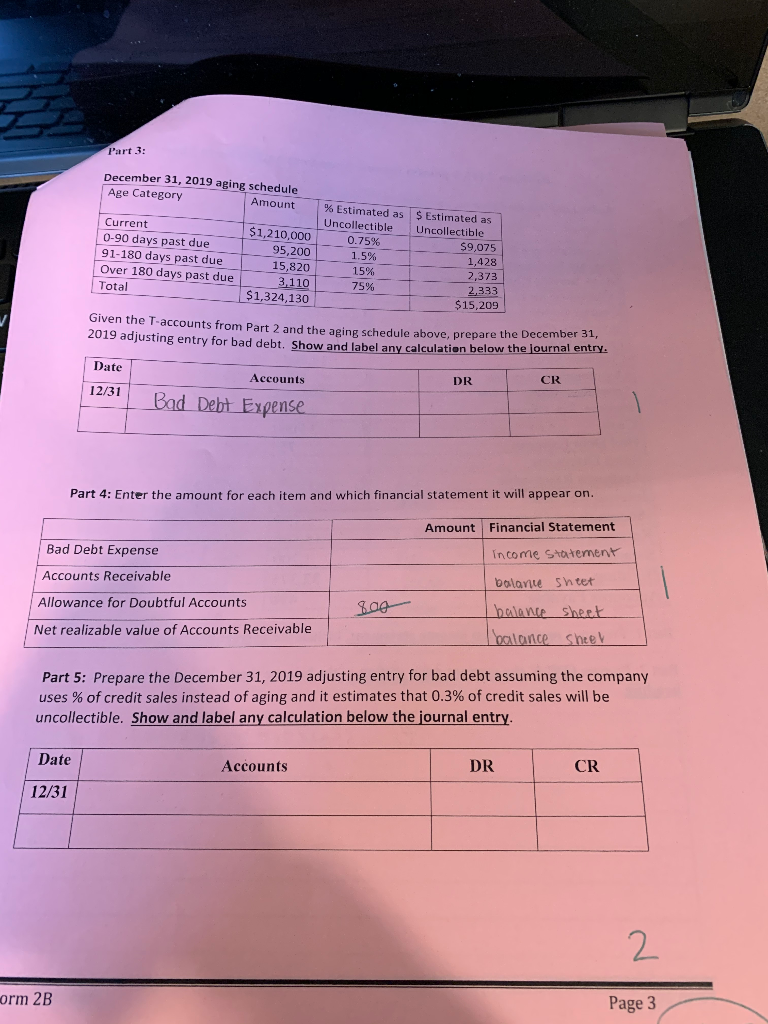

Question: Part 3: December 31, 2019 aging schedule Age Category Amount Current 0-90 days past due 91-180 days past due Over 180 days past due Total

Part 3: December 31, 2019 aging schedule Age Category Amount Current 0-90 days past due 91-180 days past due Over 180 days past due Total $1,210,000 95,200 15,820 3,110 $1,324,130 % Estimated as Uncollectible 0.75% 1.5% 15% $ Estimated as Uncollectible 59,075 1,428 2,373 2.333 $15,209 75% Given the T accounts from Part 2 and the aging schedule above, prepare the December 2019 adjusting entry for bad debt. Show and label any calculation below the jouma Date Accounts DR CR 12/31 Bad Debt Expense Part 4: Enter the amount for each item and which financial statement it will appear on Amount Financial Statement income statement Bad Debt Expense Accounts Receivable Allowance for Doubtful Accounts Net realizable value of Accounts Receivable 800 balance shtet balance sheet I balance sheet Part 5: Prepare the December 31, 2019 adjusting entry for bad debt assuming the company uses % of credit sales instead of aging and it estimates that 0.3% of credit sales will be uncollectible. Show and label any calculation below the journal entry. Date Accounts DR CR 12/31 orm 2B Page 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts