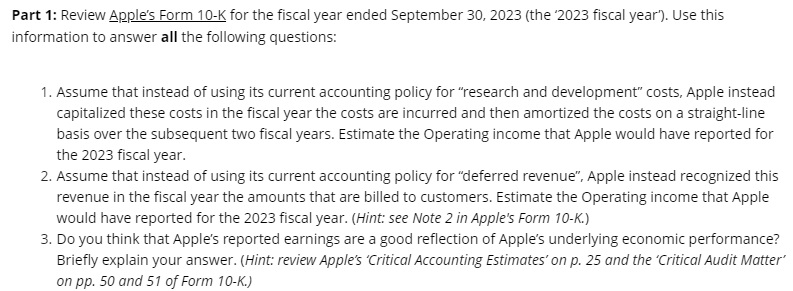

Question: Part 1 : Review Apple's Form 1 0 - K for the fiscal year ended September 3 0 , 2 0 2 3 ( the

Part : Review Apple's Form K for the fiscal year ended September the fiscal year' Use this

information to answer all the following questions:

Assume that instead of using its current accounting policy for "research and development" costs, Apple instead

capitalized these costs in the fiscal year the costs are incurred and then amortized the costs on a straightline

basis over the subsequent two fiscal years. Estimate the Operating income that Apple would have reported for

the fiscal year.

Assume that instead of using its current accounting policy for "deferred revenue", Apple instead recognized this

revenue in the fiscal year the amounts that are billed to customers. Estimate the Operating income that Apple

would have reported for the fiscal year. Hint: see Note in Apple's Form K

Do you think that Apple's reported earnings are a good reflection of Apple's underlying economic performance?

Briefly explain your answer. Hint: review Apple's 'Critical Accounting Estimates' on p and the 'Critical Audit Matter'

on pp and of Form K

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock