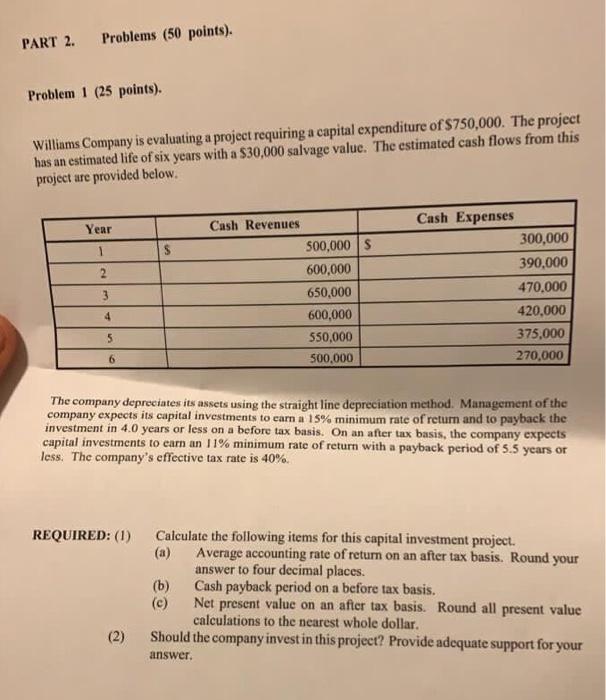

Question: PART 2. Problems (50 points) Problem 1 (25 points). Williams Company is evaluating a project requiring a capital expenditure of $750,000. The project has an

PART 2. Problems (50 points) Problem 1 (25 points). Williams Company is evaluating a project requiring a capital expenditure of $750,000. The project has an estimated life of six years with a $30,000 salvage value. The estimated cash flows from this project are provided below Year 1 2 Cash Revenues 500,000 $ 600,000 650,000 600,000 550,000 500.000 Cash Expenses 300,000 390,000 470.000 420,000 375,000 270,000 3 4 The company depreciates its assets using the straight line depreciation method. Management of the company expects its capital investments to earn a 15% minimum rate of return and to payback the investment in 4.0 years or less on a before tax basis. On an after tax basis, the company expects capital investments to earn an 11% minimum rate of return with a payback period of 5.5 years or less. The company's effective tax rate is 40%. REQUIRED: (1) Calculate the following items for this capital investment project. Average accounting rate of return on an after tax basis. Round your answer to four decimal places. (b) Cash payback period on a before tax basis. (c) Net present value on an after tax basis. Round all present value calculations to the nearest whole dollar. Should the company invest in this project? Provide adequate support for your (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts