Question: Financial Math Problem: Black-Scholes formula = Problem 3 (Required, 25 marks) An option writer has sold (short-sell) an option on an asset currently. This option

Financial Math Problem: Black-Scholes formula

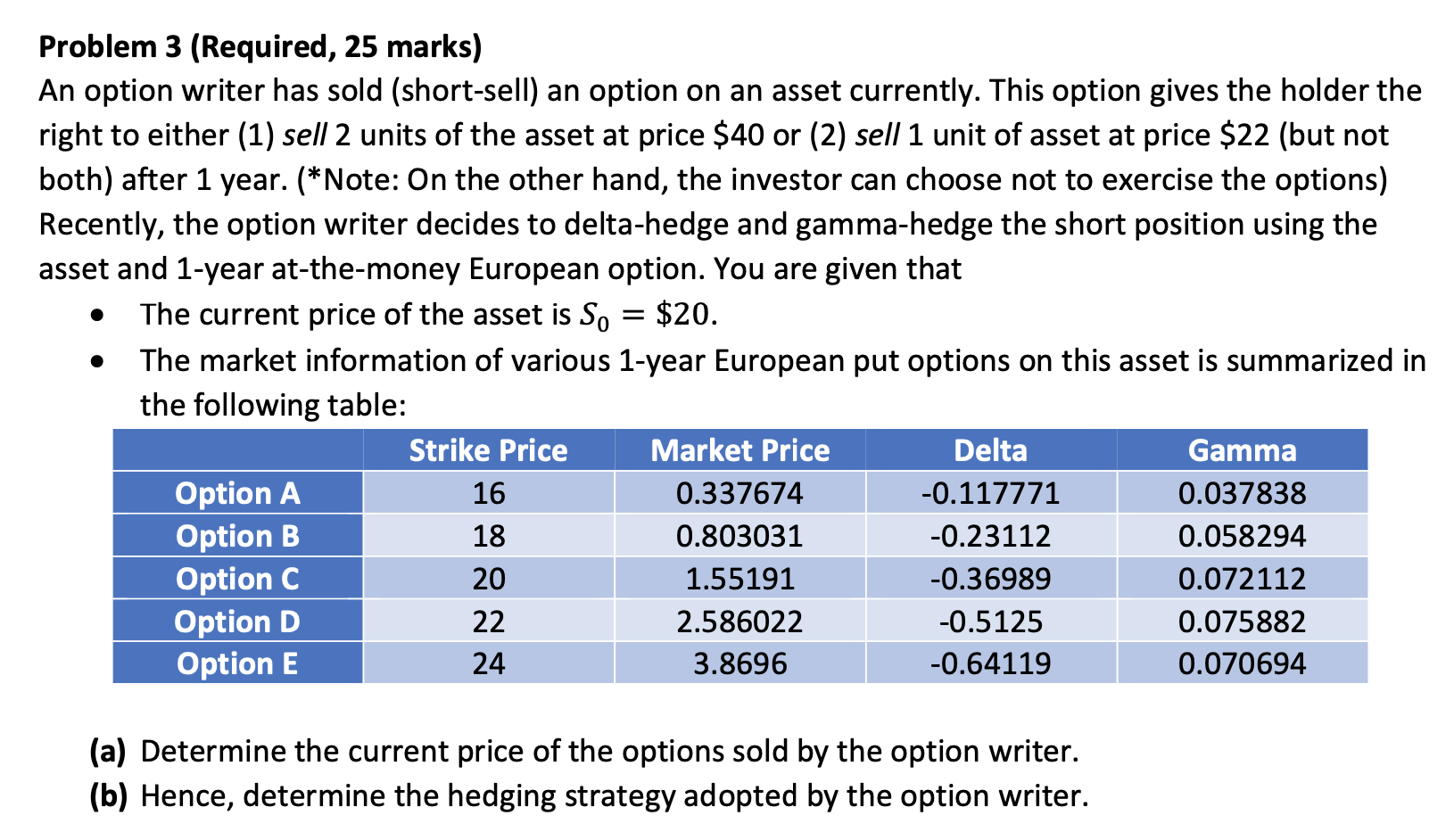

= Problem 3 (Required, 25 marks) An option writer has sold (short-sell) an option on an asset currently. This option gives the holder the right to either (1) sell 2 units of the asset at price $40 or (2) sell 1 unit of asset at price $22 (but not both) after 1 year. (*Note: On the other hand, the investor can choose not to exercise the options) Recently, the option writer decides to delta-hedge and gamma-hedge the short position using the asset and 1-year at-the-money European option. You are given that The current price of the asset is S. $20. The market information of various 1-year European put options on this asset is summarized in the following table: Strike Price Market Price Delta Gamma Option A 16 0.337674 -0.117771 0.037838 Option B 18 0.803031 -0.23112 0.058294 Option C 20 1.55191 -0.36989 0.072112 Option D 22 2.586022 -0.5125 0.075882 Option E 24 3.8696 -0.64119 0.070694 (a) Determine the current price of the options sold by the option writer. (b) Hence, determine the hedging strategy adopted by the option writer. = Problem 3 (Required, 25 marks) An option writer has sold (short-sell) an option on an asset currently. This option gives the holder the right to either (1) sell 2 units of the asset at price $40 or (2) sell 1 unit of asset at price $22 (but not both) after 1 year. (*Note: On the other hand, the investor can choose not to exercise the options) Recently, the option writer decides to delta-hedge and gamma-hedge the short position using the asset and 1-year at-the-money European option. You are given that The current price of the asset is S. $20. The market information of various 1-year European put options on this asset is summarized in the following table: Strike Price Market Price Delta Gamma Option A 16 0.337674 -0.117771 0.037838 Option B 18 0.803031 -0.23112 0.058294 Option C 20 1.55191 -0.36989 0.072112 Option D 22 2.586022 -0.5125 0.075882 Option E 24 3.8696 -0.64119 0.070694 (a) Determine the current price of the options sold by the option writer. (b) Hence, determine the hedging strategy adopted by the option writer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts