Question: solve for part A Oriole Inc. has two temporary differences at the end of 2019. The first difference stems from installment sales, and the second

solve for part A

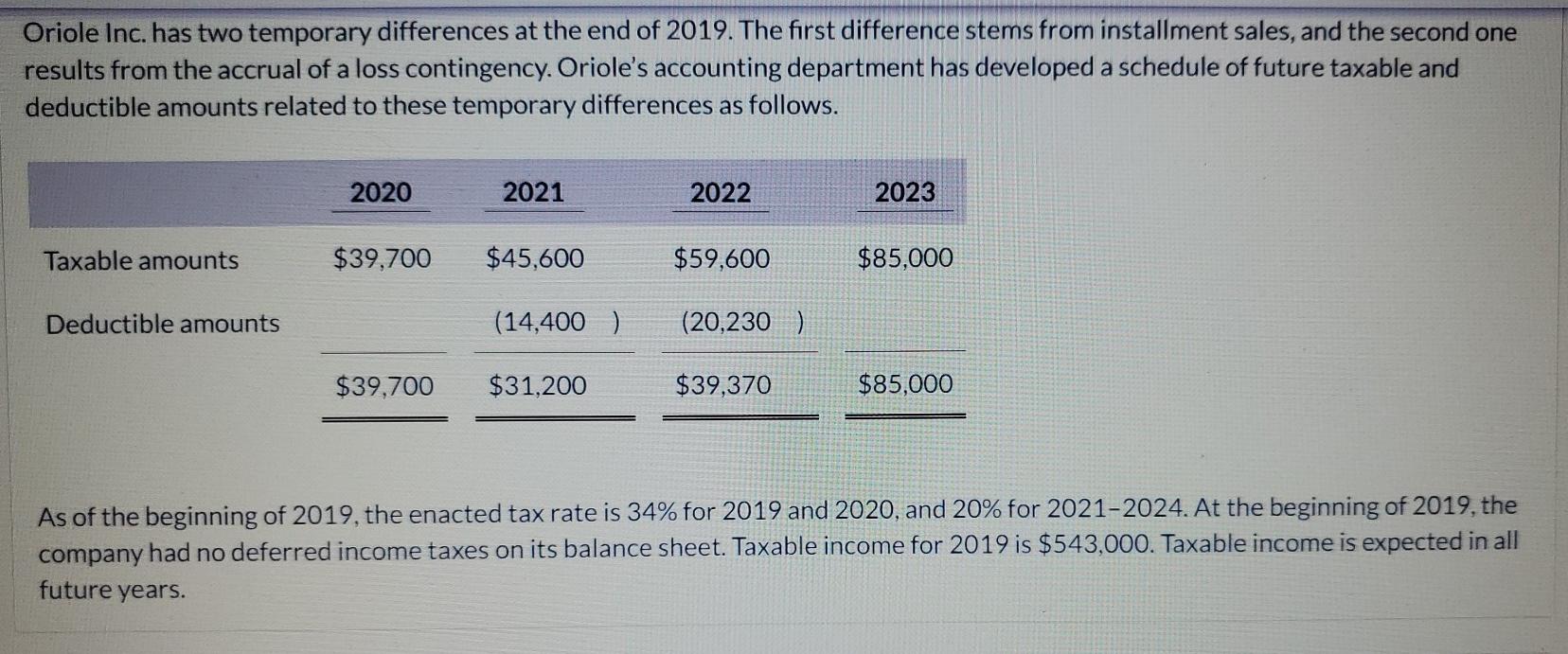

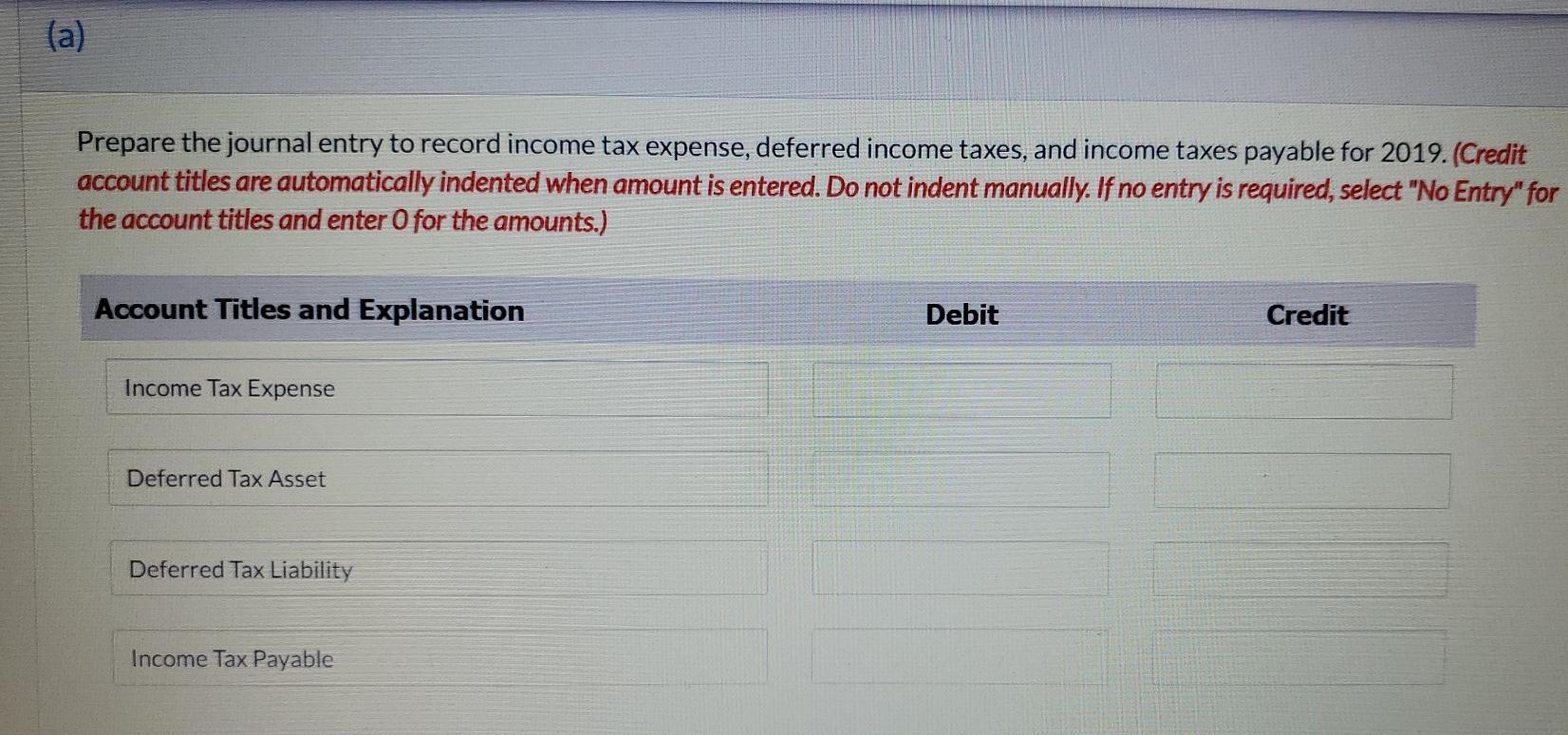

Oriole Inc. has two temporary differences at the end of 2019. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Oriole's accounting department has developed a schedule of future taxable and deductible amounts related to these temporary differences as follows. 2020 2021 2022 2023 Taxable amounts $39,700 $45,600 $59,600 $85,000 Deductible amounts (14,400 ) (20,230) $39,700 $31,200 $39,370 $85,000 As of the beginning of 2019, the enacted tax rate is 34% for 2019 and 2020, and 20% for 2021-2024. At the beginning of 2019, the company had no deferred income taxes on its balance sheet. Taxable income for 2019 is $543,000. Taxable income is expected in all future years. (a) Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Income Tax Expense Deferred Tax Asset Deferred Tax Liability Income Tax Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts