Question: Part 2: Long problems (30 points) In class we have calculated the payoff and profit for currency options long positions that is, we assume the

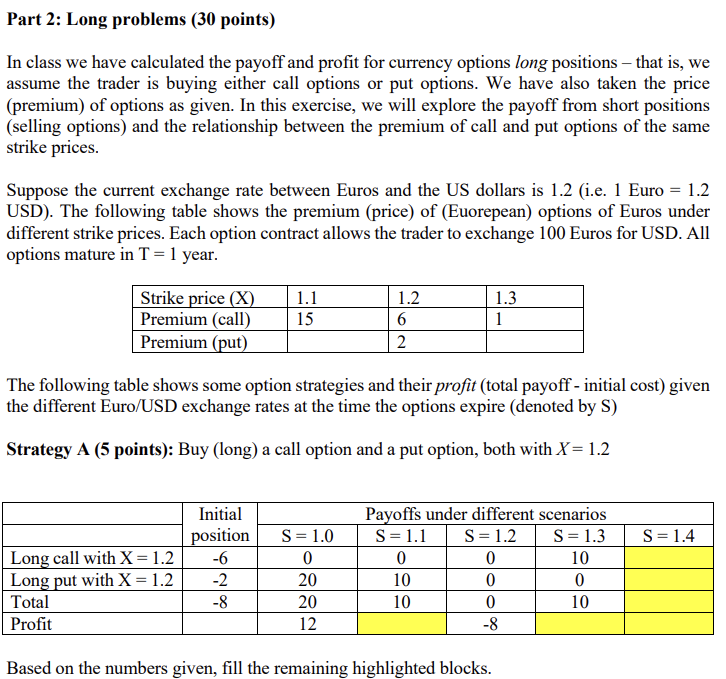

Part 2: Long problems (30 points) In class we have calculated the payoff and profit for currency options long positions that is, we assume the trader is buying either call options or put options. We have also taken the price (premium) of options as given. In this exercise, we will explore the payoff from short positions (selling options) and the relationship between the premium of call and put options of the same strike prices. Suppose the current exchange rate between Euros and the US dollars is 1.2 (i.e. 1 Euro = 1.2 USD). The following table shows the premium (price) of (Euorepean) options of Euros under different strike prices. Each option contract allows the trader to exchange 100 Euros for USD. All options mature in T = 1 year. 1.3 Strike price (X) Premium (call) Premium (put) 1.1 15 1.2 6 2 1 The following table shows some option strategies and their profit (total payoff - initial cost) given the different Euro/USD exchange rates at the time the options expire (denoted by S) Strategy A (5 points): Buy (long) a call option and a put option, both with X = 1.2 S= 1.4 Initial position Long call with X = 1.2 -6 Long put with X = 1.2 -2 Total -8 Profit S= 1.0 0 20 20 12 Payoffs under different scenarios S= 1.1 S=1.2 S= 1.3 0 0 10 10 0 0 10 0 10 -8 Based on the numbers given, fill the remaining highlighted blocks. Part 2: Long problems (30 points) In class we have calculated the payoff and profit for currency options long positions that is, we assume the trader is buying either call options or put options. We have also taken the price (premium) of options as given. In this exercise, we will explore the payoff from short positions (selling options) and the relationship between the premium of call and put options of the same strike prices. Suppose the current exchange rate between Euros and the US dollars is 1.2 (i.e. 1 Euro = 1.2 USD). The following table shows the premium (price) of (Euorepean) options of Euros under different strike prices. Each option contract allows the trader to exchange 100 Euros for USD. All options mature in T = 1 year. 1.3 Strike price (X) Premium (call) Premium (put) 1.1 15 1.2 6 2 1 The following table shows some option strategies and their profit (total payoff - initial cost) given the different Euro/USD exchange rates at the time the options expire (denoted by S) Strategy A (5 points): Buy (long) a call option and a put option, both with X = 1.2 S= 1.4 Initial position Long call with X = 1.2 -6 Long put with X = 1.2 -2 Total -8 Profit S= 1.0 0 20 20 12 Payoffs under different scenarios S= 1.1 S=1.2 S= 1.3 0 0 10 10 0 0 10 0 10 -8 Based on the numbers given, fill the remaining highlighted blocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts