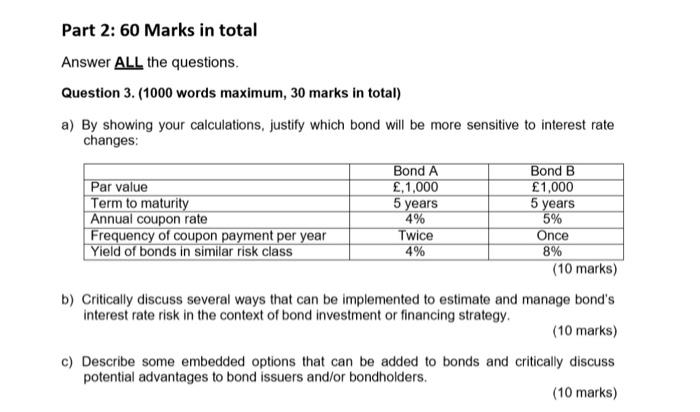

Question: Part 2: 60 Marks in total Answer ALL the questions. Question 3.(1000 words maximum, 30 marks in total) a) By showing your calculations, justify which

Part 2: 60 Marks in total Answer ALL the questions. Question 3.(1000 words maximum, 30 marks in total) a) By showing your calculations, justify which bond will be more sensitive to interest rate changes: Bond A Bond B Par value ,1,000 1,000 Term to maturity 5 years 5 years Annual coupon rate 4% 5% Frequency of coupon payment per year Twice Once Yield of bonds in similar risk class 4% 8% (10 marks) b) Critically discuss several ways that can be implemented to estimate and manage bond's interest rate risk in the context of bond investment or financing strategy. (10 marks) c) Describe some embedded options that can be added to bonds and critically discuss potential advantages to bond issuers and/or bondholders. (10 marks) PART B QUESTION 3 a) Present your calculation and discussion here. b) Provide you discussion here. c) Provide you discussion here. Part 2: 60 Marks in total Answer ALL the questions. Question 3.(1000 words maximum, 30 marks in total) a) By showing your calculations, justify which bond will be more sensitive to interest rate changes: Bond A Bond B Par value ,1,000 1,000 Term to maturity 5 years 5 years Annual coupon rate 4% 5% Frequency of coupon payment per year Twice Once Yield of bonds in similar risk class 4% 8% (10 marks) b) Critically discuss several ways that can be implemented to estimate and manage bond's interest rate risk in the context of bond investment or financing strategy. (10 marks) c) Describe some embedded options that can be added to bonds and critically discuss potential advantages to bond issuers and/or bondholders. (10 marks) PART B QUESTION 3 a) Present your calculation and discussion here. b) Provide you discussion here. c) Provide you discussion here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts