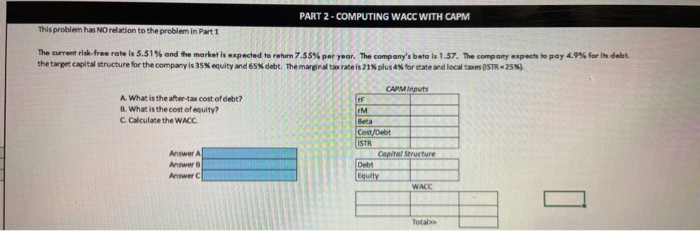

Question: PART 2 -COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk-free rate is 5.51% and the

PART 2 -COMPUTING WACC WITH CAPM This problem has NO relation to the problem in Part 1 The current risk-free rate is 5.51% and the market is expected to return 7.55 per year. The company's beta is 1.57. The company expect to pay 4.9% for its debt the target capital structure for the company is equity and en debt. marginal tax rate is 21 plus en forstate and locales STR 25). CAPM Inputs A. What is the after-tax cost of debt? B. What is the cost of equity? calculate the WACC M Beta Cost/Debt Capital Structure Answer A Answers Answers Debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts