463,721 $3,239 $1.885 $137,140 Accounti Receivable $7.913 Depreciation $2.385 $13.489 $56.576 Interest Expense $430 $1.412 Total Current Ansets $17.846 $61 $5.724 Fived Anti Add Bond Information NEE PPE $167.542 WA Common Shares Outstanding 462.1 2.709.0 Total $167,547 WE Stock Price pad Share $141.84 Dividend per Share 51.96 $2.24 Total Anseti $51.835 $240.536 Ai of Dile 31-Ode-22 11-Dec-22 Liabilities and Shareholder Equity Current Liabilities Accounts Payable $13,487 Total $19.580 592-155 Shareholder Equity $14.283 $81.571 Total Liabilities and Shareholder Equity $51,315 $240.936

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts