Question: Part A) B) C) Problem 1 (Required, 25 marks) The current spot rates of various maturities are given in the table below. Term 6 months

Part A) B) C)

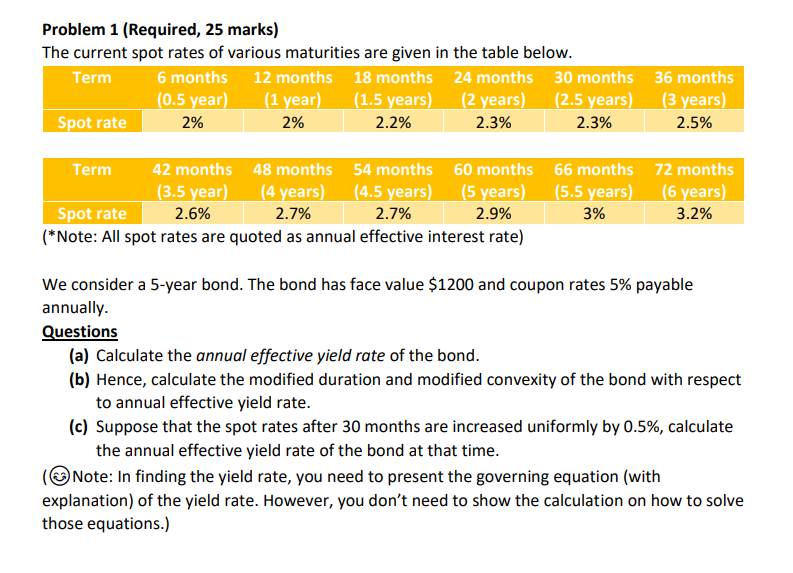

Problem 1 (Required, 25 marks) The current spot rates of various maturities are given in the table below. Term 6 months 12 months 18 months 24 months 30 months 36 months (0.5 year) (1 year) (1.5 years) (2 years) (2.5 years) (3 years) Spot rate 2% 2% 2.2% 2.3% 2.3% 2.5% Term 42 months 48 months 54 months 60 months 66 months 72 months (3.5 year) (4 years) (4.5 years) (5 years) (5.5 years) (6 years) Spot rate 2.6% 2.7% 2.7% 2.9% 3% 3.2% (*Note: All spot rates are quoted as annual effective interest rate) We consider a 5-year bond. The bond has face value $1200 and coupon rates 5% payable annually. Questions (a) Calculate the annual effective yield rate of the bond. (b) Hence, calculate the modified duration and modified convexity of the bond with respect to annual effective yield rate. (c) Suppose that the spot rates after 30 months are increased uniformly by 0.5%, calculate the annual effective yield rate of the bond at that time. (Note: In finding the yield rate, you need to present the governing equation (with explanation) of the yield rate. However, you don't need to show the calculation on how to solve those equations.) Problem 1 (Required, 25 marks) The current spot rates of various maturities are given in the table below. Term 6 months 12 months 18 months 24 months 30 months 36 months (0.5 year) (1 year) (1.5 years) (2 years) (2.5 years) (3 years) Spot rate 2% 2% 2.2% 2.3% 2.3% 2.5% Term 42 months 48 months 54 months 60 months 66 months 72 months (3.5 year) (4 years) (4.5 years) (5 years) (5.5 years) (6 years) Spot rate 2.6% 2.7% 2.7% 2.9% 3% 3.2% (*Note: All spot rates are quoted as annual effective interest rate) We consider a 5-year bond. The bond has face value $1200 and coupon rates 5% payable annually. Questions (a) Calculate the annual effective yield rate of the bond. (b) Hence, calculate the modified duration and modified convexity of the bond with respect to annual effective yield rate. (c) Suppose that the spot rates after 30 months are increased uniformly by 0.5%, calculate the annual effective yield rate of the bond at that time. (Note: In finding the yield rate, you need to present the governing equation (with explanation) of the yield rate. However, you don't need to show the calculation on how to solve those equations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts