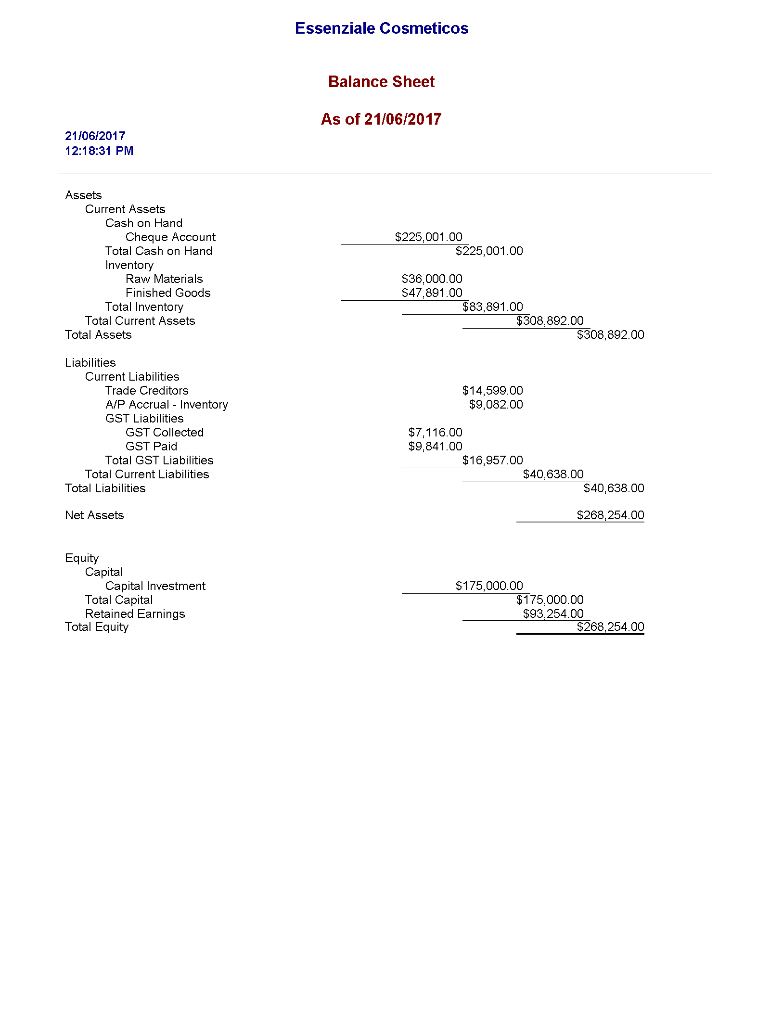

Question: Part 1 . Using above MYOB, view the Balance Sheet as of 21/06/2017. Open Compute and interpret for the: Current ratio (current assets/current liabilities) Debt

| Part 1. Using above MYOB, view the Balance Sheet as of 21/06/2017. Open Compute and interpret for the:

Use the following format when presenting your answers.

|

| Part 2. Verifying PAYG You are auditing the bookkeepers work, and you chose five (5) random figures to confirm. Access the Australian Taxation Office (ATO) PAYG calculator here. Indicate whether the computed take home pay per month for each employee is correct or not.

|

| Part 3. The bookkeeper, Amanda Ford, upon her review of the ageing of receivables, recommended the write-off of an account. You as the accountant would have to approve or disapprove this. You have reviewed the recovery plan documents for this receivable and it shows:

Below is the recovery plan document detailing the actions taken by the company to recover the debt. Evaluate each action and indicate whether it is correct or not.

Having examined and evaluated the information given, you are to decide if it is proper to write-off the Sophia Kings long overdue debt. If you decide to approve the write-off, you must indicate your name on the Approved by field and the date on the corresponding field in the write-off report below:

| |||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||

Essenziale Cosmeticos Balance Sheet As of 21/06/2017 21/06/2017 12:18:31 PM $225,001.00 $225,001.00 Assets Current Assets Cash on Hand Cheque Account Total Cash on Hand Inventory Raw Materials Finished Goods Total Inventory Total Current Assets Total Assets $36,000.00 $47,891.00 $83.891.00 $308,892.00 $308,892.00 $14,599.00 $9,082,00 Liabilities Current Liabilities Trade Creditors A/P Accrual - Inventory GST Liabilities GST Collected GST Paid Total GST Liabilities Total Current Liabilities Total Liabilities $7,116.00 $9,841.00 $ 16,957.00 $40,638.00 $40,638.00 Net Assets $268,254.00 Equity Capital Capital Investment Total Capital Retained Earnings Total Equity $175,000.00 $175.000,00 $93.254.00 $268,254.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts