Question: Part 2: Journalize the entry to recognize depreciation for October, 2022 On June 01,2021 , Wembley Assembly bought a $39,432 piece of equipment for their

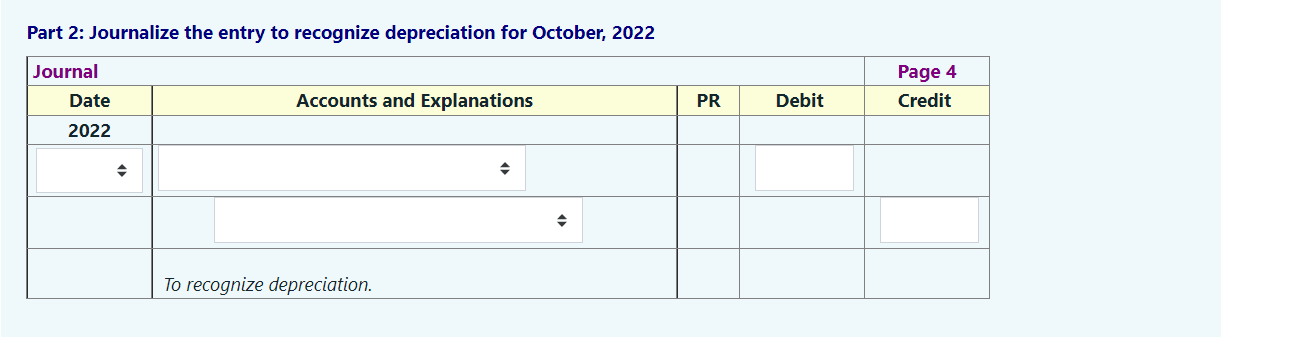

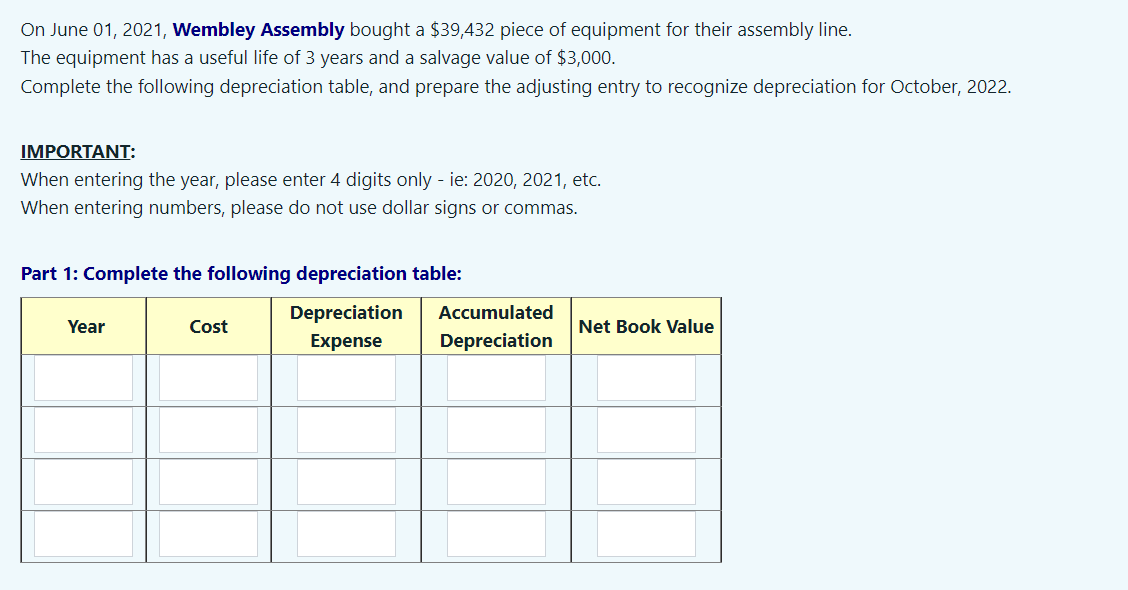

Part 2: Journalize the entry to recognize depreciation for October, 2022 On June 01,2021 , Wembley Assembly bought a $39,432 piece of equipment for their assembly line. The equipment has a useful life of 3 years and a salvage value of $3,000. Complete the following depreciation table, and prepare the adjusting entry to recognize depreciation for October, 2022. IMPORTANT: When entering the year, please enter 4 digits only - ie: 2020, 2021, etc. When entering numbers, please do not use dollar signs or commas. Part 1: Complete the following depreciation table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock