Question: Part 2. Analyse the project described below and make recommendations to COL whether they should undertake the project (30 marks) The company is now considering

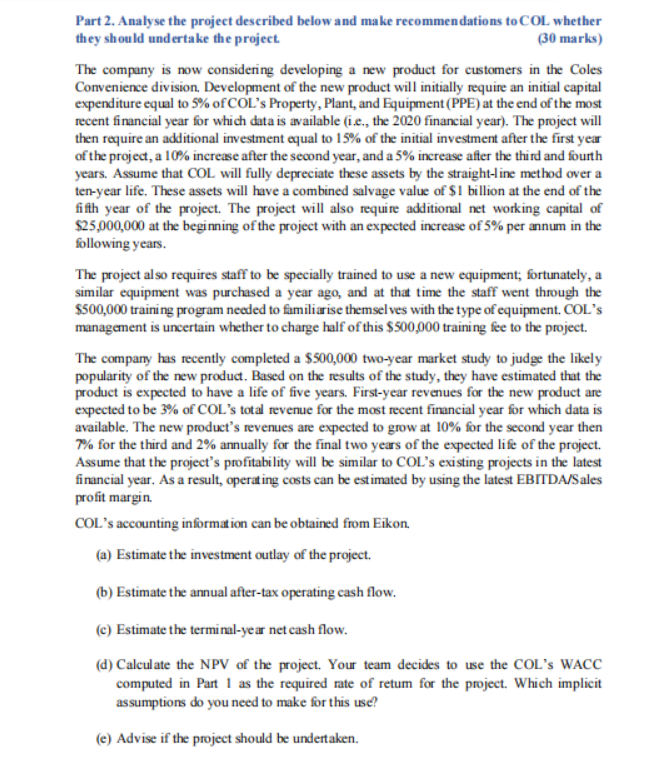

Part 2. Analyse the project described below and make recommendations to COL whether they should undertake the project (30 marks) The company is now considering developing a new product for customers in the Coles Convenience division. Development of the new product will initially require an initial capital expenditure equal to 5% of COL's Property, Plant, and Equipment (PPE) at the end of the most recent financial year for which data is available (1.c., the 2020 financial year). The project will then require an additional investment equal to 15% of the initial investment after the first year of the project, a 10% increase after the second year, and a 5% increase after the third and fourth years. Assume that COL will fully depreciate these assets by the straight-line method over a ten-year life. These assets will have a combined salvage value of $1 billion at the end of the fifth year of the project. The project will also require additional net working capital of $25,000,000 at the beginning of the project with an expected increase of 5% per annum in the following years. The project also requires staff to be specially trained to use a new equipment, fortunately, a similar equipment was purchased a year ago, and at that time the staff went through the $500,000 training program needed to familiarise themselves with the type of equipment. COL's management is uncertain whether to charge half of this $500,000 training fee to the project. The company has recently completed a $500,000 two-year market study to judge the likely popularity of the new product. Based on the results of the study, they have estimated that the product is expected to have a life of five years. First-year revenues for the new product are expected to be 3% of COL's total revenue for the most recent financial year for which data is available. The new product's revenues are expected to grow at 10% for the second year then 7% for the third and 2% annually for the final two years of the expected life of the project. Assume that the project's profitability will be similar to COL's existing projects in the latest financial year. As a result, operating costs can be estimated by using the latest EBITDA/Sales profit margin COL's accounting information can be obtained from Eikon, (a) Estimate the investment outlay of the project. (b) Estimate the annual after-tax operating cash flow. C) Estimate the terminal-year net cash flow. (d) Calculate the NPV of the project. Your team decides to use the COL's WACC computed in Part 1 as the required rate of retum for the project. Which implicit assumptions do you need to make for this use? (e) Advise if the project should be undertaken. Part 2. Analyse the project described below and make recommendations to COL whether they should undertake the project (30 marks) The company is now considering developing a new product for customers in the Coles Convenience division. Development of the new product will initially require an initial capital expenditure equal to 5% of COL's Property, Plant, and Equipment (PPE) at the end of the most recent financial year for which data is available (1.c., the 2020 financial year). The project will then require an additional investment equal to 15% of the initial investment after the first year of the project, a 10% increase after the second year, and a 5% increase after the third and fourth years. Assume that COL will fully depreciate these assets by the straight-line method over a ten-year life. These assets will have a combined salvage value of $1 billion at the end of the fifth year of the project. The project will also require additional net working capital of $25,000,000 at the beginning of the project with an expected increase of 5% per annum in the following years. The project also requires staff to be specially trained to use a new equipment, fortunately, a similar equipment was purchased a year ago, and at that time the staff went through the $500,000 training program needed to familiarise themselves with the type of equipment. COL's management is uncertain whether to charge half of this $500,000 training fee to the project. The company has recently completed a $500,000 two-year market study to judge the likely popularity of the new product. Based on the results of the study, they have estimated that the product is expected to have a life of five years. First-year revenues for the new product are expected to be 3% of COL's total revenue for the most recent financial year for which data is available. The new product's revenues are expected to grow at 10% for the second year then 7% for the third and 2% annually for the final two years of the expected life of the project. Assume that the project's profitability will be similar to COL's existing projects in the latest financial year. As a result, operating costs can be estimated by using the latest EBITDA/Sales profit margin COL's accounting information can be obtained from Eikon, (a) Estimate the investment outlay of the project. (b) Estimate the annual after-tax operating cash flow. C) Estimate the terminal-year net cash flow. (d) Calculate the NPV of the project. Your team decides to use the COL's WACC computed in Part 1 as the required rate of retum for the project. Which implicit assumptions do you need to make for this use? (e) Advise if the project should be undertaken

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts