Question: Part 2: Patton, Inc. has two temporary differences at the end of 2019. The first difference stems from installment sales, and the second one results

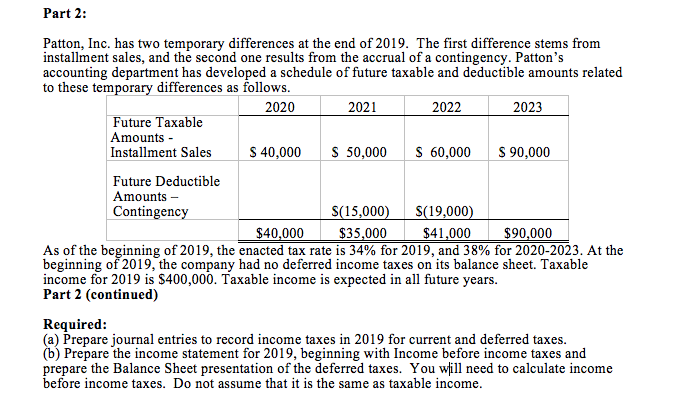

Part 2: Patton, Inc. has two temporary differences at the end of 2019. The first difference stems from installment sales, and the second one results from the accrual of a contingency. Patton's accounting department has developed a schedule of future taxable and deductible amounts related to these temporary differences as follows 2020 2021 2022 2023 Future Taxable Amounts - Installment Sales S 40,000S 50,000S 60,000 S 90,000 Future Deductibl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts