Question: Part 2 1. Columns C, D and E contain weekly returns of three stocks. Assume the stocks have the following weights: KO = 10%, BBBY

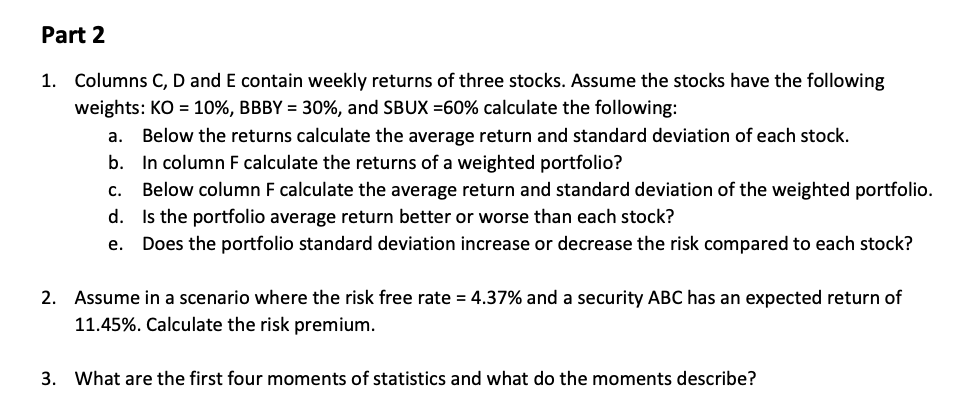

Part 2 1. Columns C, D and E contain weekly returns of three stocks. Assume the stocks have the following weights: KO = 10%, BBBY = 30%, and SBUX =60% calculate the following: a. Below the returns calculate the average return and standard deviation of each stock. b. In column F calculate the returns of a weighted portfolio? C. Below column F calculate the average return and standard deviation of the weighted portfolio. d. Is the portfolio average return better or worse than each stock? e. Does the portfolio standard deviation increase or decrease the risk compared to each stock? 2. Assume in a scenario where the risk free rate = 4.37% and a security ABC has an expected return of 11.45%. Calculate the risk premium. 3. What are the first four moments of statistics and what do the moments describe? Part 2 1. Columns C, D and E contain weekly returns of three stocks. Assume the stocks have the following weights: KO = 10%, BBBY = 30%, and SBUX =60% calculate the following: a. Below the returns calculate the average return and standard deviation of each stock. b. In column F calculate the returns of a weighted portfolio? C. Below column F calculate the average return and standard deviation of the weighted portfolio. d. Is the portfolio average return better or worse than each stock? e. Does the portfolio standard deviation increase or decrease the risk compared to each stock? 2. Assume in a scenario where the risk free rate = 4.37% and a security ABC has an expected return of 11.45%. Calculate the risk premium. 3. What are the first four moments of statistics and what do the moments describe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts