Question: Part 2: Longer Question Answer the following longer question. Explain your answers. Again, you will only be graded on the quality of your explanations. Consider

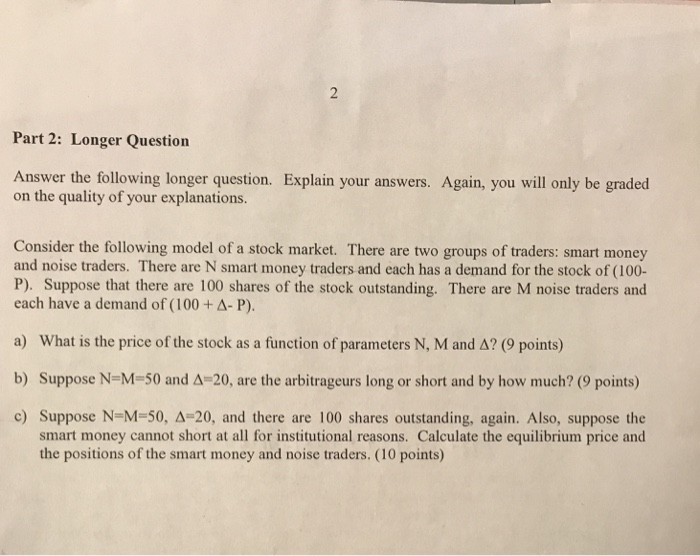

Part 2: Longer Question Answer the following longer question. Explain your answers. Again, you will only be graded on the quality of your explanations. Consider the following model of a stock market. There are two groups of traders: smart money and noise traders. There are N smart money traders and each has a demand for the stock of (100- P). Suppose that there are 100 shares of the stock outstanding. There are M noise traders and each have a demand of (100 + -P). a) What is the price of the stock as a function of parameters N, M and ? (9 points) b) Suppose N=M-50 and =20, are the arbitrageurs long or short and by how much? (9 points) Suppose N-M-50, =20, and there are 100 shares outstanding, again. Also, suppose the smart money cannot short at all for institutional reasons. Calculate the equilibrium price and the positions of the smart money and noise traders. (10 points) c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts