Question: Part 1 of 9 Points: 0011 Save Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichols State

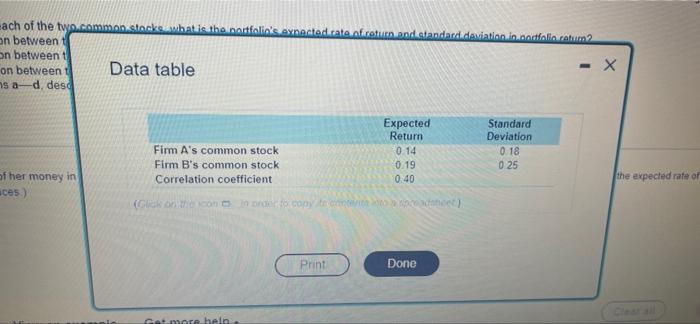

Part 1 of 9 Points: 0011 Save Computing the standard deviation for a portfolio of two risky investments) Mary Gulott recently graduated from Nichols State University and is nous to begin investing her mager saving as a way of applying what she has leared in bittinen school Specifically, the is evaluating an investment in a portfolio comprised of two firma common stock She has collected the following matin atout the common lack of Fim And Form 3 Mary incerts that her money in each of the twin common stocs what is the portokos expected tale of return and standard deviation du porten? 6. Answer part a where the correlation between the two common stock investments equal to me c. Answer part where the correlation between the two common stock investments is tot d. Answer part where the correlation between the two common stock investment is a 10-1 Ung your room to questions describe to relationship between the conation and think and return of the portfolio Mary w 50% the money in Fim Ascommon stock and this common stock and the condition to see the beach w 20th cen in the Rotowe decimal places Helme solve this View un sample Get more help Each of the two.common stacks what is the nortfolio's expected.cate of return and standard deviation.in.codelio raum2 on between on between t on between Data table - X sa-d, desd Expected Return 0 14 0.19 0.40 Standard Deviation 018 0.25 Firm A's common stock Firm B's common stock Correlation coefficient the expected rate of of her money in aces) (Gloomondo conto Print Done Get more helin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts