Question: - Part (2) Practical Part 1. Suppose you think Aleppo Company is going to Depreciate substantially in value in the next year. The stock price

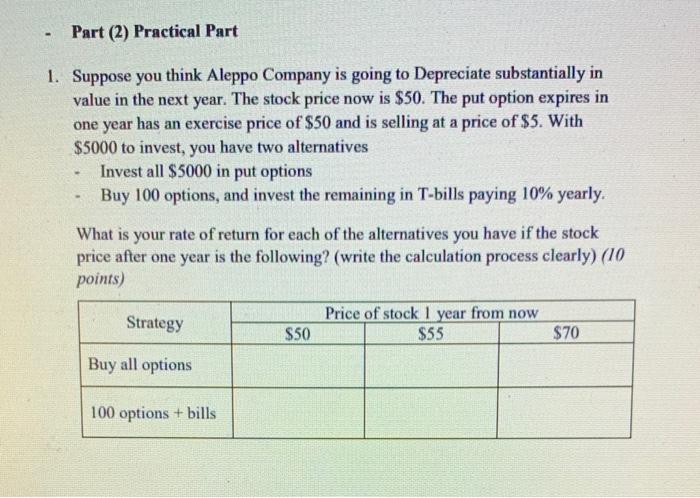

- Part (2) Practical Part 1. Suppose you think Aleppo Company is going to Depreciate substantially in value in the next year. The stock price now is $50. The put option expires in one year has an exercise price of $50 and is selling at a price of $5. With $5000 to invest, you have two alternatives Invest all $5000 in put options Buy 100 options, and invest the remaining in T-bills paying 10% yearly. What is your rate of return for each of the alternatives you have if the stock price after one year is the following? (write the calculation process clearly) (10 points) Strategy Price of stock 1 year from now S50 $55 $70 Buy all options 100 options + bills

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts