Question: Part 3 - Create a worksheet named Part 3 - Bonus. Use simple formulas to determine your fictitious bonus. Use the following calculations and information:

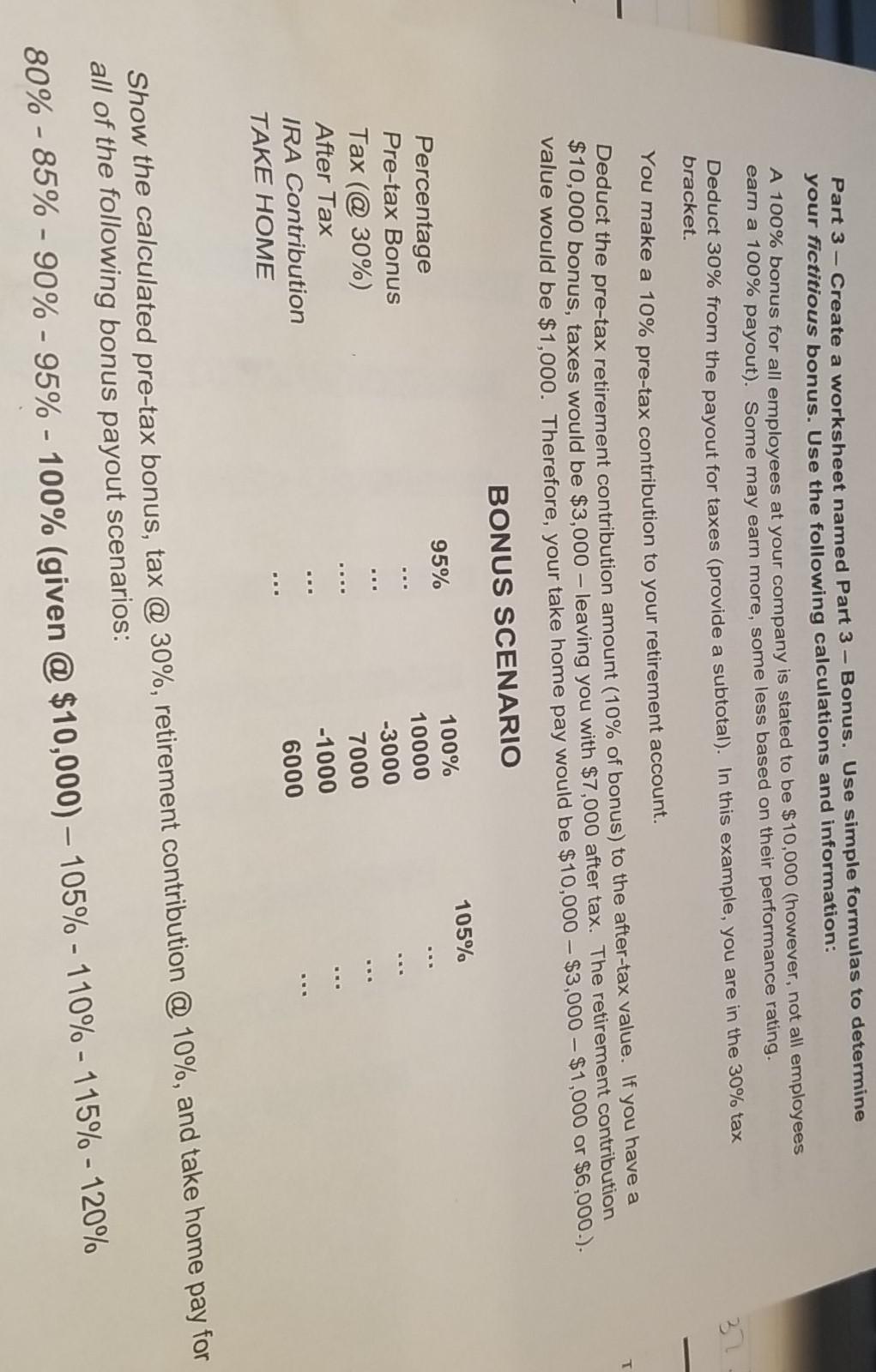

Part 3 - Create a worksheet named Part 3 - Bonus. Use simple formulas to determine your fictitious bonus. Use the following calculations and information: A 100% bonus for all employees at your company is stated to be $10,000 (however, not all employees earn a 100% payout). Some may earn more, some less based on their performance rating. Deduct 30% from the payout for taxes (provide a subtotal). In this example, you are in the 30% tax bracket. 37 T You make a 10% pre-tax contribution to your retirement account. Deduct the pre-tax retirement contribution amount (10% of bonus) to the after-tax value. If you have a $10,000 bonus, taxes would be $3,000 - leaving you with $7,000 after tax. The retirement contribution value would be $1,000. Therefore, your take home pay would be $10,000 - $3,000 - $1,000 or $6,000.). BONUS SCENARIO 105% 95% Percentage Pre-tax Bonus Tax (@ 30%) After Tax IRA Contribution TAKE HOME 100% 10000 -3000 7000 -1000 6000 Show the calculated pre-tax bonus, tax @ 30%, retirement contribution @ 10%, and take home pay for all of the following bonus payout scenarios: 80% - 85% - 90% - 95% - 100% (given @ $10,000) 105% - 110% - 115% - 120%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock