Question: part 2 updated because the first is blurry The assignment consists of two (2) parts. You are required to make sure your assignment is complete.

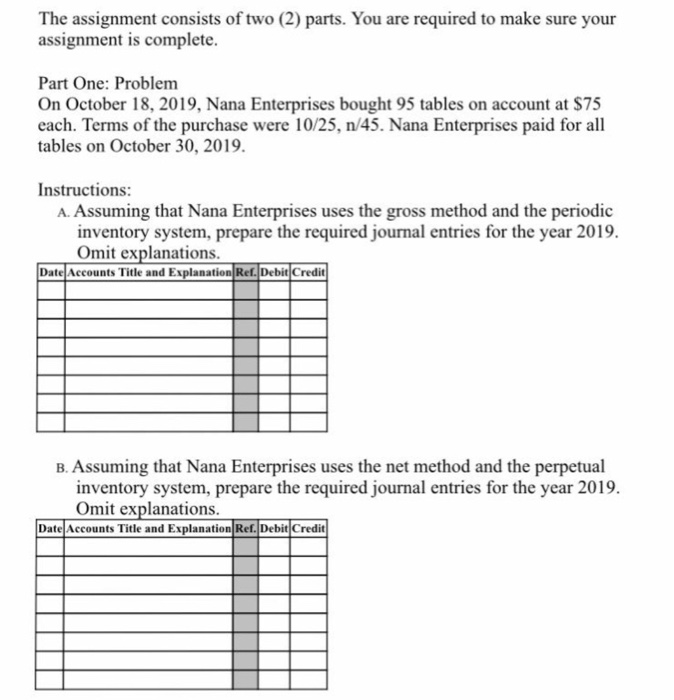

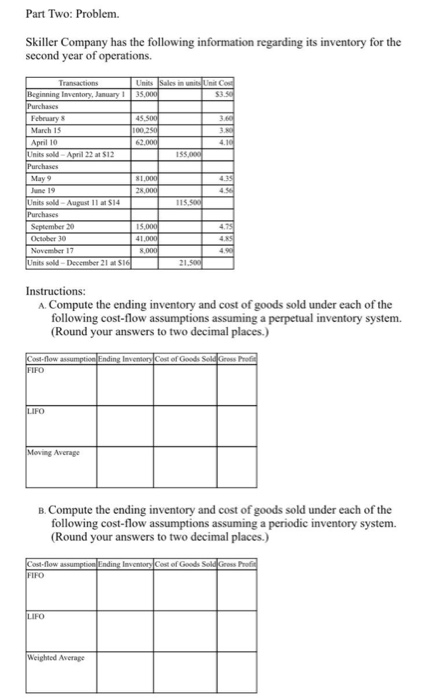

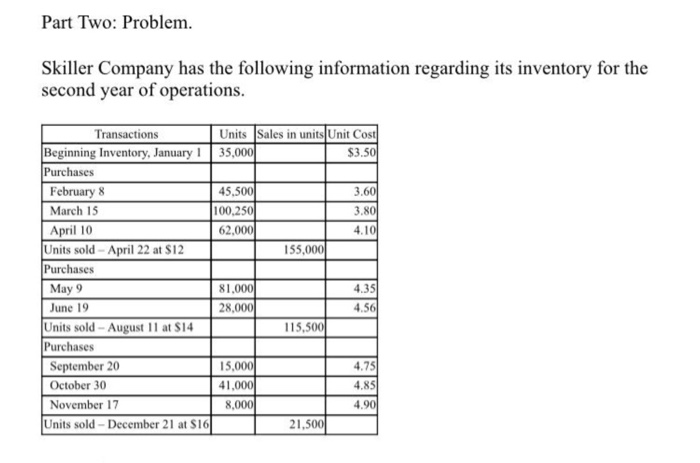

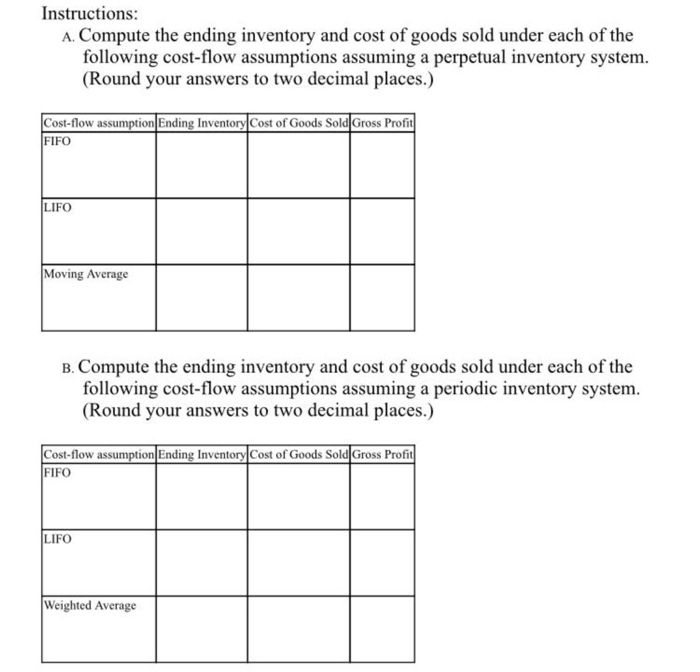

The assignment consists of two (2) parts. You are required to make sure your assignment is complete. Part One: Problem On October 18, 2019, Nana Enterprises bought 95 tables on account at $75 each. Terms of the purchase were 10/25, n 45. Nana Enterprises paid for all tables on October 30, 2019. Instructions: A. Assuming that Nana Enterprises uses the gross method and the periodic inventory system, prepare the required journal entries for the year 2019. Omit explanations. Date Accounts Title and Explanation Rel. Debit Credit B. Assuming that Nana Enterprises uses the net method and the perpetual inventory system, prepare the required journal entries for the year 2019. Omit explanations. Date Accounts Title and Explanation Ref. Debit Credit Part Two: Problem. Skiller Company has the following information regarding its inventory for the second year of operations. cos Units Sales in Hemingway lumal 35.00 Purchases February 45 sod March 15 10. April 10 200 April 2012 HEFITS May Au 514 Sphere October 30 November 17 Units sold-December 2016 Instructions: A Compute the ending inventory and cost of goods sold under each of the following cost-flow assumptions assuming a perpetual inventory system, (Round your answers to two decimal places.) Com flow assumption Ending Inventory Cost of Goods Sold Gross Pool Moving Average B. Compute the ending inventory and cost of goods sold under each of the following cost-flow assumptions assuming a periodic inventory system. (Round your answers to two decimal places.) Color Ending events Case of Goods Sol Goss Wed Average Part Two: Problem. Skiller Company has the following information regarding its inventory for the second year of operations. Transactions Units Sales in units Unit Cost Beginning Inventory, January 1 35,000 $3.50 Purchases February 8 45.500 March 15 100.2501 April 10 62,000 Units sold - April 22 at $12 155,000 Purchases May 9 81.0001 June 19 28,000 Units sold - August 11 at S14 Purchases September 20 15,000 October 30 41.000 November 17 8,000 Units sold - December 21 at $16| 115.500 Instructions: A. Compute the ending inventory and cost of goods sold under each of the following cost-flow assumptions assuming a perpetual inventory system. (Round your answers to two decimal places.) Cost-flow assumption Ending Inventory Cost of Goods Sold Gross Profit FIFO LIFO Moving Average B. Compute the ending inventory and cost of goods sold under each of the following cost-flow assumptions assuming a periodic inventory system. (Round your answers to two decimal places.) Cost-flow assumption Ending Inventory Cost of Goods Sold Gross Profit FIFO Weighted Average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts