Question: Part 1: View the tutorial, then complete the worksheet, replacing the question marks below with formulas. Given Information: 1 Cash on hand at the company

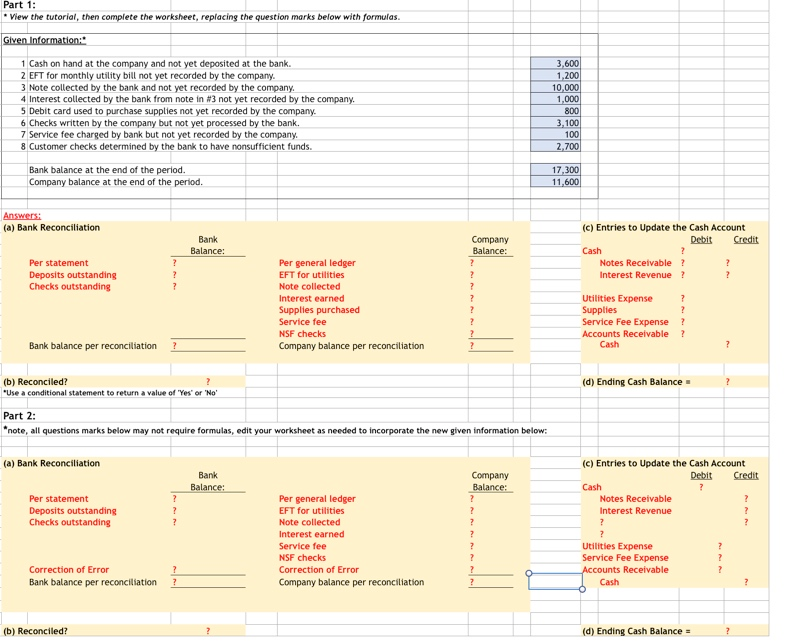

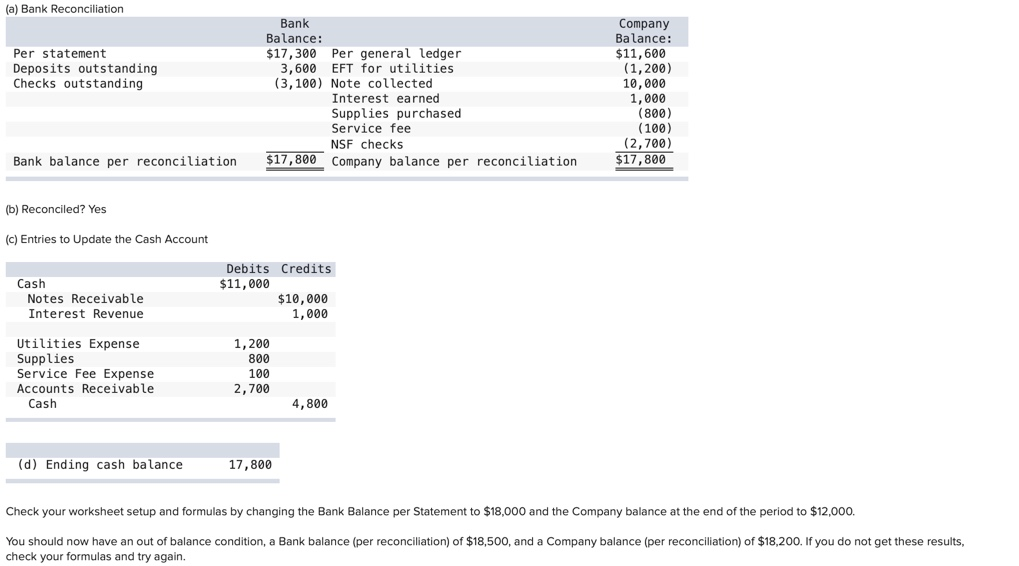

Part 1: View the tutorial, then complete the worksheet, replacing the question marks below with formulas. Given Information: 1 Cash on hand at the company and not yet deposited at the bank. 2 EFT for monthly utility bill not yet recorded by the company. 3 Note collected by the bank and not yet recorded by the company. 4 Interest collected by the bank from note in #3 not yet recorded by the company. 5 Debit card used to purchase supplies not yet recorded by the company. 6 Checks written by the company but not yet processed by the bank. 7 Service fee charged by bank but not yet recorded by the company. 8 Customer checks determined by the bank to have nonsufficient funds 3.600 1,200 10,000 1.000 800 3.100 100 2.700 Bank balance at the end of the period Company balance at the end of the period. 17.300 11.600 Answers: (a) Bank Reconciliation Bank Balance: Company Balance: (c) Entries to Update the Cash Account Debit Credit Cash Notes Receivable ? Interest Revenue ? Per statement Deposits outstanding Checks outstanding Per general ledger EFT for utilities Note collected Interest earned Supplies purchased Service fee NSF checks Company balance per reconciliation Utilities Expense Supplies Service Fee Expense Accounts Receivable ? ? Bank balance per reconciliation ? Cash (d) Ending Cash Balance (b) Reconciled? "Use a conditional statement to return a value of 'Yes' or 'No' Part 2: *note, all questions marks below may not require formulas, edit your worksheet as needed to incorporate the new given information below: (a) Bank Reconciliation Bank Balance: Company Balance: (c) Entries to Update the Cash Account Debit Credit Cash Notes Receivable Interest Revenue Per statement Deposits outstanding Checks outstanding Per general ledger EFT for utilities Note collected Interest earned Service fee NSF checks Correction of Error Company balance per reconciliation Correction of Error Bank balance per reconciliation Utilities Expense Service Fee Expense Accounts Receivable Cash (b) Reconciled? (d) Ending Cash Balance = (a) Bank Reconciliation Per statement Deposits outstanding Checks outstanding Bank Balance: $17,300 Per general ledger 3,600 EFT for utilities (3,100) Note collected Interest earned Supplies purchased Service fee NSF checks $17,800 Company balance per reconciliation Company Balance: $11,600 (1,200) 10,000 1,000 (800) (100) (2,700) $17,800 Bank balance per reconciliation (b) Reconciled? Yes (c) Entries to Update the Cash Account Cash Notes Receivable Interest Revenue Debits Credits $11,000 $10,000 1,000 Utilities Expense Supplies Service Fee Expense Accounts Receivable Cash 1,200 800 100 2,700 4,800 (d) Ending cash balance 17,800 Check your worksheet setup and formulas by changing the Bank Balance per Statement to $18,000 and the Company balance at the end of the period to $12,000. You should now have an out of balance condition, a Bank balance (per reconciliation) of $18,500, and a Company balance (per reconciliation) of $18,200. If you do not get these results, check your formulas and try again

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts