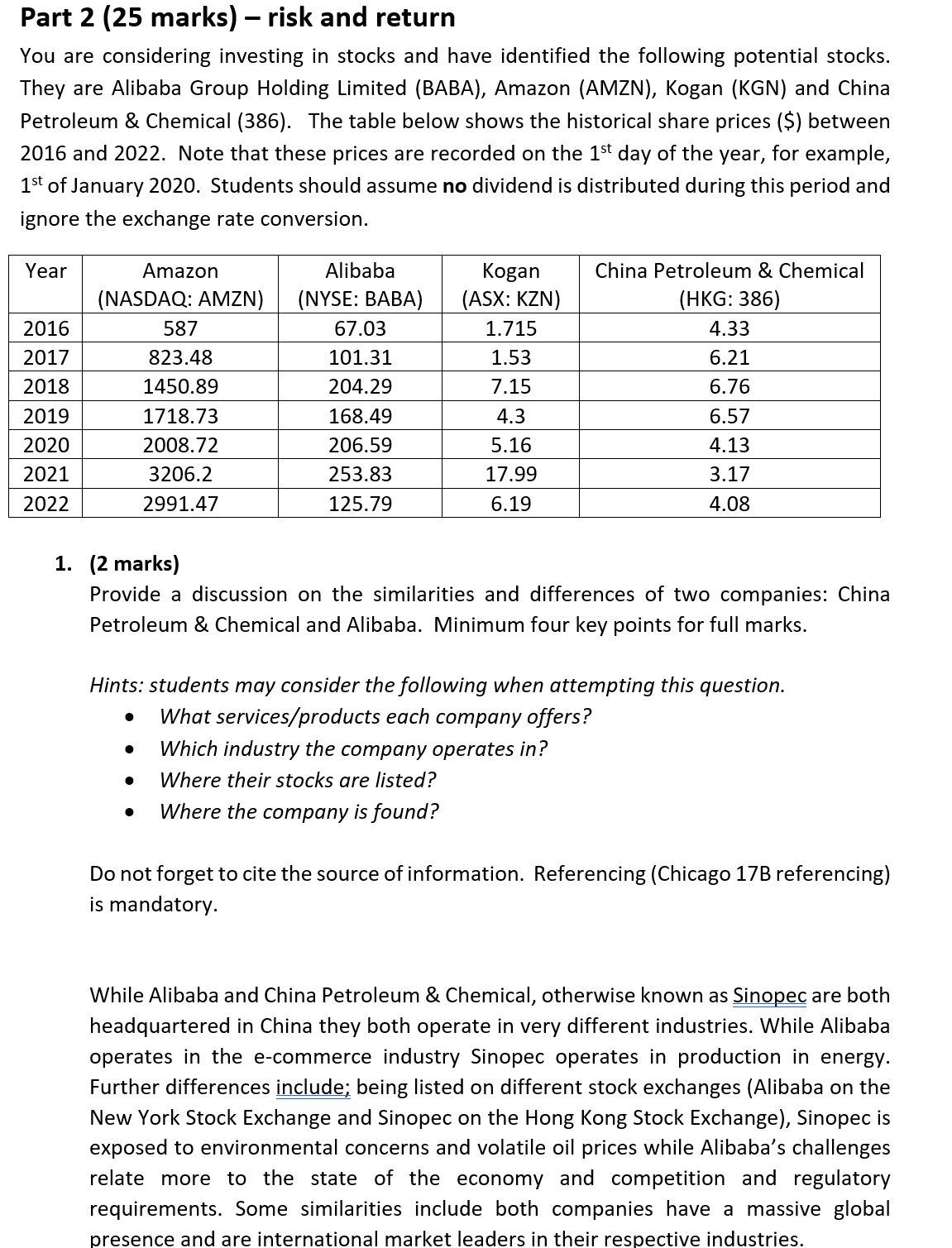

Question: Part 2 (25 marks) risk and return You are considering investing in stocks and have identified the following potential stocks. They are Alibaba Group Holding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts