Question: part 2 - journalizing this is part 1 that needs to be done as well. im pretty sure you will have to do part 1

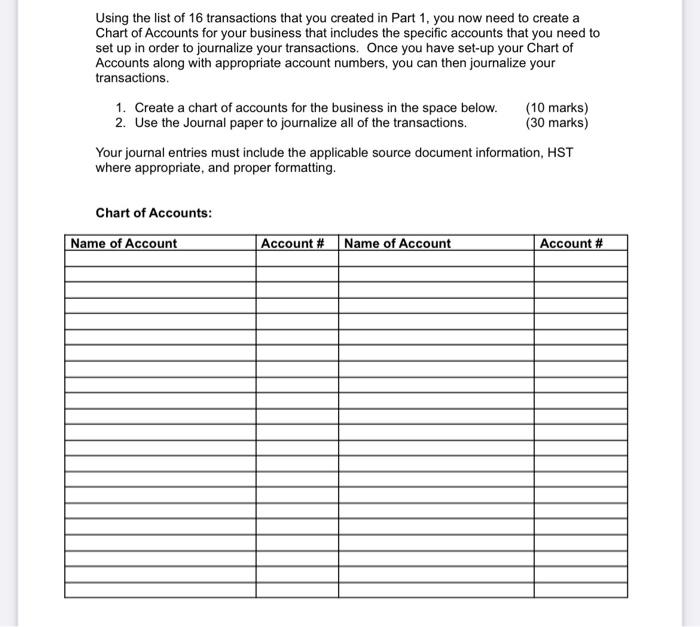

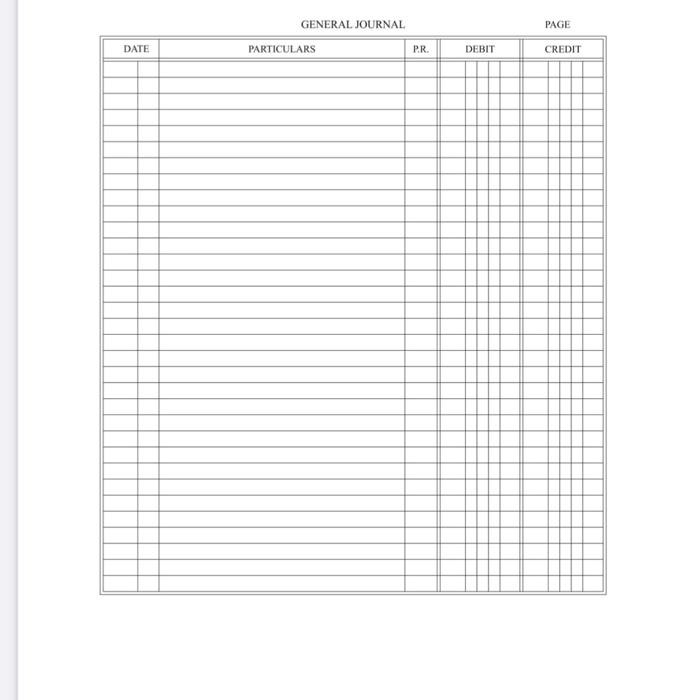

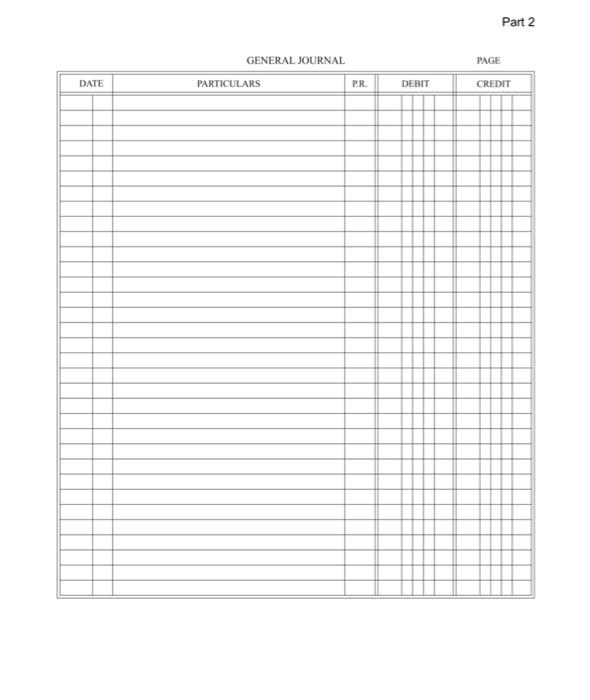

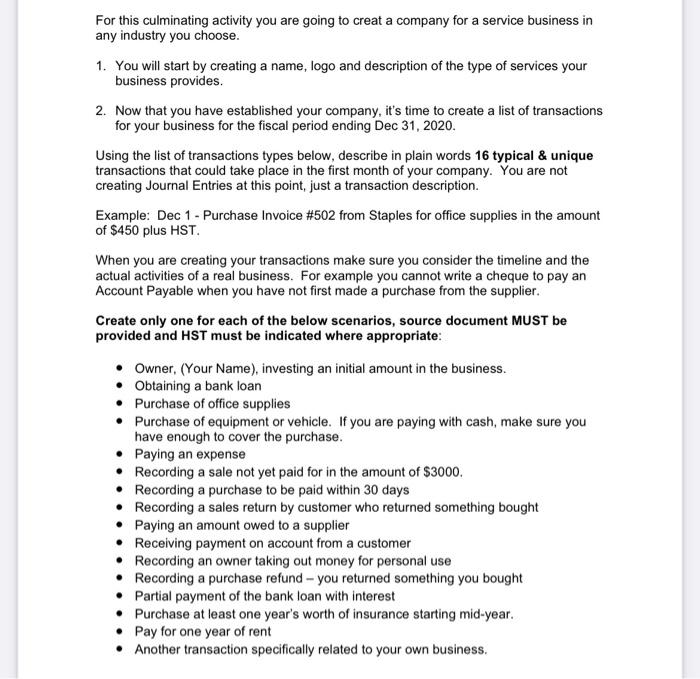

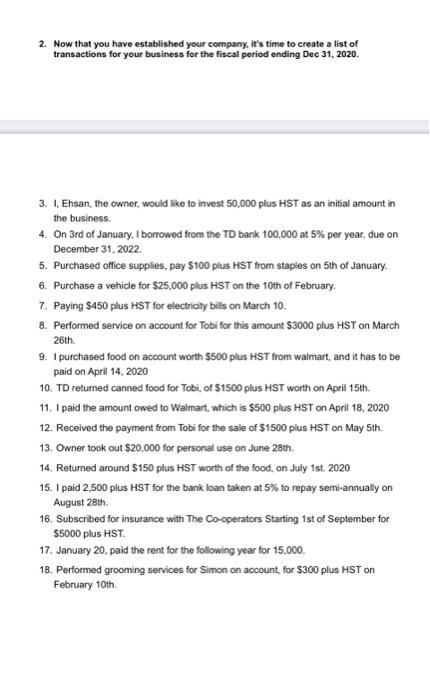

Using the list of 16 transactions that you created in Part 1, you now need to create a Chart of Accounts for your business that includes the specific accounts that you need to set up in order to journalize your transactions. Once you have set-up your Chart of Accounts along with appropriate account numbers, you can then journalize your transactions. 1. Create a chart of accounts for the business in the space below. 2. Use the Journal paper to journalize all of the transactions. (10 marks) (30 marks) Your journal entries must include the applicable source document information, HST where appropriate, and proper formatting. Chart of Accounts: Account # Name of Account Account # Name of Account DATE GENERAL JOURNAL PARTICULARS P.R. DEBIT PAGE CREDIT DATE GENERAL JOURNAL PARTICULARS P.R. DEBIT Part 2 PAGE CREDIT For this culminating activity you are going to creat a company for a service business in any industry you choose. 1. You will start by creating a name, logo and description of the type of services your business provides. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. Using the list of transactions types below, describe in plain words 16 typical & unique transactions that could take place in the first month of your company. You are not creating Journal Entries at this point, just a transaction description. Example: Dec 1 - Purchase Invoice # 502 from Staples for office supplies in the amount of $450 plus HST. When you are creating your transactions make sure you consider the timeline and the actual activities of a real business. For example you cannot write a cheque to pay an Account Payable when you have not first made a purchase from the supplier. Create only one for each of the below scenarios, source document MUST be provided and HST must be indicated where appropriate: Owner, (Your Name), investing an initial amount in the business. Obtaining a bank loan Purchase of office supplies Purchase of equipment or vehicle. If you are paying with cash, make sure you have enough to cover the purchase. Paying an expense Recording a sale not yet paid for in the amount of $3000. Recording a purchase to be paid within 30 days Recording a sales return by customer who returned something bought Paying an amount owed to a supplier Receiving payment on account from a customer Recording an owner taking out money for personal use Recording a purchase refund - you returned something you bought Partial payment of the bank loan with interest Purchase at least one year's worth of insurance starting mid-year. Pay for one year of rent Another transaction specifically related to your own business. Do-It-Yourself Culminating Project - Transactions 1. You will start by creating a name, logo and description of the type of services your business provides. Name "Paws Up" Logo Paws up Count on us Description: The type of services my business will provide the mission of being able to boost the lives of pets and their families by providing excellent pet care, peace of mind, trust, and security. Paws Up chose to expand their services to provide care for many of other animals kept as pets such as exotic pets, fish, horses, small mammals, and livestock. My business is not going to be similar to other pet-sitters. Paws Up is planning on having their own style of pet-sitting. We will open our own "Paws Up" store, which will require clients to bring their pets to our store and with the best care given. Some of the workers in Paws Up are specialized for visiting houses instead of our clients getting the pet to our store, although it won't have the same services we do at the store. Paws Up will make money offering pet services. We are going to offer several, different, and affordable assistance to our clients. Such as; overnight pet-sitting, grooming, 30-minute visit, cleaning litter boxes, food, vet care, and walking the pet. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. 3. 1, Ehsan, the owner, would like to invest 50,000 plus HST as an initial amount in the business. 4. On 3rd of January, I borrowed from the TD bank 100,000 at 5% per year, due on December 31, 2022. 5. Purchased office supplies, pay $100 plus HST from staples on 5th of January. 6. Purchase a vehicle for $25,000 plus HST on the 10th of February. 7. Paying $450 plus HST for electricity bills on March 10. 8. Performed service on account for Tobi for this amount $3000 plus HST on March 26th. 9. I purchased food on account worth $500 plus HST from walmart, and it has to be paid on April 14, 2020 10. TD returned canned food for Tobi, of $1500 plus HST worth on April 15th. 11. I paid the amount owed to Walmart, which is $500 plus HST on April 18, 2020 12. Received the payment from Tobi for the sale of $1500 plus HST on May 5th. 13. Owner took out $20,000 for personal use on June 28th. 14. Returned around $150 plus HST worth of the food, on July 1st. 2020 15. I paid 2,500 plus HST for the bank loan taken at 5% to repay semi-annually on August 28th. 16. Subscribed for insurance with The Co-operators Starting 1st of September for $5000 plus HST. 17. January 20, paid the rent for the following year for 15,000. 18. Performed grooming services for Simon on account, for $300 plus HST on February 10th Using the list of 16 transactions that you created in Part 1, you now need to create a Chart of Accounts for your business that includes the specific accounts that you need to set up in order to journalize your transactions. Once you have set-up your Chart of Accounts along with appropriate account numbers, you can then journalize your transactions. 1. Create a chart of accounts for the business in the space below. 2. Use the Journal paper to journalize all of the transactions. (10 marks) (30 marks) Your journal entries must include the applicable source document information, HST where appropriate, and proper formatting. Chart of Accounts: Account # Name of Account Account # Name of Account DATE GENERAL JOURNAL PARTICULARS P.R. DEBIT PAGE CREDIT DATE GENERAL JOURNAL PARTICULARS P.R. DEBIT Part 2 PAGE CREDIT For this culminating activity you are going to creat a company for a service business in any industry you choose. 1. You will start by creating a name, logo and description of the type of services your business provides. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. Using the list of transactions types below, describe in plain words 16 typical & unique transactions that could take place in the first month of your company. You are not creating Journal Entries at this point, just a transaction description. Example: Dec 1 - Purchase Invoice # 502 from Staples for office supplies in the amount of $450 plus HST. When you are creating your transactions make sure you consider the timeline and the actual activities of a real business. For example you cannot write a cheque to pay an Account Payable when you have not first made a purchase from the supplier. Create only one for each of the below scenarios, source document MUST be provided and HST must be indicated where appropriate: Owner, (Your Name), investing an initial amount in the business. Obtaining a bank loan Purchase of office supplies Purchase of equipment or vehicle. If you are paying with cash, make sure you have enough to cover the purchase. Paying an expense Recording a sale not yet paid for in the amount of $3000. Recording a purchase to be paid within 30 days Recording a sales return by customer who returned something bought Paying an amount owed to a supplier Receiving payment on account from a customer Recording an owner taking out money for personal use Recording a purchase refund - you returned something you bought Partial payment of the bank loan with interest Purchase at least one year's worth of insurance starting mid-year. Pay for one year of rent Another transaction specifically related to your own business. Do-It-Yourself Culminating Project - Transactions 1. You will start by creating a name, logo and description of the type of services your business provides. Name "Paws Up" Logo Paws up Count on us Description: The type of services my business will provide the mission of being able to boost the lives of pets and their families by providing excellent pet care, peace of mind, trust, and security. Paws Up chose to expand their services to provide care for many of other animals kept as pets such as exotic pets, fish, horses, small mammals, and livestock. My business is not going to be similar to other pet-sitters. Paws Up is planning on having their own style of pet-sitting. We will open our own "Paws Up" store, which will require clients to bring their pets to our store and with the best care given. Some of the workers in Paws Up are specialized for visiting houses instead of our clients getting the pet to our store, although it won't have the same services we do at the store. Paws Up will make money offering pet services. We are going to offer several, different, and affordable assistance to our clients. Such as; overnight pet-sitting, grooming, 30-minute visit, cleaning litter boxes, food, vet care, and walking the pet. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. 2. Now that you have established your company, it's time to create a list of transactions for your business for the fiscal period ending Dec 31, 2020. 3. 1, Ehsan, the owner, would like to invest 50,000 plus HST as an initial amount in the business. 4. On 3rd of January, I borrowed from the TD bank 100,000 at 5% per year, due on December 31, 2022. 5. Purchased office supplies, pay $100 plus HST from staples on 5th of January. 6. Purchase a vehicle for $25,000 plus HST on the 10th of February. 7. Paying $450 plus HST for electricity bills on March 10. 8. Performed service on account for Tobi for this amount $3000 plus HST on March 26th. 9. I purchased food on account worth $500 plus HST from walmart, and it has to be paid on April 14, 2020 10. TD returned canned food for Tobi, of $1500 plus HST worth on April 15th. 11. I paid the amount owed to Walmart, which is $500 plus HST on April 18, 2020 12. Received the payment from Tobi for the sale of $1500 plus HST on May 5th. 13. Owner took out $20,000 for personal use on June 28th. 14. Returned around $150 plus HST worth of the food, on July 1st. 2020 15. I paid 2,500 plus HST for the bank loan taken at 5% to repay semi-annually on August 28th. 16. Subscribed for insurance with The Co-operators Starting 1st of September for $5000 plus HST. 17. January 20, paid the rent for the following year for 15,000. 18. Performed grooming services for Simon on account, for $300 plus HST on February 10th

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts