Question: Part 1: Part 2: Consider the example we saw in class. There are two assets, L with expected return 7% and volatility 5%, and H

Part 1: Part 2:

Part 2:

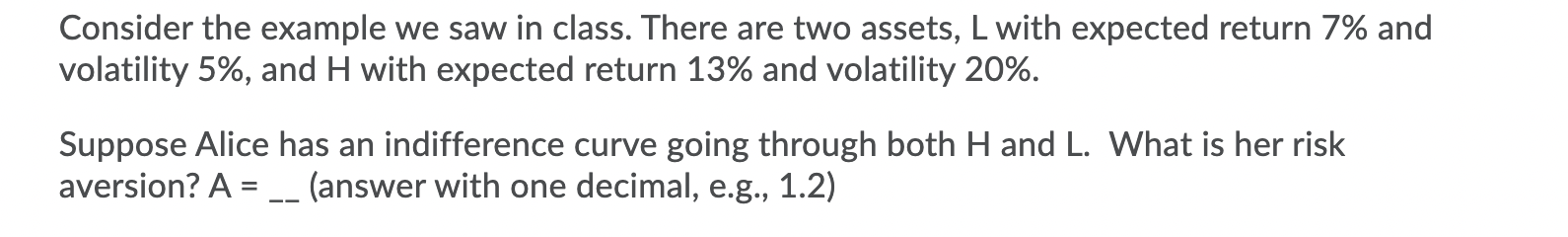

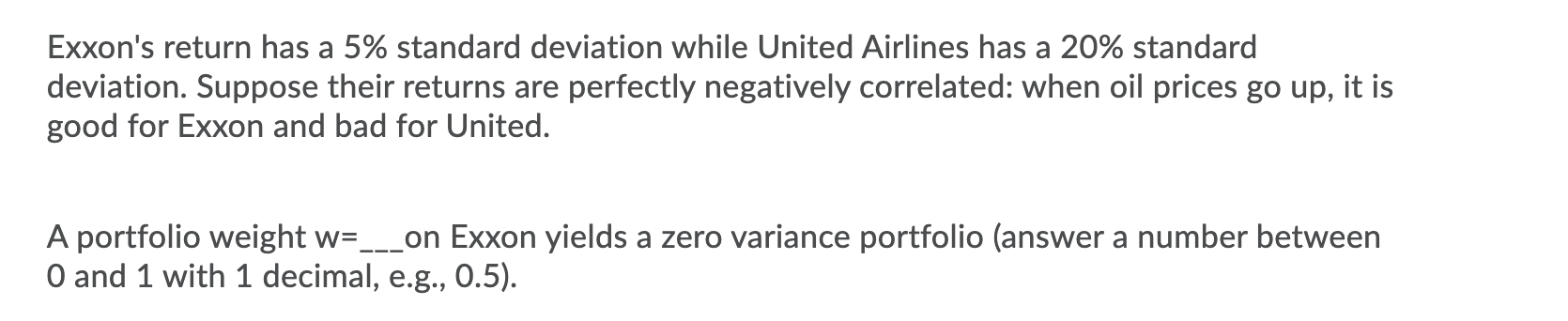

Consider the example we saw in class. There are two assets, L with expected return 7% and volatility 5%, and H with expected return 13% and volatility 20%. Suppose Alice has an indifference curve going through both H and L. What is her risk aversion? A= __ (answer with one decimal, e.g., 1.2) a Exxon's return has a 5% standard deviation while United Airlines has a 20% standard deviation. Suppose their returns are perfectly negatively correlated: when oil prices go up, it is good for Exxon and bad for United. A portfolio weight w=___on Exxon yields a zero variance portfolio (answer a number between O and 1 with 1 decimal, e.g., 0.5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts