Question: PART 2 - COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk free rate in 5.51%

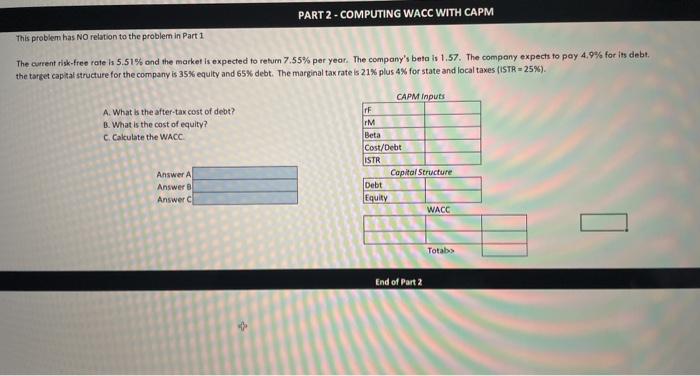

PART 2 - COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk free rate in 5.51% and the market is expected to return 7.55% per year. The company's beta is 1.57. The company expects to pay 4.9% for its debt. the target capital structure for the company is 35% equilty and 65% debt. The marginal tax rate is 21% plus 4X for state and local taxes (ISTR = 25%). A. What is the after-tax cost of debt? B. What is the cost of equity? C.Calculate the WACC CAPM Inputs IrF IM Beta Cost/Debt ISTR Capital Structure Debt Equity Answer A Answer Answer WACC Totab End of Part 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts