Question: Part 2: a) Determine an incremental per share effect for the Class B preferred Shares. b) Rank the dilutive securities from most dilutive to least

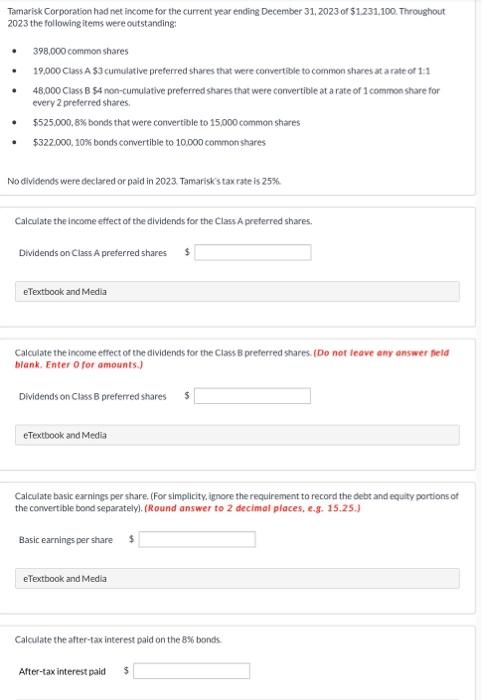

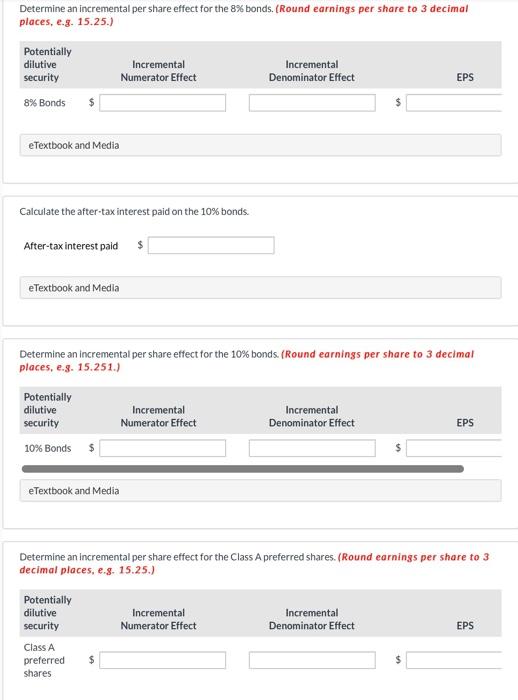

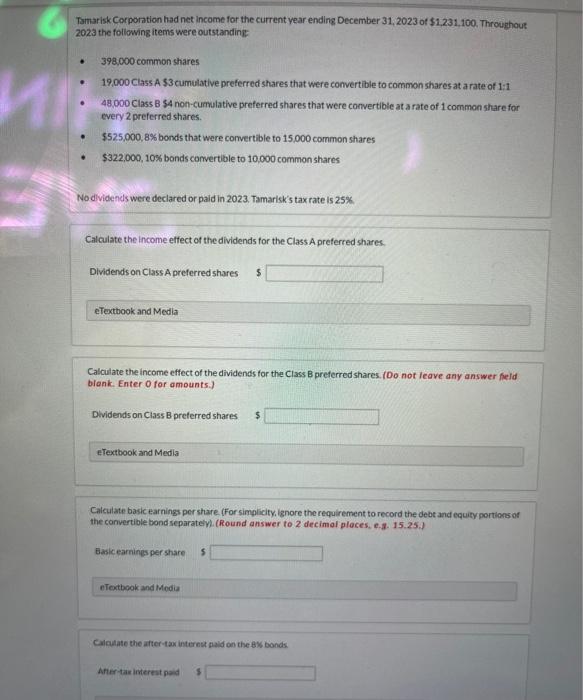

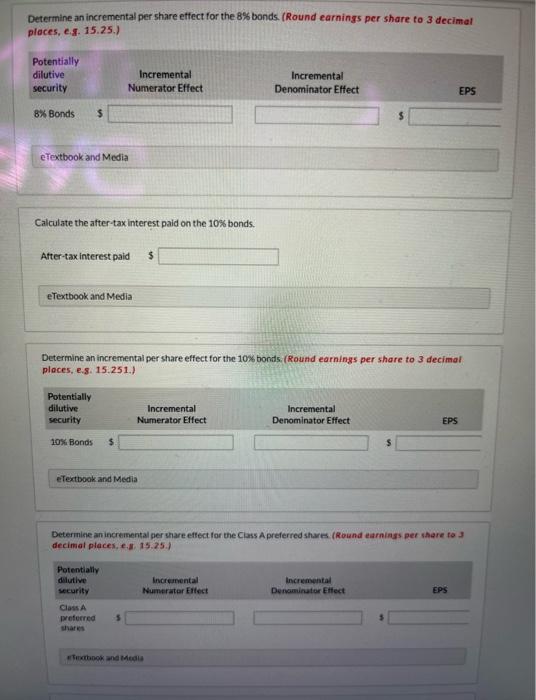

Tamarisk Corporation had net income for the current year ending December 31,2023 of $1,231,100. Throushout 2023 the following items were outstanding: - 398,000 common shares - 19.000 Class A $3 cumulative preferred shares that were comvertible to common shares at a rate of 1:1 - 48,000 Class B $4 non-cumulative preferred shares that were comvertible at a rate of 1 common share for every 2 preferred shares. - $525,000,8% bonds that were convertible to 15,000 commonshares - $322000,10% bonds convertible to 10,000 common shares No dividends were declared or paid in 2023 Tamarisk's tax rate is 25% Calculate the income effect of the dividends for the Class A preferred shares. Dividends on Class A preferred shares $ Calculate the income effect of the dividends for the Class B preferred shares. (Do not leave amy answer feld blank. Eater 0 for ambunts.) Dividends on Class B preferred shares $ Calculate basic earnings per share. (For simpiicity. ignore the requirement to record the debt and equity portions ot the convertible bond separately). (Round answer to 2 decimal places, e.g. 15.25.) Basic earnings per share $ Calculate the after-tax interest paid on the 8% bonds. Determine an incremental per share effect for the 8% bonds. (Round earnings per share to 3 decimal places, e.g. 15.25.) Calculate the after-tax interest paid on the 10% bonds. After-tax interest paid Determine an incremental per share effect for the 10% bonds. (Round earnings per share to 3 decimal places, e.g. 15.251.) Determine an incremental per share effect for the Class A preferred shares. (Round earnings per share to 3 decimal places, e.g. 15.25.) Tamarisk Corporation had net income for the current year ending December 31,2023 of $1,231,100. Throughout 2023 the following items were outstanding: - 398,000 common shares - 19,000 Class A $3 cumulative preferred shares that were comertible to common shares at a rate of 1:1 - 48000 Class B 54 non-cumulative preferred shares that were convertibie at a rate of 1 common share for every 2 preferred shares. - $525,000,8% bonds that were comvertible to 15,000 common shares - $322,000,10% bonds comvertible to 10,000 common shares No dlvidends were declared or paid in 2023. Tamarisk's tax rate is 25\%. Calculate the income effect of the dividends for the Class A preferred shares. Dividends on Class A preferred shares Calculate the income effect of the dividends for the Class B preferred shares. (Do not leave any answer feld blank. Enter 0 for amounts.] Dividends on Class B preferred shares $5 Calculate basic earnings per share (For simplicity. ignore the requirement to record the debt and equity portions of the convertible bond separately. (Round answer to 2 decimol ploces, e.3. 15.25.) Basic earnings per share eTextbook and tofedia Caleutate the after-tax internet fald on the 8 bonds. A Aier tax interest paid Determine an incremental per share effect for the 8% bonds. (Round earnings per share to 3 decimat places, e.g. 15.25.) Calculate the after-taxinterest paid on the 10% bonds. After-tax interest paid Determine an incremental per share effect for the 10% bonds, (Round earnings per share to 3 decimal. ploces, e.8. 15.251.) Determine an incremental per share effect for the Class A preferred shares (Round earnings per share to 3 decimal places, e.1. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts