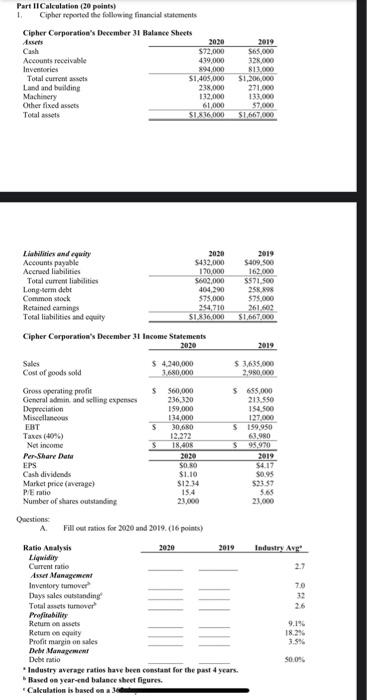

Question: Part 11 Calculation (20 points) 1 Capher reported the following financial statements Cipher Corporation's December 31 Balance Sheets Assets 2020 Cash $72,000 Accounts receivable 439,000

Part 11 Calculation (20 points) 1 Capher reported the following financial statements Cipher Corporation's December 31 Balance Sheets Assets 2020 Cash $72,000 Accounts receivable 439,000 Inventories 894,000 Total current $1,405,000 Land and building 238.000 Machinery 132,000 Other fixed assets 61,000 Totales SIX16000 2019 S65.000 32.000 813.000 SI 200.000 271.000 13.000 57.000 $1,667.000 2589 Liabilities and equity 2020 2019 Accounts payable S432,000 S409.500 Accrued liabilities 120,000 162.000 Total current liabilities 5600.000 5571.500 Long-term debt 404.200 Common stock 575.000 575.000 Retained earnings 254.710 261.00 Total liabilities and equity S1.836,000 $1,667.000 Cipher Corporation's December 31 Income Statements 2020 2019 Sales $ 4,240,000 $ 3,635.000 Cost of goods sold 160,000 2.980000 Gross operating profit $ $60,000 5 655,000 General in and selling expenses 236,320 21250 Depreciation 159.000 154.500 Miscellaneous 134,000 127.000 EBT s 30.680 $ 159.950 Taxes (40%) 12.272 63.980 Not income $ 18,408 95,970 Per Share Data 2020 EPS SO.NO $4.17 Cash dividends $1.10 $0.95 Market price (average) $12.74 $23.59 PE ratio 15.4 5.65 Number of shares outstanding 23.000 23.000 Questions A Fill out ratios for 2020 and 2019. (16 points) Ratio Analysis 2019 Industry Avg Liquidity Current ratio 2.7 Asset Management Inventory tumover 70 Duys sales outstanding 32 Total atstumewer 26 Profitability Return on 9.19 Retum nequity 18.2% Profit margin on sales Del Manage Debt ratio S006 * Industry average ratios have been constant for the past 4 years. Based on year-end balance sheet figures. Calculation is based on a 36 2030 B Assess Cipher's financial position such as liquidity, asset management, debt, and profitability, and determine how it compares with peer and how Cipher financial position has changed over time. (4 points) Part III Writings (20 points) 1. Describe E-commerce business models including benefit, characteristic, advantages and disadvantages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts