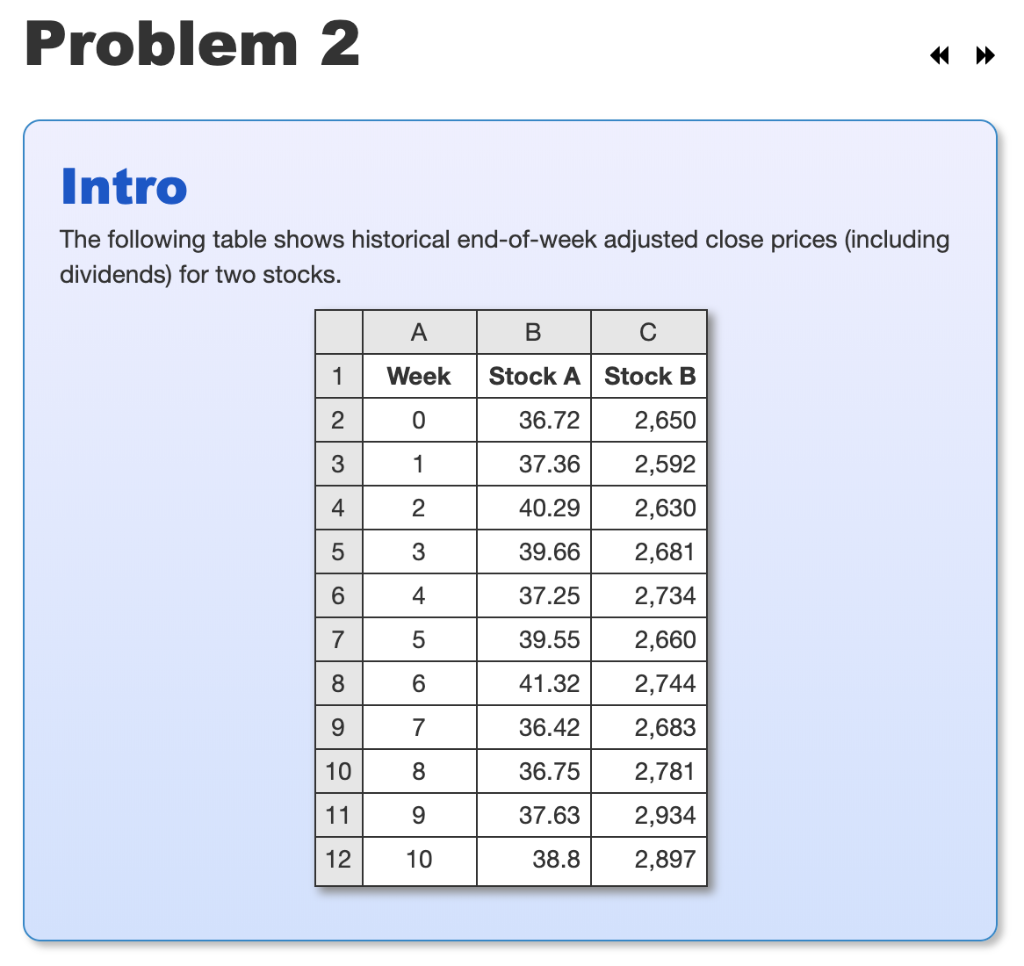

Question: Part 5 Only Problem 2 Intro The following table shows historical end-of-week adjusted close prices (including dividends) for two stocks. 2 3 4 Week 0

Part 5 Only

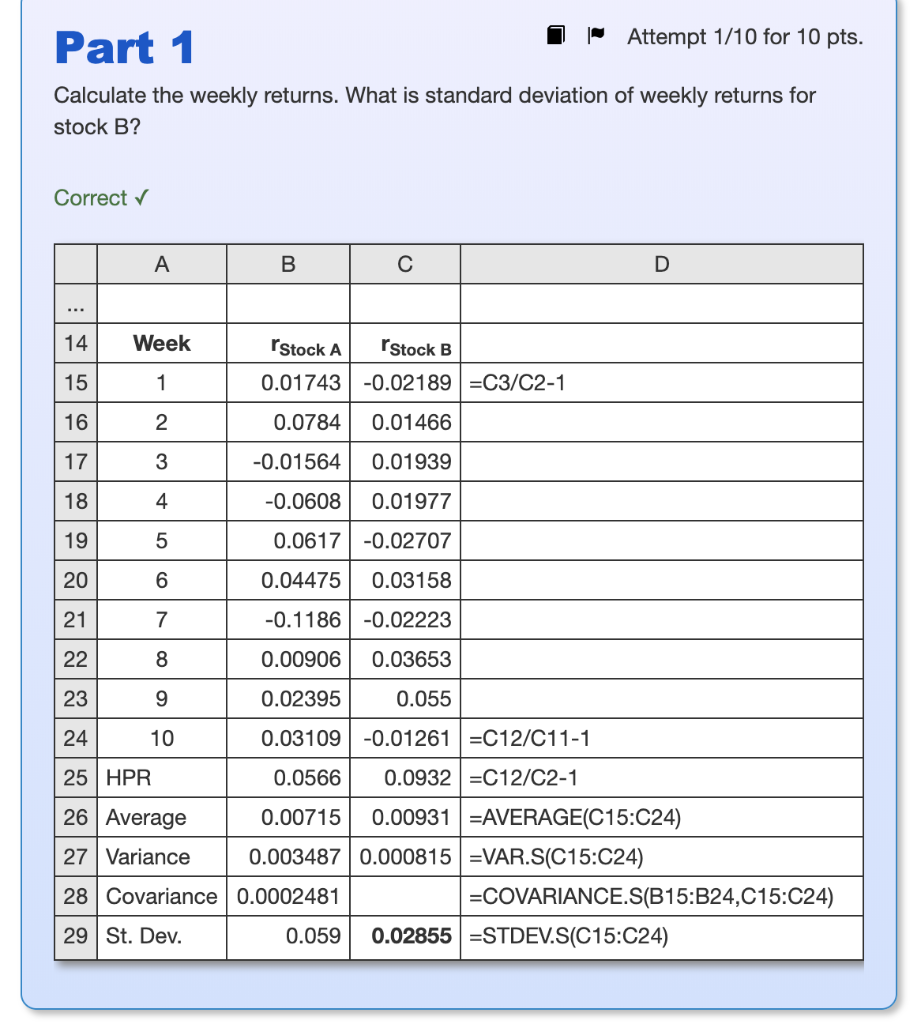

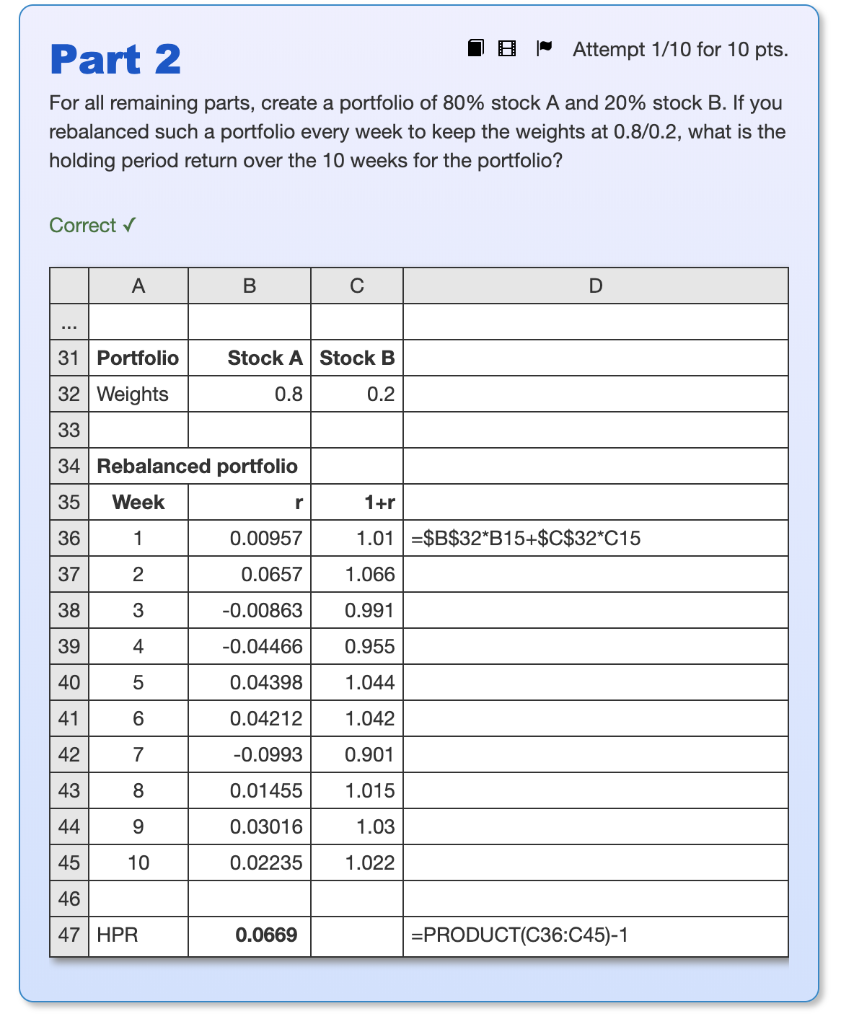

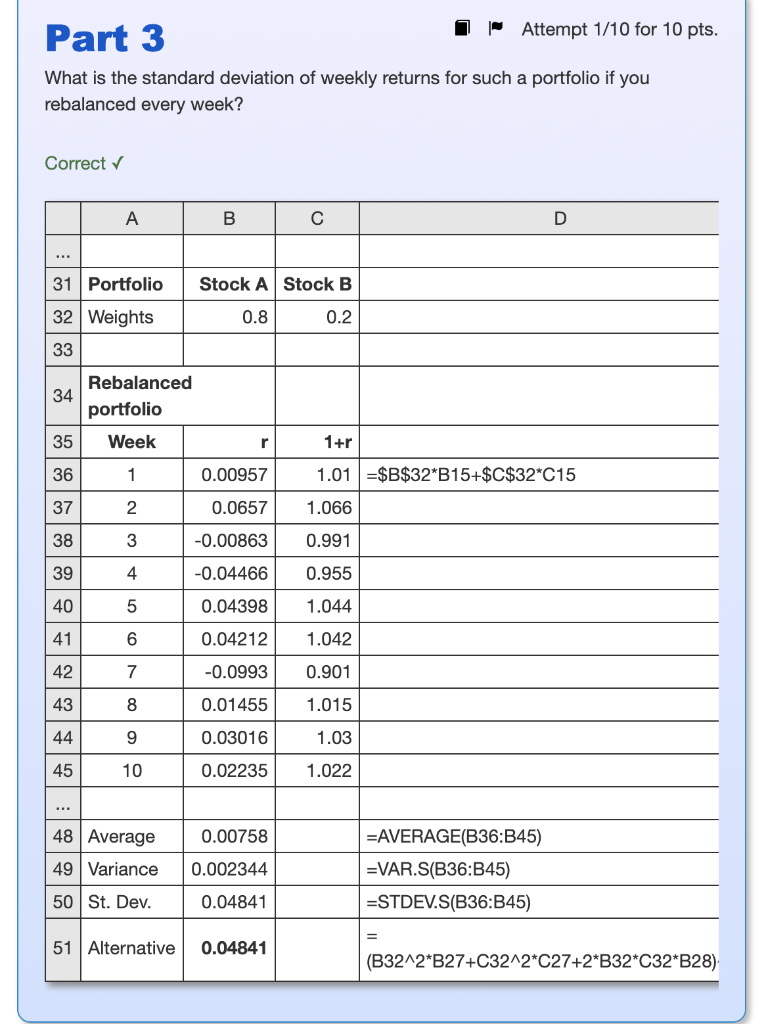

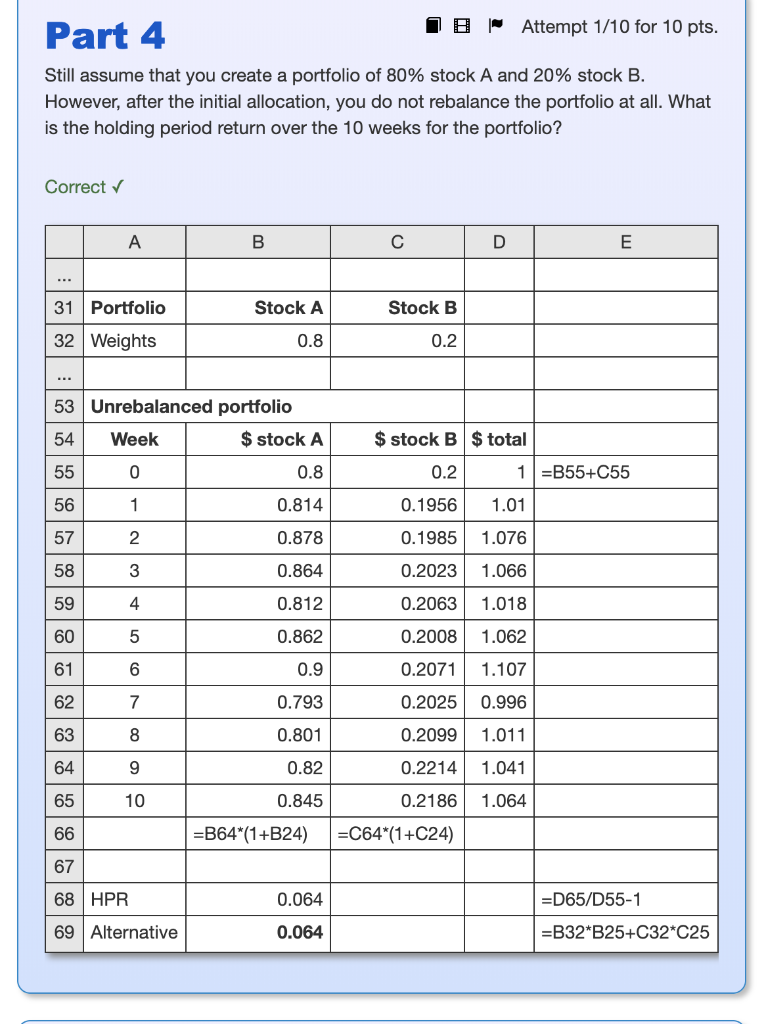

Problem 2 Intro The following table shows historical end-of-week adjusted close prices (including dividends) for two stocks. 2 3 4 Week 0 1 2 Stock A Stock B / 36.72 2,650 37.36 2,592 40.29 2,630 39.66 2,681 37.25 2,734 39.55 2,660 41.32 2,744 36.42 2,683 36.75 2,781 37.63 2,934 38.8 2,897 7 5 9 7 11 12 9 10 Part 1 1 | Attempt 1/10 for 10 pts. Calculate the weekly returns. What is standard deviation of weekly returns for stock B? Correct v A B C 18 21 14 Week rStock A rStock B 15 0.01743 -0.02189 =C3/C2-1 16 2 0.0784 0.01466 -0.01564 0.01939 -0.0608 0.01977 19 0.0617 -0.02707 0.04475 0.03158 -0.1186 -0.02223 0.00906 0.03653 0.02395 0.055 0.03109 -0.01261 =C12/C11-1 25 HPR 0.0566 0.0932 | =C12/C2-1 26 Average 0.00715 0.00931 | =AVERAGE(C15:C24) 27 Variance 0.003487 0.000815 =VAR.S(C15:C24) 28 Covariance 0.0002481 =COVARIANCE.S(B15:B24,C15:C24) 29 St. Dev. 0.059 0.02855 =STDEV.S(C15:C24) 22 23 24 IB | Attempt 1/10 for 10 pts. Part 2 For all remaining parts, create a portfolio of 80% stock A and 20% stock B. If you rebalanced such a portfolio every week to keep the weights at 0.8/0.2, what is the holding period return over the 10 weeks for the portfolio? Correct v D 31 Portfolio Stock A Stock B 32 Weights 0.8 0.2 33 34 Rebalanced portfolio 35 Week 1+r 36 1 0.00957 1.01 | =$B$32*B15+$C$32*C15 37 2 0.0657 1.066 38 -0.00863 0.991 -0.04466 0.955 0.04398 1.044 0.04212 11.042 -0.0993 0.901 0.01455 1.015 0.03016 1.03 10 0.02235 1.022 41 43 45 46 47 HPR 0.0669 =PRODUCT(C36:C45)-1 Attempt 1/10 for 10 pts. Part 3 What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week? Correct c | 31 Portfolio 32 Weights Stock A Stock B 0.8 0.2 34 Rebalanced portfolio Week 35 36 1 0.00957 0.0657 2 -0.00863 -0.04466 0.04398 0.04212 -0.0993 1+r 1.01 =$B$32*B15+$C$32*C15 1.066 0.991 0.955 1.044 1.042 0.901 1.015 1.03 1.022 43 0.01455 44 0.03016 0.02235 45 10 48 Average 49 Variance 50 St. Dev. 0.00758 0.002344 0.04841 =AVERAGE(B36:B45) =VAR.S(B36:B45) =STDEV.S(B36:B45) 51 Alternative 0.04841 (B3212*B27+C32^2*C27+2*B32*C32*B28) IB | Part 4 Attempt 1/10 for 10 pts. Still assume that you create a portfolio of 80% stock A and 20% stock B. However, after the initial allocation, you do not rebalance the portfolio at all. What is the holding period return over the 10 weeks for the portfolio? Correct A B C D E 31 Portfolio 32 Weights Stock A 0.8 Stock B 0.2 53 Unrebalanced portfolio 54 Week $ stock A 0 0.8 1 0.814 0.878 0.864 59 0.812 0.862 $ stock B $ total 0.2 1| =B55+C55 0.1956 1.01 0.1985 1.076 0.2023 1.066 0.2063 1.018 0.2008 1.062 0.2071 1.107 0.2025 0.996 0.2099 1.011 0.2214 1.041 0.2186 1.064 =C64*(1+C24) 61 0.9 62 0.793 63 0.801 64 65 0.82 0.845 =B64*(1+B24) 66 67 68 HPR 69 Alternative 0.064 0.064 =D65/D55-1 =B32*B25+C32*C25 Part 5 1 Attempt 10/10 for 8 pts. What is the standard deviation of weekly returns for such a portfolio if you do not rebalance at all? 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts