Question: Part 1-11 Marks Grumpy Inc purchased a machine on January 1, 2021, at a cost of $120,000. The machine was originally estimated to have

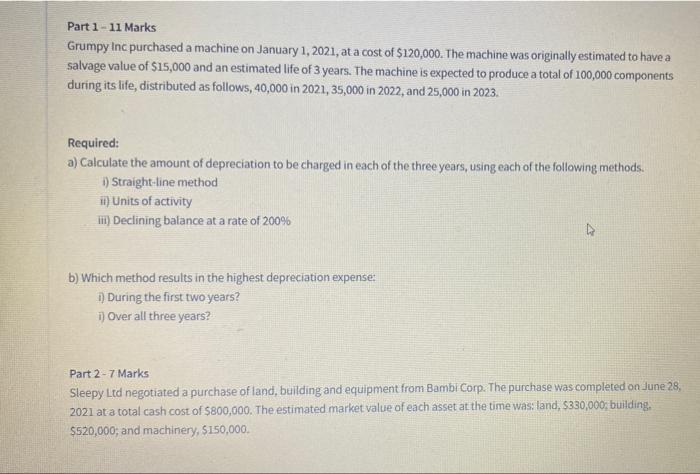

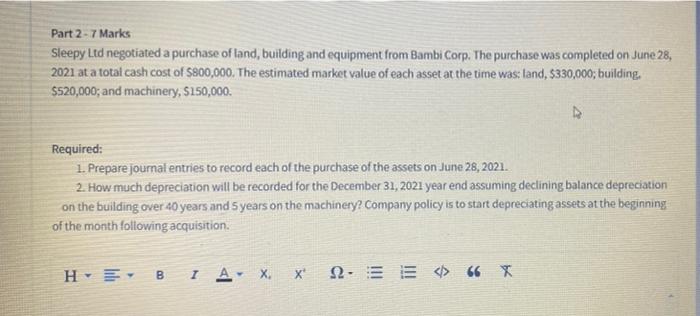

Part 1-11 Marks Grumpy Inc purchased a machine on January 1, 2021, at a cost of $120,000. The machine was originally estimated to have a salvage value of $15,000 and an estimated life of 3 years. The machine is expected to produce a total of 100,000 components during its life, distributed as follows, 40,000 in 2021, 35,000 in 2022, and 25,000 in 2023. Required: a) Calculate the amount of depreciation to be charged in each of the three years, using each of the following methods. i) Straight-line method ii) Units of activity iii) Declining balance at a rate of 200% b) Which method results in the highest depreciation expense: i) During the first two years? i) Over all three years? Part 2-7 Marks Sleepy Ltd negotiated a purchase of land, building and equipment from Bambi Corp. The purchase was completed on June 28, 2021 at a total cash cost of $800,000. The estimated market value of each asset at the time was: land, $330,000; building. $520,000; and machinery, $150,000.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts