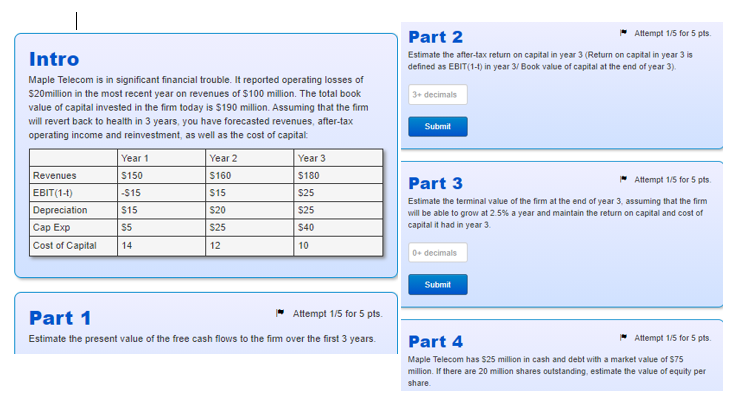

Question: Part 2 Attempt 1/5 for 5 pis. Intro Estimate the after-tax return on capital in year 3 (Return on capital in year 3 is defined

Part 2 "Attempt 1/5 for 5 pis. Intro Estimate the after-tax return on capital in year 3 (Return on capital in year 3 is defined as EBIT(1-1) in year 3/ Book value of capital at the end of year 3). Maple Telecom is in significant financial trouble. It reported operating losses of $20million in the most recent year on revenues of $100 million. The total book 3+ decimals value of capital invested in the firm today is $190 million. Assuming that the firm will revert back to health in 3 years, you have forecasted revenues, after-tax Submit operating income and reinvestment, as well as the cost of capital Year 1 Year 2 Year 3 Revenues $150 $160 $180 Part 3 Attempt 1/5 for 5 pis. EBIT (1-1) -$15 $15 $25 Estimate the terminal value of the firm at the end of year 3, assuming that the firm Depreciation $15 $20 $25 will be able to grow at 2 5% a year and maintain the return on capital and cost of Cap Exp $25 $40 capital it had in year 3. Cost of Capital 14 12 10 0+ decimals Submit Part 1 Attempt 1/5 for 5 pts. Estimate the present value of the free cash flows to the firm over the first 3 years. Part 4 Attempt 1/5 for 5 pis. Maple Telecom has $25 million in cash and debt with a market value of $75 million. If there are 20 million shares outstanding, estimate the value of equity per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts