Question: Part 3: Inventory Valuation Methods As the new CFO, the last area that you would like to review on the balance sheet has to do

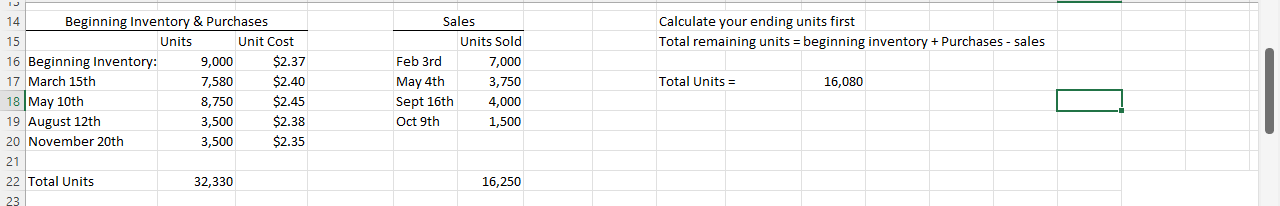

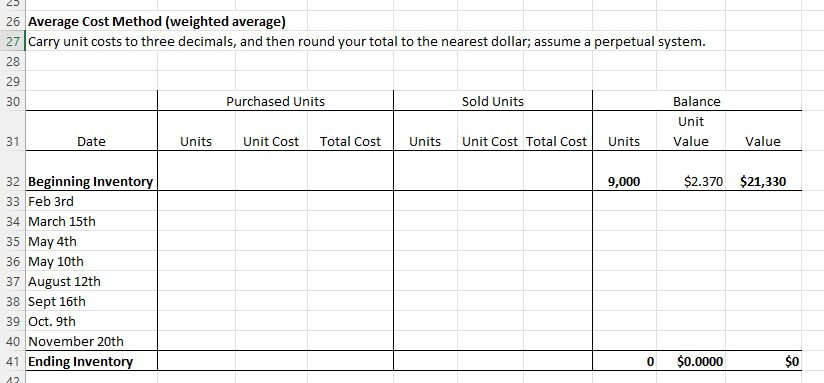

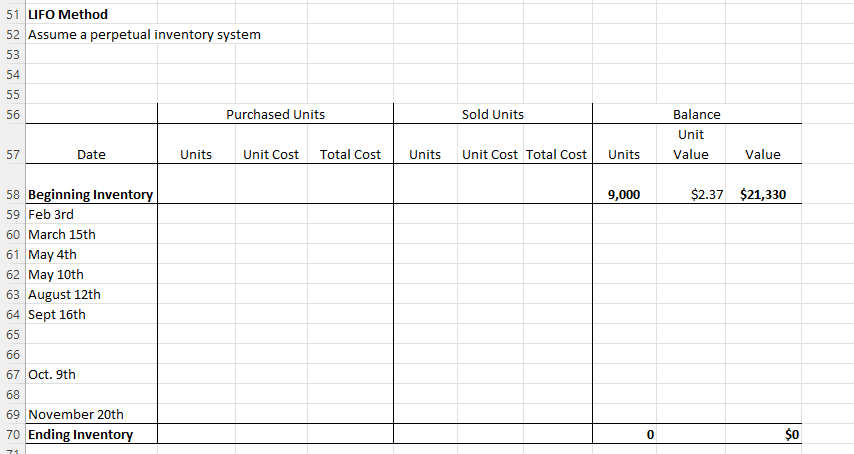

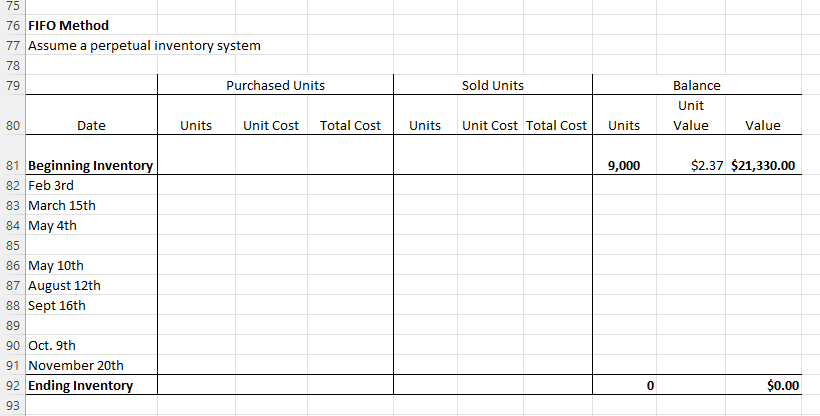

Part 3: Inventory Valuation Methods As the new CFO, the last area that you would like to review on the balance sheet has to do with how inventory is valued. Roof Raisers Industrial Co. currently uses the average cost method (aka weighted average) and has a perpetual inventory system. However, you are wondering if perhaps it would be better for the company as a whole to use one of the other costing methods - LIFO, FIFO, or Specific Identification. To test the costing methods, you have selected a sample of inventory for your calculations. Directions: For the inventory information below, determine the costs for the remaining inventory for the period based on the average cost method (weighted average), LIFO, FIFO and specific identification. Use this information on the last tab called Recommendation to support your suggestion for what inventory method should be employed by Roof Raisers Industrial Co. Assume that the company uses a perpetual inventory system. Templates have been set up to help guide you.

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline 51 & LIFO Method & & & & & & & & & \\ \hline 52 & \multicolumn{10}{|c|}{ Assume a perpetual inventory system } \\ \hline \multicolumn{11}{|l|}{53} \\ \hline \multicolumn{11}{|l|}{54} \\ \hline \multicolumn{11}{|l|}{55} \\ \hline 56 & & \multicolumn{3}{|c|}{ Purchased Units } & \multicolumn{3}{|c|}{ Sold Units } & \multicolumn{3}{|c|}{ Balance } \\ \hline 57 & Date & Units & Unit Cost & Total Cost & Units & Unit Cost & Total Cost & Units & UnitValue & Value \\ \hline 58 & Beginning Inventory & & & & & & & 9,000 & $2.37 & $21,330 \\ \hline 59 & Feb 3rd & & & & & & & & & \\ \hline 60 & March 15th & & & & & & & & & \\ \hline 61 & May 4th & & & & & & & & & \\ \hline 62 & May 10 th & & & & & & & & & \\ \hline 63 & August 12th & & & & & & & & & \\ \hline 64 & Sept 16th & & & & & & & & & \\ \hline \multicolumn{11}{|l|}{65} \\ \hline \multicolumn{11}{|l|}{66} \\ \hline 67 & Oct. 9th & & & & & & & & & \\ \hline \multicolumn{11}{|l|}{68} \\ \hline 69 & November 20th & & & & & & & & & \\ \hline 70 & Ending Inventory & & & & & & & 0 & & $0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline 14 & \multicolumn{3}{|c|}{ Beginning Inventory \& Purchases } & \multicolumn{2}{|c|}{ Sales } & \multirow{2}{*}{\multicolumn{3}{|c|}{CalculateyourendingunitsfirstTotalremainingunits=beginninginventory+Purchases-sales}} & \\ \hline 15 & & & Unit Cost & & Units Sold & & & & \\ \hline 16 & Beginning Inventory: & 9,000 & $2.37 & Feb 3rd & 7,000 & & & & \\ \hline 17 & March 15th & 7,580 & $2.40 & May 4th & 3,750 & Total Units = & 16,080 & & \\ \hline 18 & May 10th & 8,750 & $2.45 & Sept 16th & 4,000 & & & & \\ \hline 19 & August 12th & 3,500 & $2.38 & Oct 9th & 1,500 & & & & \\ \hline 20 & November 20th & 3,500 & $2.35 & & & & & & \\ \hline 21 & & & & & & & & & \\ \hline 22 & Total Units & 32,330 & & & 16,250 & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{11}{|l|}{75} \\ \hline 76 & FIFO Method & & & & & & & & & \\ \hline 77 & \multicolumn{10}{|c|}{ Assume a perpetual inventory system } \\ \hline \multicolumn{11}{|l|}{78} \\ \hline 79 & & \multicolumn{3}{|c|}{ Purchased Units } & \multicolumn{3}{|c|}{ Sold Units } & \multicolumn{3}{|c|}{ Balance } \\ \hline 80 & Date & Units & Unit Cost & Total Cost & Units & Unit Cost & Total Cost & Units & UnitValue & Value \\ \hline 81 & Beginning Inventory & & & & & & & 9,000 & $2.37 & $21,330.00 \\ \hline 82 & Feb 3rd & & & & & & & & & \\ \hline 83 & March 15th & & & & & & & & & \\ \hline 84 & May 4th & & & & & & & & & \\ \hline \multicolumn{11}{|l|}{85} \\ \hline 86 & May 10th & & & & & & & & & \\ \hline 87 & August 12th & & & & & & & & & \\ \hline 88 & Sept 16th & & & & & & & & & \\ \hline \multicolumn{11}{|l|}{89} \\ \hline 90 & Oct. 9th & & & & & & & & & \\ \hline 91 & November 20th & & & & & & & & & \\ \hline 92 & Ending Inventory & & & & & & & 0 & & $0.00 \\ \hline 93 & & & & & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts