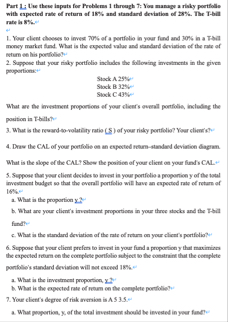

Question: Part 1 ; The these inputs for Problems 1 through 7 : You manuge a riaky pertifolls with expected rabe of refurn of 1 8

Part ; The these inputs for Problems through : You manuge a riaky pertifolls with expected rabe of refurn of and standard deviation of The Thit rate la money market flad. What is the expected value and standard deviatioe of the mate of evtum ob his portoliethr

Sappose that your riaky portfolio includes the following irvestanents in the given proportions:

Stack A

Stock B

Stock C

What are the imestront proportions of your clients ovenal portiolis, inclading the position is Thillstor

What is the rewandsovolatility ratio $ of your risky portfolio? Your clients?

Draw the CAL of your portfolie of in expected rebrinstandaed deviation diagran.

What is the slope of the CAL'? Sbew the pooition of your client on your finds CAL

Seppose then yoer client decifer so imeot is your portfitio s propontive y of the tint investment hudget sa that the overall portfolio will have an expected rate of retarn of

a What in the propartion z

b What ane your client's irvostrent proportions in your throe stocks and the Thill find?

c What in the itandurd deviation of the rate of returs on your clicer's portiolio?

Suppose that your clime prefins to irvost in your fund a proportion y that maximines the expected roturn on the complete portiolion sibject so the eomstrint that the complete pontiole's standerd Siviacioe will not exceed

a What in the investrnent proportion, v

b What is the expected rate of rosum on the conplete portiolie?

Your client's acgree of risk mersion is A

a What popertion, x of the notal investruent should be invested in yoer fandt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock