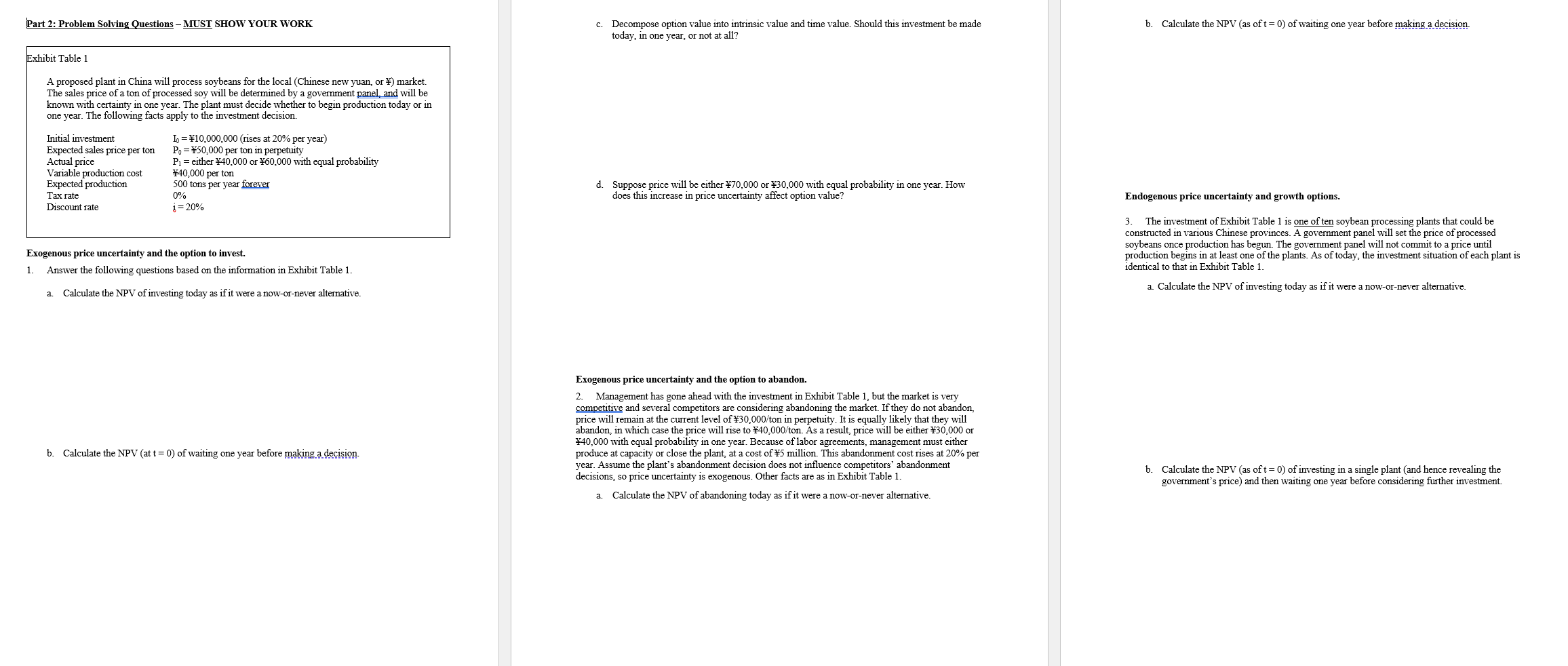

Question: Part 2 : Problem Solving Questions - MUST SHOW YOUR WORK c . Decompose option value into intrinsic value and time value. Should this investment

Part : Problem Solving Questions MUST SHOW YOUR WORK

c Decompose option value into intrinsic value and time value. Should this investment be made

today, in one year, or not at all?

Exogenous price uncertainty and the option to invest.

Answer the following questions based on the information in Exhibit Table

a Calculate the NPV of investing today as if it were a nowornever alternative.

b Calculate the NPV at of waiting one year before making a decision.

b Calculate the NPV as of of waiting one year before making a decision.

d Suppose price will be either or with equal probability in one year. How

does this increase in price uncertainty affect option value?

Exogenous price uncertainty and the option to abandon.

Management has gone ahead with the investment in Exhibit Table but the market is very

competitive and several competitors are considering abandoning the market. If they do not abandon

price will remain at the current level of ton in perpetuity. It is equally likely that they will

abandon, in which case the price will rise to ton As a result, price will be either or with equal probability in one year. Because of labor agreements, management must either

produce at capacity or close the plant, at a cost of million. This abandonment cost rises at per

year. Assume the plant's abandonment decision does not influence competitors' abandonment

decisions, so price uncertainty is exogenous. Other facts are as in Exhibit Table

a Calculate the NPV of abandoning today as if it were a nowornever alternative.

Endogenous price uncertainty and growth options.

The investment of Exhibit Table is one of ten soybean processing plants that could be

constructed in various Chinese provinces. A government panel will set the price of processed

soybeans once production has begun. The government panel will not commit to a price until

production begins in at least one of the plants. As of today, the investment situation of each plant is

identical to that in Exhibit Table

a Calculate the NPV of investing today as if it were a nowornever alternative.

b Calculate the NPV as of of investing in a single plant and hence revealing the

government's price and then waiting one year before considering further investment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock