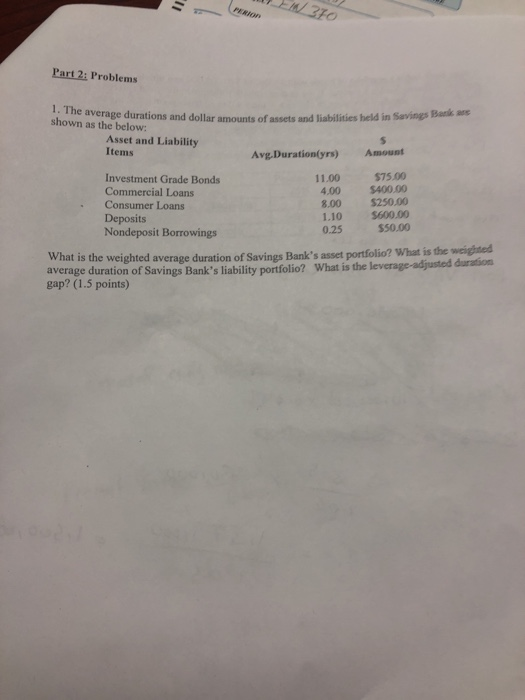

Question: ? Part 2: Problems 1. Th e average durations and dollar amounts of assets and liabilities held in Savings Bank shown as the below Asset

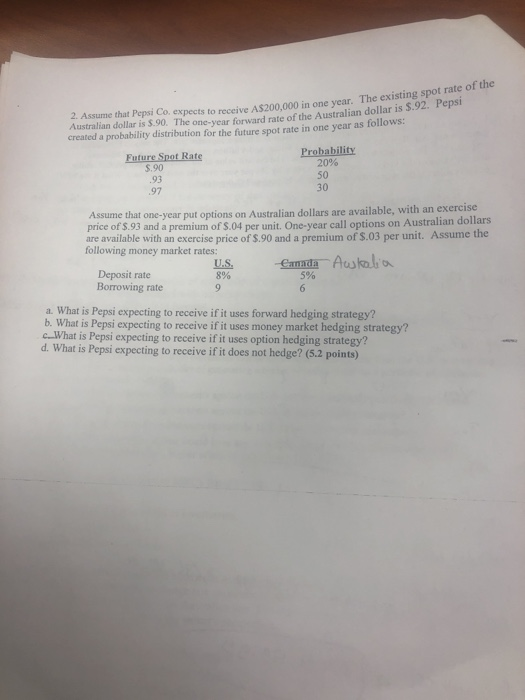

? Part 2: Problems 1. Th e average durations and dollar amounts of assets and liabilities held in Savings Bank shown as the below Asset and Lability Items Avg Duration(yrs) Amount $75.00 $400.00 $250.00 Investment Grade Bonds Commercial Loans 11.00 4.00 . Consumer Loans Deposits 8.00 110 $600.00 0.25 $50.00 What is the weighted average duration of Savings Bank's asset portfolio? What is the average duration of Savings Bank's liability portfolio? What is the leverage-adjusted gap? (1.5 points) weighted duration expects to receive AS200,000 in one year. The existing spot rate of the one-year forward rate of the Australian dollar is $.92. Pepsi 2. Assume that Pepsi Co, Australian dollar is $.90. The created a probability distribution for the future spot rate in one year as follows: Probability 20% 50 30 Future Spot Rate $.90 93 97 Assume that one- year put options on Australian dollars are available, with an exercise price of S.93 and a premium of $.04 per unit. One-year call options on Australian doll are available with an exercise price of $.90 and a premium of $.03 per unit. Assume the following money market rates: Asal Deposit rate Borrowing rate 8% 5% a. What is Pepsi expecting to receive if it uses forward hedging strategy? b. What is Pepsi expecting to receive if it uses money market hedging strategy? cWhat is Pepsi expecting to receive if it uses option hedging strategy? d. What is Pepsi expecting to receive if it does not hedge? (5.2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts